GBP/USD Weekly Forecast: Pound Sterling hit by increasing risk-off sentiment, strong Dollar

- The Pound Sterling hit five-month lows below 1.2400 against the US Dollar.

- GBP/USD is set for more pain, with US advance GDP due in the week ahead.

- The Pound Sterling tested 1.2400, daily RSI still remains in the negative zone.

The Pound Sterling (GBP) accelerated its south run against the US Dollar (USD), knocking the GBP/USD pair to levels unseen since late November 2023.

Pound Sterling dumped on Middle East tensions, hawkish Fed outlook

Mounting fears over a fully blown-out war in the Middle East combined with a hawkish shift in the US Federal Reserve (Fed) interest-rate outlook doubled up the demand for the US Dollar at the expense of the Pound Sterling. The underlying cautious environment throughout the week weighed on the risk currencies such as the British Pound.

Market participants began the week digesting Saturday’s Iran’s drone attacks on Israel. Citing the Islamic Revolutionary Guard Corps, Iran’s state-run media reported that dozens of drones were fired in retaliation to the suspected Israeli attack on Iran’s consulate in Damascus on 1 April.

Since then, investors remained fearful of whether Iran’s unprecedented strike on Israel could fuel a wider regional conflict. Even though Iran repeatedly said that it seeks no further escalation of its conflict with Israel, the Western response to the Iranian attack remains a cause of concern for broader markets. White House National Security Adviser Jake Sullivan announced late Tuesday that the US will impose new sanctions against Iran’s missile and drone program, entities supporting Islamic Revolutionary Guard Corp. (IRGC) and the Defense Ministry.

Risk-aversion intensified toward the midweek after markets entered “sell everything” mode in response to a surprise hawkish tone in Fed Chair Jerome Powell’s speech on Tuesday. Powell said recent inflation data, with three months of upside surprises, had not given policymakers enough confidence to ease policy soon. He added that the central bank may need to keep rates higher for longer than previously thought. His comments further squashed expectations of Fed rate cuts this year, spiking up the US Dollar.

Markets slashed bets for June and July Fed rate cuts, although chances of a September Fed rate reducton still stand at about 65%, according to the CME Group’s FedWatch Tool. Besides Powell, several other Fed policymakers continued to express concerns over sticky inflation, backing the view of a delayed and slower policy pivot.

On Friday, risk sentiment took a big hit after ABC News confirmed, citing a US official, that Israel fired missiles on Iran’s central city of Isfahan. Iran's Fars news agency said an explosion was heard at the city airport but the cause was not immediately known. Several Iranian nuclear sites are located in Isfahan province. Against this backdrop, the US Dollar received a fresh boost, while GBP/USD hit a five-month low below the 1.2400 threshold.

From the UK side of the equation, the Pound Sterling tried its luck on a lesser-than-expected cool down in the country’s inflation data for March released on Wednesday but failed to sustain the recovery, as sellers continued to lurk near 1.2500. Consumer Price Index (CPI) rose at an annual pace of 3.2% in March, slower than a 3.4% uptick in February, the data released by the Office for National Statistics (ONS) showed. The data beat the market expectations of a 3.1% increase in the reported period.

Following the UK inflation data release, money markets now fully price in the first Bank of England (BoE) rate cut in November, compared with September previously expected, per Reuters. Meanwhile, Tuesday’s UK employment data had a limited impact on the currency pair. Further, the UK Retail Sales stagnated in March, the Office for National Statistics reported on Friday.

The week ahead: All eyes on US advance GDP

It’s about the US economic data releases in the week ahead, as the UK calendar remains devoid of any significant event, leaving GBPUSD at the mercy of the US Dollar dynamics and the sentiment around the Fed.

