BNGO Stock Forecast: BioNano Genomics Inc set to crash after offering shares at 35% below close price

- NASDAQ: BNGO is set to reverse its gains and crash after announcing a fresh public offering.

- BioNano Genomics may be trying to cash on the recent massive rally.

- The firm's genetic breakthrough may allow it to recover once the dust settles.

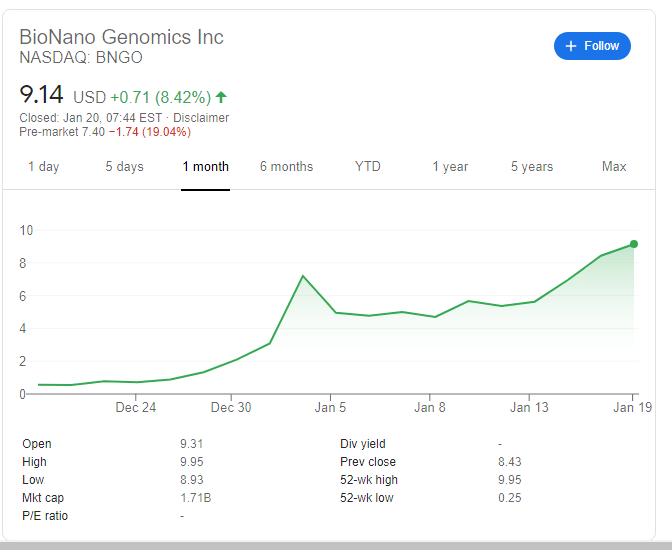

The company giveth, the company taketh away – BioNano Genomics (NASDAQ: BNGO) shares are set to suffer on Wednesday, reversing a substantial portion of its gains. Premarket trading figures are pointing to a drop of roughly 20% to $7.27 from the previous close at $9.14. It can get substantially worse.

The San Diego-based genetics firm has announced it is offering new shares at only $6. Does management value the company's worth some 35% below what investors are willing to pay? Is BioNano in dire economic straits, forcing a firesale?

These questions and others may compound the damage inflicted on NASDAQ: BNGO as investors digest the news on the day that Joe Biden is inaugurated as US President. The incoming administration is emphasizing the role of science in society and may channel funds to Research and Development – that may benefit BionNano.

BNGO stock price

Apart from a Biden boost, will NASDAQ: BNGO rise despite the low pricing? It is essential to note that this is not the first time such news is floated. Earlier this year, reports of issuance sent shares below $5, and now the firm is worth much more. Can it swiftly recover?

The answer depends mostly on BioNano's products – all related to genetic treatment. The company announced progress in several fields, from the autism spectrum, identifying reasons for severe COVID-19 illness and cancer treatments. Upbeat news on what the company produces and discovers could prove more significant than financial developments. Neverteless, shares will likely suffer badly before attempting a recovery.

More Best Stocks to Buy Forecast 2021: Vaccines and zero rates to broaden recovery

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.