Gold Price Forecast: Worried world buys the safe-haven metal

- Market players run for safety as coronavirus hits global growth.

- The US economy is the most resilient to the coronavirus crisis.

- XAUUSD overbought but bullish, the rally could continue as long as above 1,585.

Gold prices have added this week roughly $60 a troy ounce, to hit levels last seen in 2013. The Chinese coronavirus outbreak continues to dominate the market’s sentiment, as the world´s second-largest economy is pretty much in quarantine. Shuttered stores and workers staying at home has forced big names such as Nike, Adidas, Apple and Versace to warn investors that sales could take a hit. The China Passenger Car Association (CPCA), reported that sales of passenger cars in the country plunged 92% YoY in the first half of February.

China’s growth will no doubts be affected by the outbreak. But as the virus, the crisis won’t remain within the mainland. According to Oxford Economics, the coronavirus could cost the global economy more than $1tn in lost output and knock 1.3% off global growth this year if it becomes a pandemic.

US economy in better shape

Meanwhile, US macroeconomic data continues to signal that the local economy is the most resilient. Producer Prices rose by more than anticipated in January, while regional manufacturing indexes soared. Employment figures failed to impress but remained at healthy levels. The greenback has been the strongest currency across the board but was not able to take advantage against the bright metal, reflecting the market’s fears.

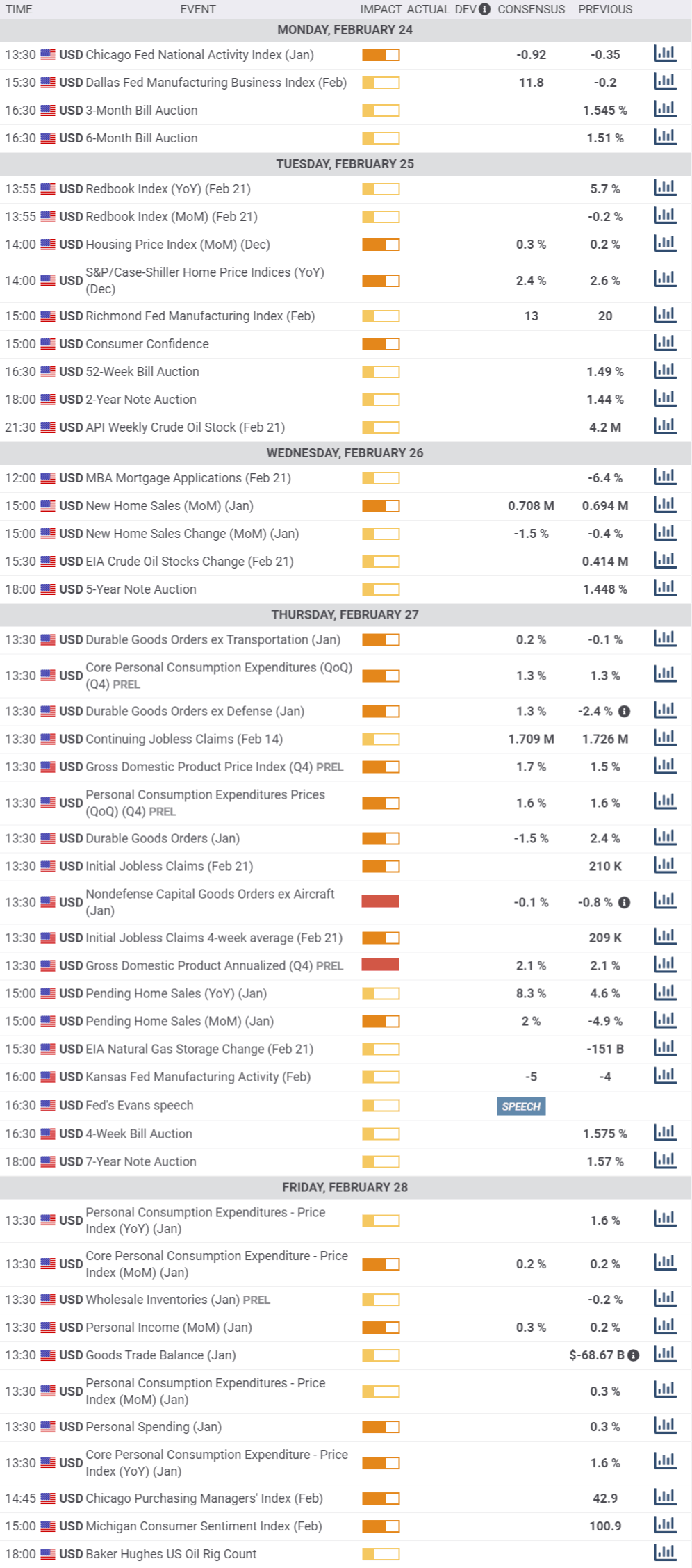

The US macroeconomic calendar will be packed next week, as the country will publish several regional manufacturing indexes and housing data. The most relevant report will be Durable Goods Orders scheduled for Thursday and seen down by -1.5%. The country will also release the first revision of Q4 GDP, seen steady at 2.1%. On Friday, the US will publish the January Core PCE Price Index, Fed’s favourite inflation measure, previously at 1.6%.