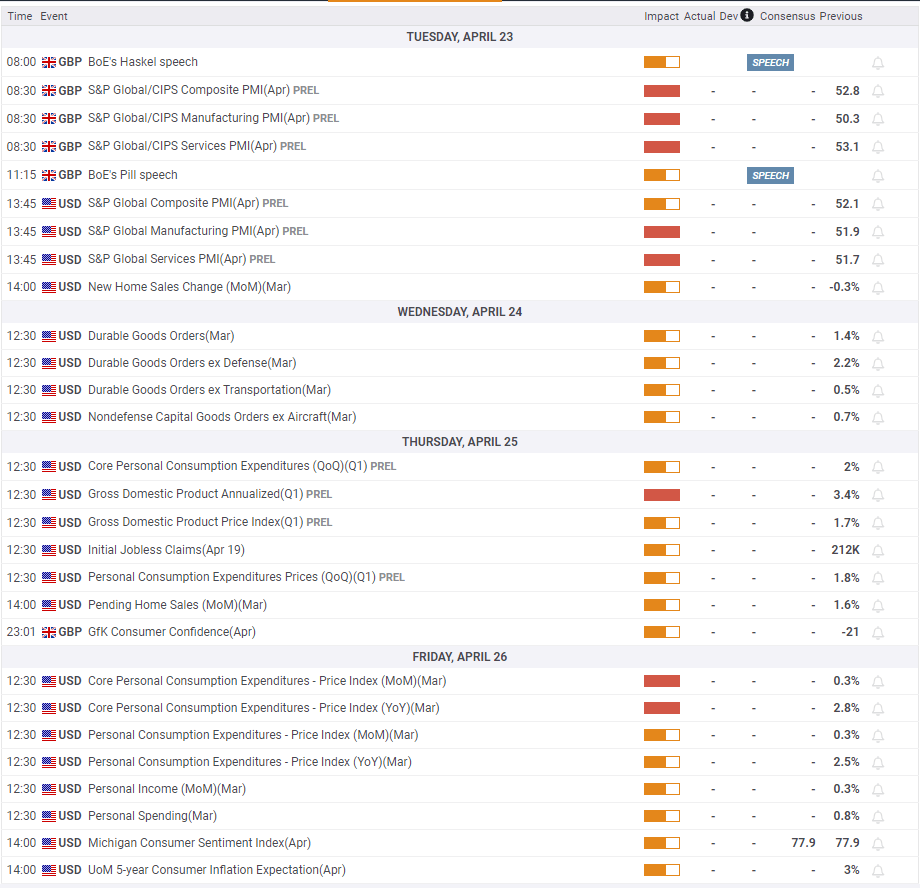

Monday is quiet, in terms of data publications, and hence, attention turns toward Tuesday’s S&P Global Preliminary Manufacturing and Services PMI data for April from both the UK and the US. Also, the US New Homes Sales data and Treasury’s Currency Report will entertain traders.

The US Durable Goods Orders data for March will feature on Wednesday, followed by the high-impact Advance first-quarter US Gross Domestic Product (GDP) report on Thursday. The weekly Jobless Claims and Pending Homes Sales will also be released that day.

The Bank of Japan (BoJ) will announce its monetary policy on Friday, which could have a USD/JPY-driven big “rub-off” effect on the US Dollar, eventually influencing GBP/USD price action. Later on Friday, the US will report the monthly Personal Consumption Expenditures (PCE) Price Index for March and the revised University of Michigan (UoM) Consumer Sentiment data for April.

Apart from the data releases, speeches BoE policymakers, as well as, the Middle East geopolitical developments will be closely watched by market participants.

GBP/USD: Technical Outlook

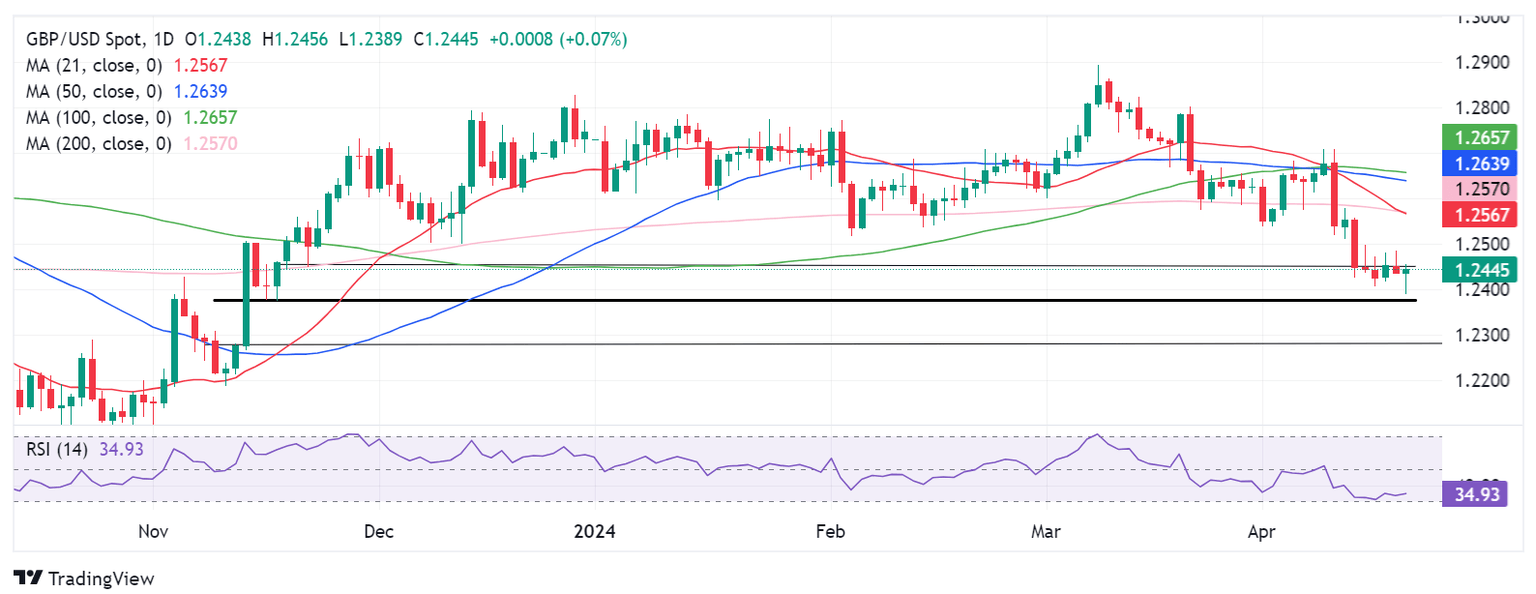

From a short-term technical perspective, GBP/USD remains posied for some more weakness, as the 14-day Relative Strength Index (RSI) indicator holds deep in the negative territory but not yet in the oversold region.

Adding credence to the bearish potential, the 21-day Simple Moving Average (SMA) crossed the 200-day SMA for the downside on Thursday, charting a Bear Cross.

Therefore, a sustained move below the intersection of the November 16 and 17 lows near 1.2375 will trigger a sharp downtrend toward the November 14 low of 1.2266.

If the RSI conditions turn oversold, a meaningful recovery will initiate only on a sustained move above the previous key support-turned resistance of 1.2449.

The net topside hurdle is seen at around 1.2565, the crossover of the 21- and 200-day SMAs.

Acceptance above the latter will call for a test of the 1.2650 supply zone, where the 50- and 100-day SMAs guard the upside.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.