Signal Advance Inc (SIGL) Stock Price and Forecast: The WhatsApp (FB) killer, except it is not!

- Signal is a not-for-profit foundation with a messaging app.

- Signal Advance Inc. (SIGL) is a medical technology company with no messaging app.

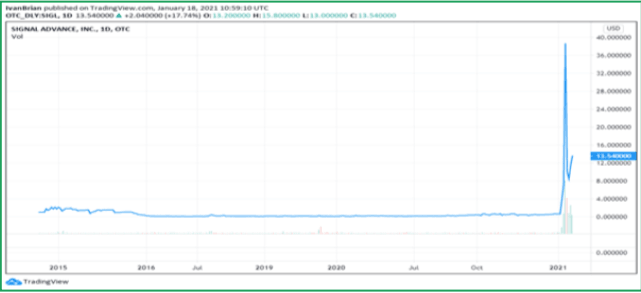

- Investors mixed the two up and SIGL rose 5000%.

Signal Advance (SIGL) is a tiny medical technology company which was unheard of until last week. On January 4, not a single share traded in the stock market, a few days later the stock traded over 2 million shares! The daily average is less than 10,000.

The stock moved from $0.60 to nearly $40 in a matter of days.

Update: WhatsApp has informed it is delaying its new privacy policy until May 15.

SIGL stock: A case of mistaken identity

The reason for this extraordinary surge was due to a tweet sent out by Tesla (TSLA) CEO Elon Musk. He wanted people to switch from WhatsApp (FB) to Signal messaging app. Instead, people raced to snap up stock of Signal Advance (SIGL)!

Zoom (ZM) in, ZOOM out

Back in March 2020, at the start of the pandemic, the Securities and Exchange Commission (SEC) suspended trading of Zoom Technologies (ZOOM) as traders were buying it thinking it was ZOOM Video (ZM). ZOOM was up 900% when the SEC stepped in.

SIGL still going strong

Despite Signal Advance (SIGL) issuing a press release making people aware of the mistaken identity, SIGL is still trading much higher than its long-term average. SIGL closed on Friday at $13.54 down from near $40 earlier in the week. On January 6th it closed at $0.60!

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has received compensation for writing this article. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to do your own research before making any investment and take independent advice from a registered investment advisor. This article is for information purposes only. We/I do not provide personalized recommendations. I make no representations as to accuracy, completeness, the suitability of this information. I will not be liable for any errors, omissions or any losses, injuries or damages arising from this information display or use. I will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.