EUR/USD Forecast: US data missed again, bad news that are good news?

EUR/USD Current price: 1.0682

- The German IFO Survey surprised positively in April, all components improved.

- March US Durable Goods Orders missed expectations despite improving on a monthly basis.

- EUR/USD seems poised to resume its slide after a corrective advance.

The EUR/USD pair retreated from 1.0713, a fresh weekly high, and trades at around 1.0680 ahead of Wall Street’s opening. The broad US Dollar’s weakness, triggered by softer-than-anticipated United States data on Tuesday, extended throughout the first half of the day. Meanwhile, stock markets advanced, adding pressure on the USD. The tech sector led the way higher and will likely retain the attention in the American session.

During the European session, the Euro found near-term support in German data as the April IFO Survey showed the Business Climate improved to 89.4 from 87.9 in March. The assessment of the current situation also improved by more than anticipated, up to 88.9, while the Expectations sub-component hit 89.9, also beating expectations.

The pair retreated modestly before the release of United States (US) Durable Goods Orders remaining stable. The report showed orders were up 2.3% in March, missing the 2.5% anticipated by market participants. Furthermore, the February figure was downwardly revised to 1.5% from a previous estimate of 2.2%.

US data missed for a second consecutive day, but are those terrible news? Somehow, the worse-than-anticipated growth-related figures could build the case for sooner-than-anticipated rate cuts. If that’s the case or not, it will likely be more straightforward following upcoming US data. The country will unveil the first estimate of the Q1 Gross Domestic Product (GDP) next Thursday, which is expected to show that the economy grew at an annualized pace of 2.5% in the three months to March. Also, the US will publish the March Personal Consumption Expenditures (PCE) Price Index on Friday, the Federal Reserve’s (Fed) favorite inflation gauge.

EUR/USD short-term technical outlook

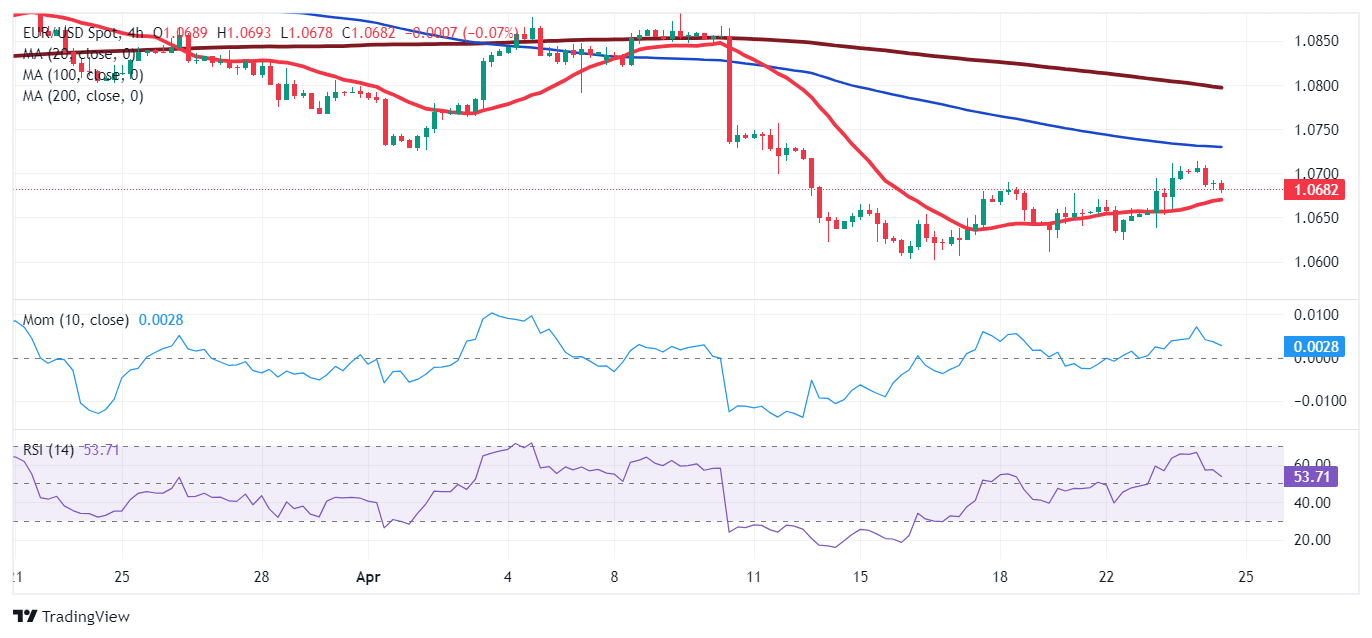

From a technical point of view, the EUR/USD pair seems to have completed its corrective advance and is poised to resume its decline. The pair trades near a daily low of 1.0677, and technical indicators in the daily chart maintain their downward slopes within negative levels, in line with dominant selling interest. Additionally, the pair trades below all its moving averages. The 20 Simple Moving Average (SMA) provides resistance at around 1.0735 while extending its slide below the longer one, also reflecting sellers’ dominance.

In the near term, and according to the 4-hour chart, the outlook is neutral. EUR/USD is a handful of pips above a mildly bullish 20 SMA, while a bearish 100 SMA provides resistance in the 1.0730 price zone, reinforcing the relevance of the area. At the same time, the Momentum indicator heads south just above its 100 line, falling short of confirming an upcoming slide. Finally, the Relative Strength Index (RSI) indicator stands pat at around 55. The pair still needs to break through the 1.0600 mark to confirm a bearish extension, although it would hardly happen ahead of upcoming US first-tier data.

Support levels: 1.0645 1.0600 1.0570

Resistance levels: 1.0700 1.0740 1.0785

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.