BNGO Stock Forecast: BioNano Genomics Inc soars another 20% after cancer-related progress

- NASDAQ: BNGO is trading some 20% higher in Monday's pre-market trading.

- Renewed interest in BioNano Genomics Inc is behind the comeback.

- High volatility is set to endure amid the firm's stock issuance.

Is raising cash a sign of strength or a sign of weakness? That is the question for those investing in Bionano Genomics (NASDAQ: BNGO). The San-Diego-based pharmaceutical company kicked off 2021 with a dramatic announcement of a breakthrough in researching the genes behind the autism spectrum. Its groundbreaking analysis would allow developing care and sent share skyrocketing.

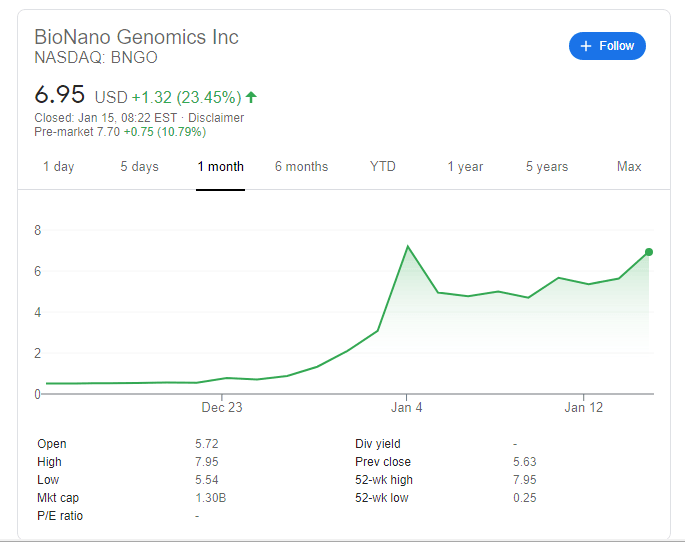

Update: BioNano Genomics (NASDAQ: BNGO) has been extending its gains, rising by another 20% above $8.

Update: NASDAQ: BNGO has surged by over 23% on Thursday, closing the day at $6.95 – and there may be more in store. Friday's premarket trading is pointing to another double-digit leap of over 10% to $7.69. BioNano Genomic is benefiting from yet another promising announcement. In the company's symposium about cytogenetics, scientists and doctors shined a bright light on the firm's ability to help with several types of cancer, such that affecting the liver, eyes, breast, and liver, using the Saphyr optical genome mapping (OGM) system. Using BioNano's system, they could provide more precise therapies and prognoses. The news comes on top of advances in coronavirus and in the autism spectrum.

Update: Bionano Genomics (NASDAQ: BNGO) has risen by just over 5% on Wednesday, at $5.63. The increase was mostly driven by the firm's announcement that it regained compliance from NASDAQ. The news was expected following BNGO's leap last week. Shares moved away from penny stock territory, fulfilling the exchange's minimum bid requirement for remaining listed. The surge came on top of progress in genetic sequencing related to both the autism spectrum and diagnosing illness in COVID-19 patients. Thursday's premarket trading is pointing to additional gains for the firm.

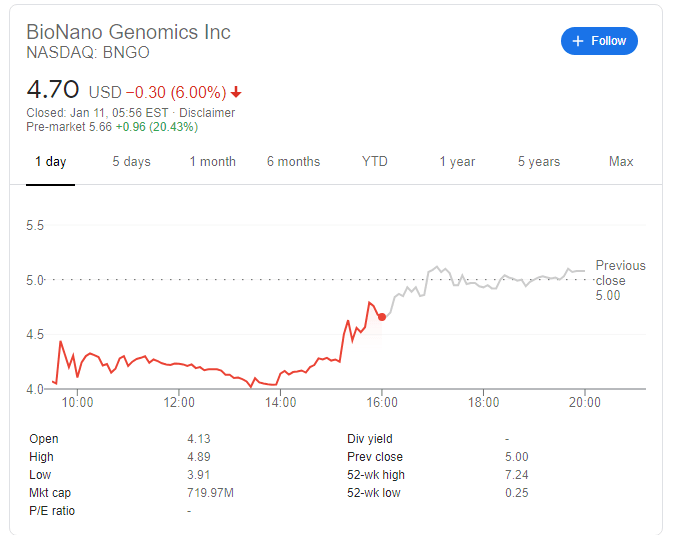

Update: NASDAQ: BNGO shares are edging lower on Wednesday, changing hands at around $5.21, down from the highs. On the other hand, it is essential to note that Bionano Genomics' stock is still above the recent closing low of $4.70 recorded on January 8. The company continues benefiting from its new insights on the different effects of COVID-19 on different patients. Genetics have an impact on outcomes, also with the novel coronavirus. Bionano performed its study on 37 patients admitted to Augusta University's ICU. After examining 37 patients, it found significant upregulation of the ST26 gene in those suffering worst. The world is coping with new variants of SARS Cov-2, the virus behind covid, and genetic changes are behind the faster spread of the illness. Differences in DNA may also explain responsiveness to vaccines in the future.

Update: NASDAQ: BNGO has closed Monday's session at $5.67, up some 20.64%. Tuesday's premarket trading is pointing to additional gains of around 3.17% to $5.85. Apart from the breakthrough in genetic research of autism, the most recent upside driver came after Bionano Genomic published a study that uses Saphyr to identify structural variants (SVs) in genes that could control the inflammatory and immune response. The world is focused on coronavirus vaccines, their production, and their deployment. However, finding the reasons to why people are becoming severely ill would also reduce physical and economic pain from the world. The all-time high of $7.24 may now come into sight.

Bionano followed up with an announcement of new shares issuance which triggered a sell-off. The fall may have only been a natural correction after the giant leap – but for many, it exposed the company's need for filling its coffers amid dire financial straits.

On the other hand, tapping markets for additional funds can be seen as a sign of growth – and that seems to be the narrative on Monday. Raising fresh cash should allow Bionano to accelerate its growth rather than dilute existing shareholders.

One thing is clear – volatility is set to remain elevated with or without new developments coming from the company.

BNGO stock price

NASDAQ: BNGO is changing hands at around $5.66 at the time of writing, up some 20%. Activity in shares has been substantial for a company worth less than $1 billion. The 52-week high of 7.24 – achieved in last week's rally – seems like a distant target. Strong support awaits at $4, which is a round number and also cushioned the stock on Friday.

Broader stock markets are trending lower after the US reported a loss of 140,000 jobs in December while the Federal Reserve seems reluctant to step with more stimulus.

For more, see the previous coverage of NASDAQ: BNGO

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.