AAL Stock Price: American Airlines Group inc soars, squeezing short sellers, shrugging covid concerns

- NASDAQ: AAL is up some 45% in Thursday's premarket trading, easily topping the $23 level.

- The move comes after American Airlines Group painted a bleak picture of aviation in 2021.

- Retail traders are squeezing those taking short positions.

Is American Airlines Group Inc (NASDAQ: AAL) the next GameStop? Retail traders have been seizing on vulnerable shorts once again, pushing an old stock higher – and spectacularly so. The Western world's vaccination campaigns are still running at a snail's pace, imposing bans on travel from one another.

American Airlines has recognized the situation and painted a bleak picture of the future. The Fort Worth-based firm continues struggling. Moreover, the company has just posted record losses – adding a past weakness to future ones.

Nevertheless, traders organizing on Reddit and other platforms have probably realized that short sellers are ready for another squeeze.

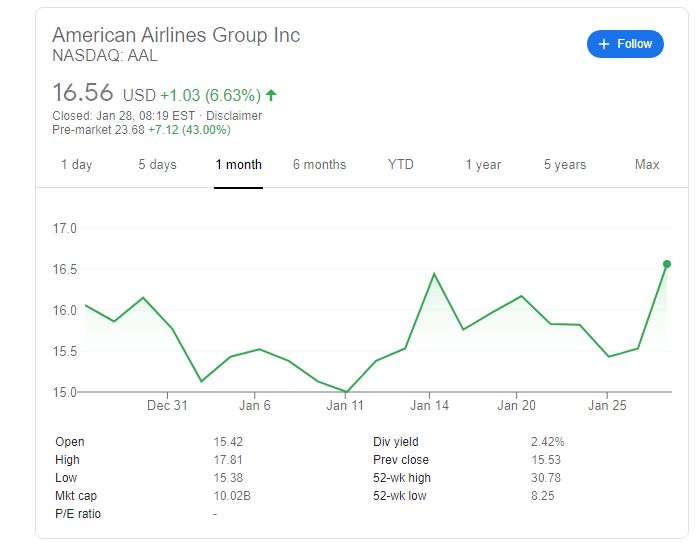

AAL stock chart

NASDAQ: AAL is surging by nearly 50% at the time of writing in Thursday's premarket trading. on course to hit the highest since February last year – just before COVID-19 hit.

The 52-week high of $30.78 is the next target to watch above current levels. Support awaits at the 52-week low of $15.38.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.