Technical Confluences Detector

What is the Technical Confluences Detector?

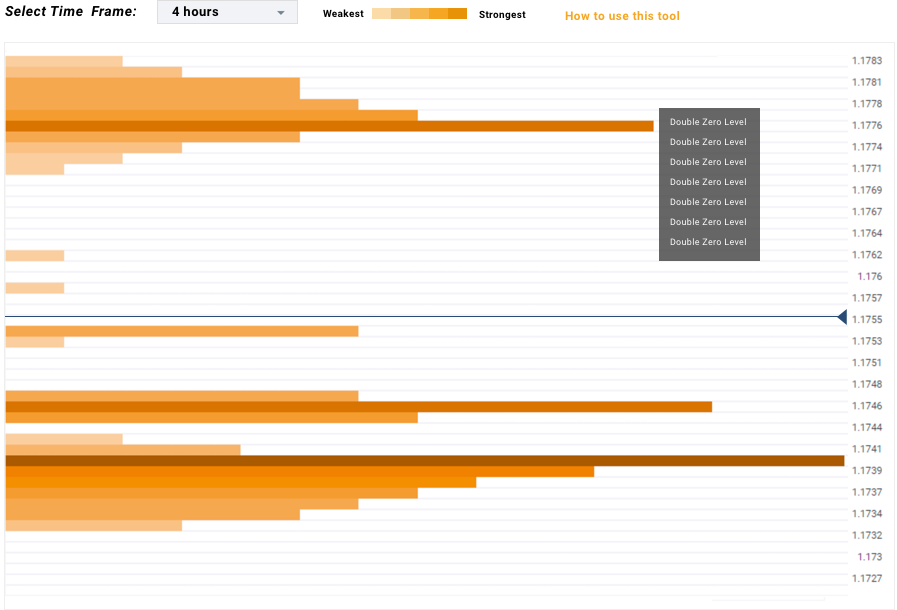

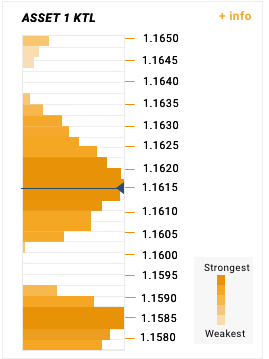

The FXS Technical Confluences Detector is an in-house tool, developed by FXStreet experts, that allows you to identify those price levels where congestion of indicators like moving averages, Fibonacci levels, Pivot Points occurs. Knowing where these congestion points are located is very helpful as it allows the trader to see these areas of support and resistance easily.

This tool is customizable so you can choose the asset selectors and the time frame that are more suitable for your trading operations.

Read more about the Technical Confluences Detector.

Gold dip buyers emerge once again near $4,650 Premium

Gold buyers are fighting back control early Friday, after having found bargain buying interest once again near the $4,650 psychological level. That being said, a sense of caution still prevails amongst them as volatility continues to remain high across the financial markets amid the ongoing rotation trend.

Best brokers in your location

Forex

Commodities

Cryptos

What are the Technical Confluences Detector?

HOW DOES IT WORK?

CONFLUENCE OF TECHNICAL LEVELS

This tool assigns a certain "weight" to each indicator according to its class and time range. This "weight" is propagated to adjacent price levels – even if those levels do not contain any indicator – to highlight the influence of the force of attraction generated by the presence of important indicators such as a simple moving average or a Pivot Point level in a daily range. The algorithm's logical structure intensifies the signal's strength in those areas where several indicators converge – so-called technical confluence zones.

HOW TO READ THE CHART?

The tool detects and draws the price levels where indicators are placed, highlighting those levels where several indicators converge simultaneously. The length of each bar indicates the intensity of the resistance or support levels generated by the technical indicators. We have also implemented a color gradient to intensify the bars' tonality where the Technical Confluences Detector finds more resistance to price advance. The white lines represent areas where no technical indicator is detected and where the price can move with ease.

TOOLTIP

You can see which indicators are within each price level by placing the cursor over the bar price level. The explanation uses a code that indicates:

- Previous daily, weekly and monthly highs and lows.

- Pivot Points

- Moving averages

- Bollinger bands

- Fibonacci retracements

HOW TO USE IT?

With the FXS Technical Confluences Detector tool, you can quickly locate the areas where the price can find a support or resistance zone and make trading decisions. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.