Virgin Galactic (SPCE) Stock Price and News: SPCE shares fall as flight delayed

- Virgin Galactic shares fall 10% as more technical checks needed.

- SPCE shares show usual volatility, news dependant stock.

- SPCE does not announce a new test flight date.

Update February 12: Shares in Virgin Galactic (SPCE) were sharply lower during Friday's pre-market session. SPCE shares were trading at $53.85 a loss of 10%. The company announced a delay to its scheduled test flight and did not immediately give a date for when it would be rescheduled.

Virgin Galactic is a US aerospace company involved in, as the ticker suggests, spaceflight. Virgin Galactic (SPCE) is aiming to launch space flight experiences for private individuals. SPCE is also a manufacturer of space flight vehicles. SPCE does not produce any revenues at present, its aim is to commercialize space flight.

See the new FXStreet Equities homepage

Hard landing to end 2020

Shares in Virgin Galactic had a difficult end to 2020 as the shares fell from above $35 to below $25. Reports of an aborted test flight in mid-December caused SPCE shares to fall 17% on December 17 alone.

The Reddit fuelled blast off

Virgin Galactic (SPCE) was brought to the attention of the /wallstreetbets traders as SPCE had a heavy short interest. The latest data shows the short interest at 30%.

This caught the attention of the new breed of aggressive retail traders looking to squeeze heavily shorted stocks. The Gamestop effect led to Virgin Galactic (SPCE) blasting off in January, shares rising from $23 to hit nearly $60 on Tuesday.

Crashing back down before blast off

Reports late on Tuesday that competitor SpaceX starship landing ended in an explosion hit Virgin Galactic (SPCE) shares as investors began to worry about the read across and the dangerous nature of space flight.

However, this news was tempered by a more positive release that SPCE will reschedule its aborted December test flight for February 13, with a second test flight potentially a few weeks later. Rumours of Richard Branson boarding his own test flight gave further reassurance to investors.

The shares rebounded sharply on Wednesday as retail traders returned to their meme stocks. Gamestop, AMC and others all bounced on Wednesday and SPCE followed suit. This renewed retail interest and news of the rescheduled test flight helped Virgin Galactic (SPCE) shares to take off (too easy!) on Wednesday, signing for a 17% gain to close at $57.12.

Where to from here

There is no doubt that SPCE is a very early-stage investment, the company does not produce any revenue. However commercial space exploration is the future and there appears to be strong demand, initially from wealthy customers as it is not a cheap enterprise. News flow and safety, in particular, will be key for the future performance of SPCE.

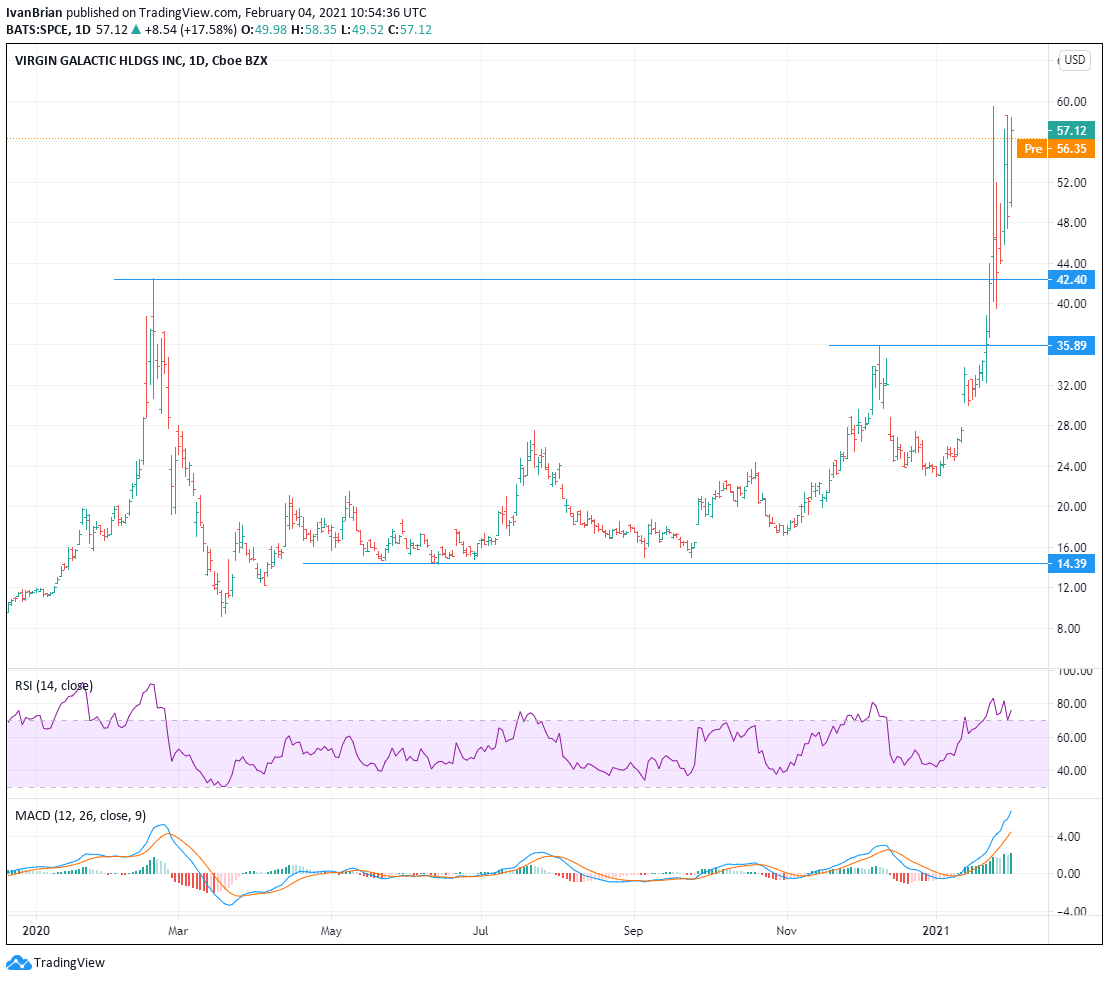

Virgin Galactic Technical analysis

Given the strong surge in January support from previous highs at $42.40 and $35.89 are in play. $60 is an initial key psychological level but not a chart level. Daily RSI and MACD both show high readings on the back of a sharp and aggressive move, but these are lagging indicators so the overbought readings need to be taken in this context. Newsflow will be more important to SPCE in the short term.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.