Palantir Technologies (PLTR) Stock Price and News: Palantir (PLTR) announces partnership with IBM, shares surge!

- PLTR announces partnership with IBM on AI applications.

- Palantir shares up 8% during Monday's pre-market trading.

- PLTR shares up 45% year to date, over 200% in last three months.

Update: Shares in Palantir (PLTR) moved sharply higher on Monday as IBM and Palantir announced a partnership for open Artificial Intelligence (AI) applications. "Together, IBM and Palantir aim to make it easier than ever for businesses to put AI to work and become data-driven throughout their operations", said Rob Thomas, Senior Vice President, Cloud and Data Platform, IBM. Shares in PLTR are up 8% at $36.87 at the time of writing.

Shares in PLTR fell heavily on Tuesday as the /wallstreetbets trade unwound. PLTR shares closed Tuesday's session at $31.02 down nearly 9%.

Palantir Technologies (PLTR) launched on the stock market at the end of September 2020 at a price of $7.25 a share. PLTR was co-founded by legendary Silicon Valley investor Peter Thiel. PLTR is a data mining and analytics technology company, it helps companies integrate and analyse their various diverse data sets to help make sense of complicated data. Palantir streamlines decision making based on data analysis. The company helps with search functions and is heavily involved in the security industry. PLTR has links to law enforcement agencies such as the FBI, CIA, police and Department of Defense.

Palantir has signed a number of important contracts recently with Rio Tinto (RIO), Proctor & Gamble (PG), California Electricity grid, UK’s NHS and US Army’s TITAN program.

See more: FXStreet New Equities homepage

Retail driven gains?

Jeffries and William Blair have recently been bullish on the stock helping keep it supported but the biggest trend in 2021 has been the /wallstreetbets phenomenon. PLTR was one of the most favoured stocks among this new group of retail traders. This, along with some positive underlying news and the analyst upgrades has helped PLTR shares to be up 30% for 2021 and up over 200% for the last 3 months. However PLTR shares had been trading notably higher, peaking at $45 on January 27 before falling back to current levels of $31.

Results could bring some headwinds

PLTR announces Q4 results on February 16. This will end the lockup period for the founding shareholders. The three founding partners Peter Thiel, Alex Karp and Stephen Cohen were only allowed to sell 20% of their holding during the stock market listing. However this restriction will be lifted 3 days after PLTR releases results. While it is unclear if the founders would want or need to sell any stock it will still be on traders minds given the strong performance of PLTR shars since listing.

Analysts turning bearish

Citigroup recently downgraded its rating for PLTR to Sell. Morgan Stanley and Credit Suisse also downgraded PLTR in December. Analysts were worried about the strong price gains since IPO and the possibility of founders selling shares after the lockup period ends.

PLTR technical analysis

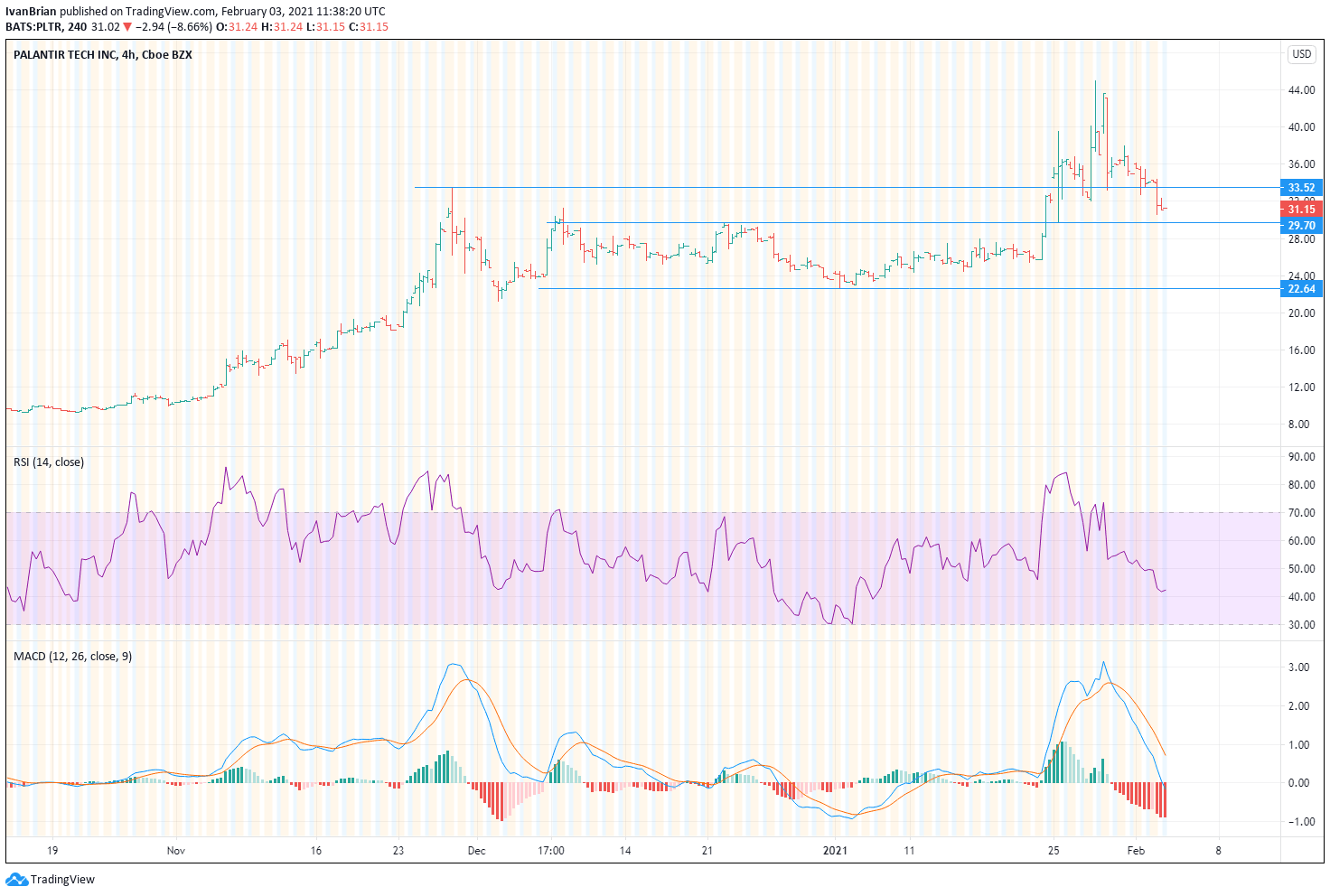

PLTR shares broke support at $33.52 on Tuesday, the next support is now at $29.70 which as the last significant low in the uptrend is key to keeping the bullish trend. A break of $29.70 brings PLTR back into the sideways channel seen since early December. MACD and RSI both trending lower putting support at $29.70 in danger.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.