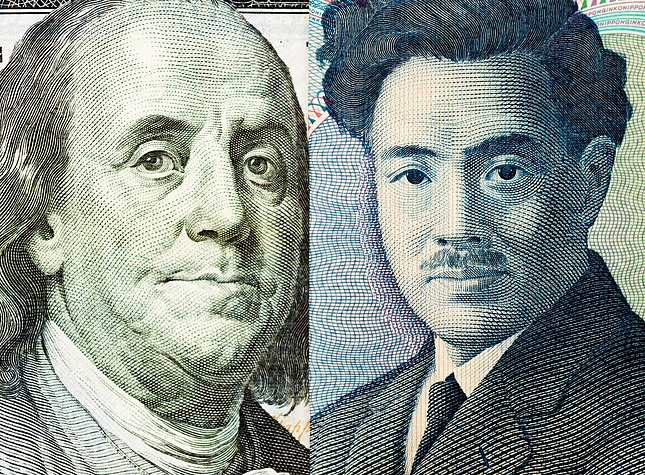

USD/JPY: Japanese Yen dives to fresh multi-decade low, around 156.00 against USD post-BoJ

The Japanese Yen weakens across the board after BoJ announced its policy decision. The lack of action by Japanese authorities and softer Tokyo CPI also exert pressure. Traders now look forward to the US PCE Price Index for some meaningful impetus.