US Stock Market Today: Markets head for gains again as strong week continues

Here is what you need to know on Thursday February 4:

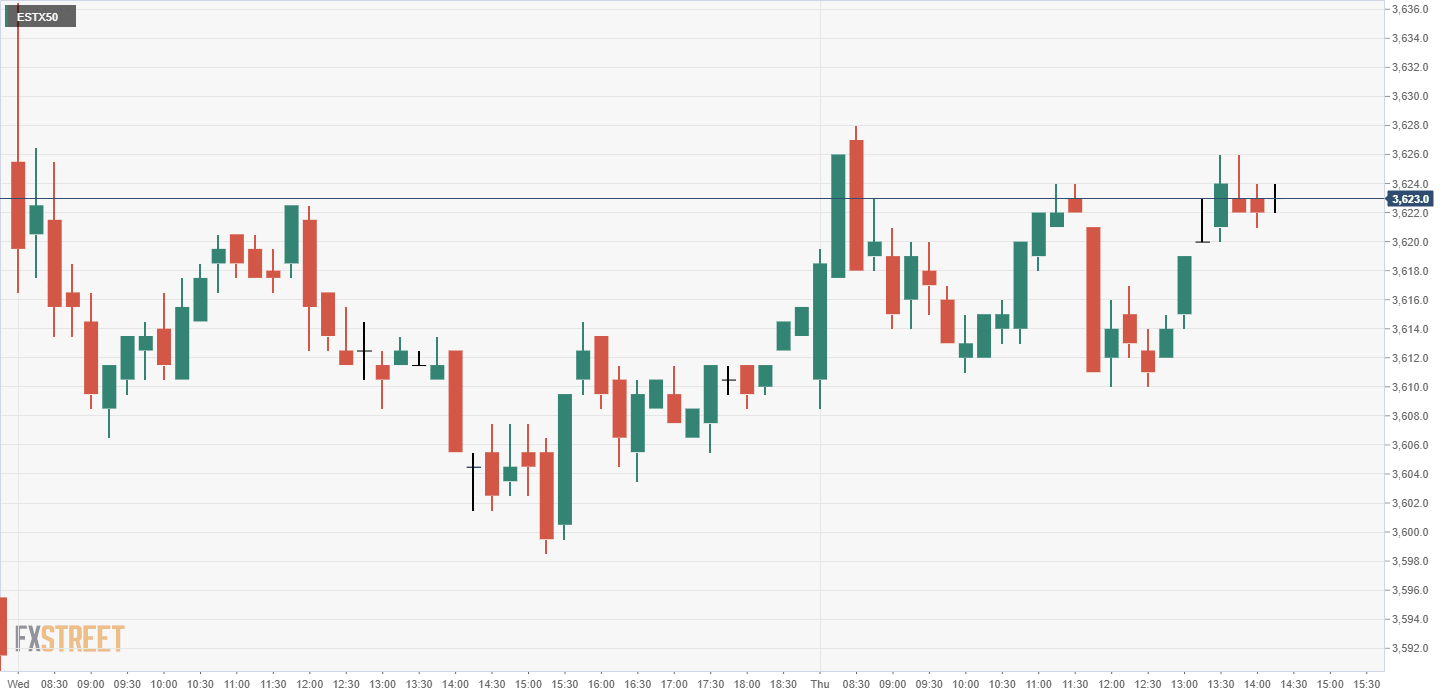

European indices were mixed on Thursday, with the FTSE showing a fall of 0.6% but the Dax and EuroStoxx both positive. The Dax was 0.4% higher and EuroStoxx up 0.1%.

Overnight, Asian stocks closed lower, with the Nikkei down 1% and the Hang Seng down 0.66%.

US markets were pointing towards a moderately higher open, Nasdaq futures were up by 0.5%, Dow up by 0.1% and S&P futures ahead by 0.2%.

See FXStreet new equities homepage

EuroStoxx 50

Asian markets fell on Thursday as higher mainland Chinese interest rates worried investors. Japanese shares dropped as the tech sector was the biggest loser. Sony, however, bucked, with shares hitting a 20-year high as it raised profit guidance.

European and US markets were moderately higher. The Dax was boosted by Germany agreeing on further stimulus measures, Bayer reaching a compensation deal and Deutsche Bank posting a small profit for 2020.

Italian markets were flat as former ECB chief Mario Draghi endeavoured to form a government.

The Bank of England left interest rates unchanged on Thursday and hinted no rush in moving towards negative rates.

US futures pointed to a slightly higher open as markets looked to solidify a solid week of gains. Earnings season remained in focus on the back of a slew of positive results this week, especially in the tech sector. Apple, E-Bay, Paypal, Facebook and Alphabet all reported strong earnings this week. Apple (AAPL) was again strong on Thursday as CNBC reported Apple and Hyundai-Kia to combine on an autonomous EV.

E-Bay (EBAY) posted strong results and strong earnings guidance. E-Bay shares were trading 9% higher in Thursday's pre-market

PayPal (PYPL) also beat and is 6% higher.

Alibaba rose as Reuters reported that Ant Group was to spin-off data operations to help its future IPO. BABA shares are 3% higher on Thursday.

US jobless claims hit a two-month low on Thursday ahead of US employment on Friday.

President Biden looked to quickly push through his $1.9 trillion stimulus plan. Democrats on Wednesday had pushed the bill through Congress without Republican support.

US Treasury Secretary Janet Yellen is due to meet with financial regulators on Thursday to discuss the Gamestop phenomenon, saying she wants to “understand deeply” before taking any action.

Morgan Stanley increased its Eli Lilly (LLY) price target, KeyBanc increased its E-Bay (EBAY) target, JPMorgan upgraded Match (MTCH) and Deutsche Bank downgraded ViacomCBS.

Elon Musk was at it again as he tweeted about Dogecoin (DOGE) pushing it higher.

Stocks covered at FXStreet:

Virgin Galactic (SPCE) Stock Price and News: Shares blast off again on Wednesday (fxstreet.com)

Gamestop (GME) Stock Price and Forecast: Are shares going to break $500 today? (fxstreet.com)

NIO Stock Price and Forecast: NIO’s recent weakness tests key support level (fxstreet.com)

NNDM Stock Price: Nano Dimension Ltd pauses for breath after recent rally (fxstreet.com)

Gamestop (GME): Should I buy or should I sell Gamestop now? (fxstreet.com)

PLTR Stock Price: Palantir Technologies Inc dips as investors assess the Demo Day (fxstreet.com)

Li Auto Inc Stock Price and News: Bulls eye a Biden boost after the Jefferies jump (fxstreet.com)

Aurora Cannabis (ACB) Stock Price and Forecast: Rollercoaster for getting high! (fxstreet.com)

AT Stock Price: Atlantic Power Corp soars on news of acquisition by I Squared Capital (fxstreet.com)

BB Stock Price: BlackBerry Ltd set to extend gains as it dances with three giants (fxstreet.com)

Alibaba (BABA) Stock Price Forecast: Gains 3% on IM electric sedan launch (fxstreet.com)

Delta Air Lines (DAL) Stock Price and Forecast: Preparing for take off (fxstreet.com)

Ideanomics Inc (IDEX) Stock Price and Forecast: Charging ahead with the sector (fxstreet.com)

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.