Li Auto Inc Stock Price and News: Bulls eye a Biden boost after the Jefferies jump

- NASDAQ: LI has advanced on Wednesday after Jefferies initiated coverage with a bullish outlook.

- President Biden's calm tone may allow Chinese firms more leeway.

- Following the consolidating in early January, Li Auto's shares may be ready to move higher.

Alexious Lee is a name that investors in Li Auto Auto will learn quickly. Lee, an analyst at Jefferies, is not optimistic on the Chinese car firm due to its name, but rather looking at the firm's EREV Powertrain, which has been a commercial success. Moreover, Lee is bullish on future growth in the current year and also in 2022 – 100% and 86% respectively.

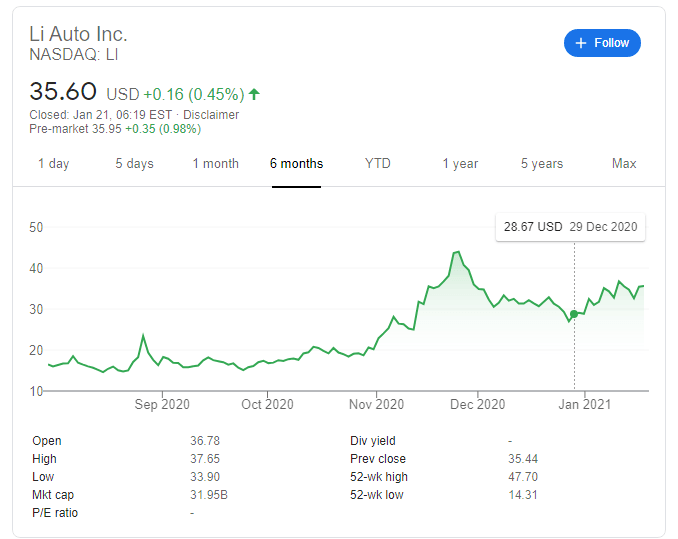

Jefferies' target price is $44.50, substantially above Li's closing price of $35.60 on Wednesday. Premarket trading indicates another increase toward $36 on Thursday, extending its gains.

Another factor playing in the electric carmaker's favor is the change of guard at the White House. President Joe Biden has offered a calmer tone to both Americans and the world, contrary to former President Donald Trump's feisty approach to China. Will that mean a different policy? Probably not, as both Democrats and Republicans share a disdain for Beijing's trade practices. However, the smoother tone means investors may have less noise to worry about.

Tesla's Elon Musk recently became the world's richest person – and perhaps his electric vehicle company has rich pricing. The search for the next Tesla has boosted shares of various EV makers, such as Nio, Nikola, and also Li Auto.

Li Auto stock forecast

NASDAQ: LI has risen above the lows but still faces a hurdle at $36.75, which is the 2021 peak. If it manages to break higher, the next noteworthy target is $43.96 – the highest closing price for the stock, and just below Lee's target. Support awaits $32.60, followed by $31.00.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.