BB Stock Price: BlackBerry Ltd shrugs defies bearish analysts, competes with Gamestop for attention

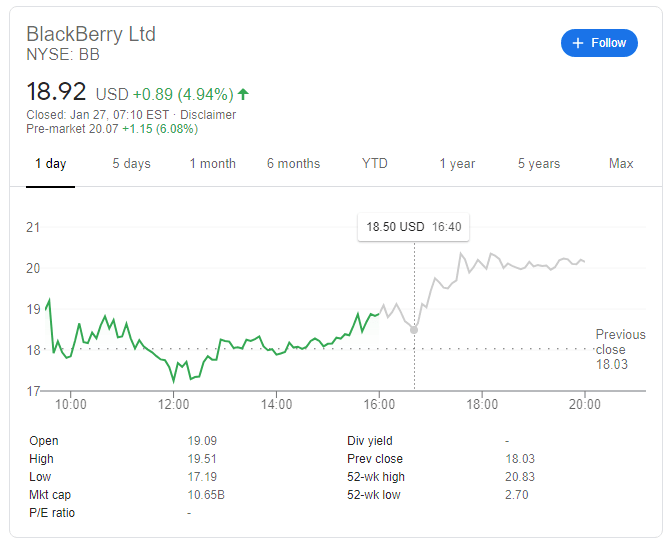

- NYSE: BB has risen by nearly 5% on Tuesday and is set to advance at the same rate on Wednesday.

- Investors are shrugging off a negative analysis by RBC.

- BlackBerry's valuation is similar to Gamestop and also garners attention from retail traders.

BlackBerry Ltd. (NYSE: BB) is not only a blast from the past – but also a hot stock in 2021. The Canadian maker of handhelds – one belonging to then-president Barack Obama – has genuine reasons to rise, including deals with three large tech firms.

However, the experts at RBC suspect that the recent rise in its shares makes it overvalued. Paul Treiber, an analyst at the bank, downgraded the stock to "underperform" from "sector perform. " Treiber cited a drop dollar-based net revenue retention in BB's third-quarter results and also doubted the chances of the firm significantly benefiting from Intellectual Property. Investors beg to disagree.

BB Stock Forecast

NYSE: BB has risen by 4.94% on Tuesday and Wednesday's premarket trading That would put it at fresh nine-year highs – it last traded at these levels in 2012, when around the time that Obama probably picked another phone.

Will the retail crowd drop Gamestop (NASDAQ: GME) and pick up NYSE: BB? While these tech firms are in different fields, both are valued at around $10 billion and both are garnering the attention of retail traders. The Gamestop army of Reddit retail traders against hedge funds is related to options, some expiring on Friday. Will Wall Street Bets' participants move to another target of a similar size?

Another point to watch is a bearish sentiment from institutional against enthusiasm from smaller investors. An answer to this question could be seen toward the of the week.

See

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.