Spot Gold Technical Outlook

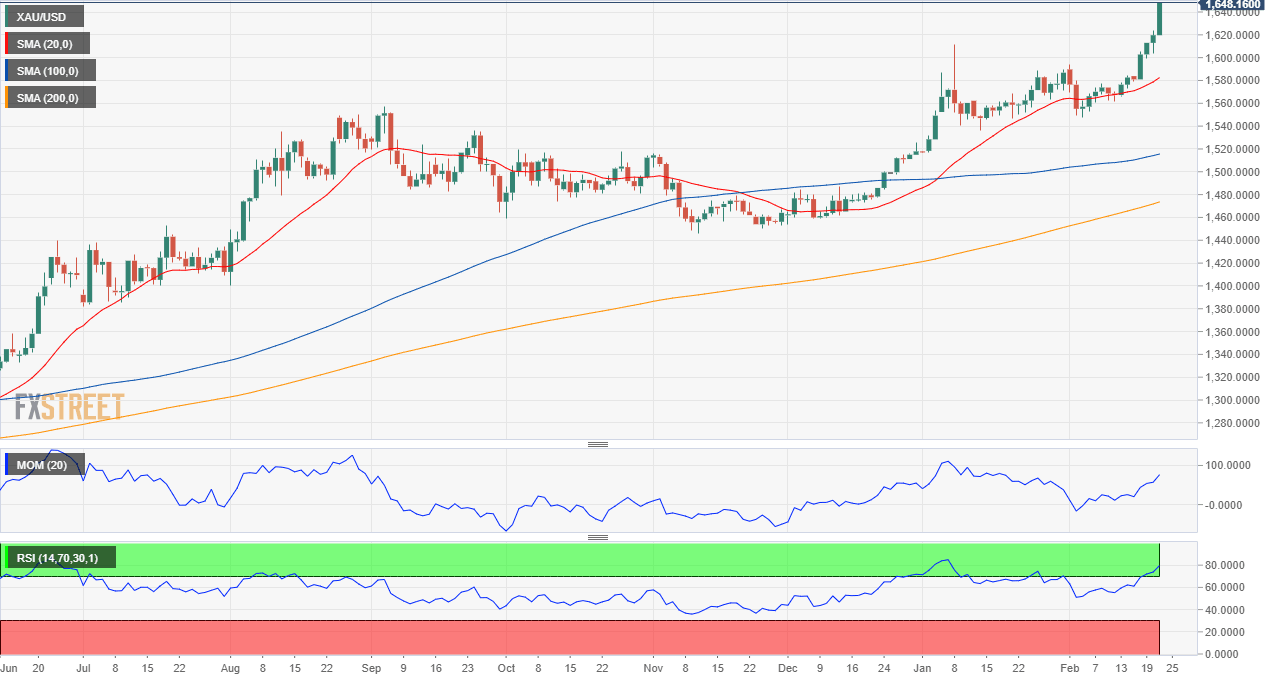

Spot gold trades at around $1,645.00 a troy ounce, finishing the week well above a critical long-term Fibonacci level, the 61.8% retracement of the multi-year decline at 1,585.98, now a line in the sand.

The metal is overbought in its weekly chart, although technical indicators retain their bullish momentum, indicating the strength of long-term buyers. Moving averages continue to head firmly north, also supportive of another leg north.

The daily chart is also indicating bulls are in control, as the metal finally shrugged off its neutral stance. The 20 DMA in the mentioned chart stands just below the mentioned Fibonacci support, reinforcing it, while technical indicators head north, the Momentum almost vertically and the RSI at 75.

Given the extreme overbought conditions, a corrective decline is not out of the table, but as long as the 1,586 support holds, the upside will remain favoured.

The immediate support is 1,611, the former yearly high ahead of 1,586. Below this last, the slide can continue to 1,560, although in the current risk-averse environment, such slide seems unlikely. A weekly close above 1,635 should signal higher chances of an advance toward 1,679, the next relevant resistance, ahead of the 1,700 figure.

Gold Sentiment Poll

The FXStreet Forecast Poll shows that gold’s rally has largely surpassed investors’ expectations. On average, polled experts set a target of 1,629.30 for the upcoming week, and of 1,640.18 in the monthly perspective, both below the current level. The bright metal is holding on to gains quarterly basis, leaving the longer-term views neutral.

However, the Overview chart shows that the moving averages have turned sharply higher in all the three time-frame under study, indicating sustainable buying interest. And while the spread of possible targets is wide, the lows have been sharply upgraded when compared to a week ago.

Related Forecasts:

EUR/USD Forecast: Interim bottom not yet confirmed

GBP/USD Forecast: Brexit, coronavirus, and slippery support open door to 1.2700

AUD/USD Forecast: Oversold conditions may provide (temporary) relief from coronavirus carnage

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.