AUD/USD Forecast: Oversold conditions may provide (temporary) relief from coronavirus carnage

- AUD/USD has tumbled down to the lowest since 2009 amid coronavirus fears and other factors.

- Chinese data and further headlines about the disease are set to move the Aussie.

- Late February's daily chart is pointing to the downside.

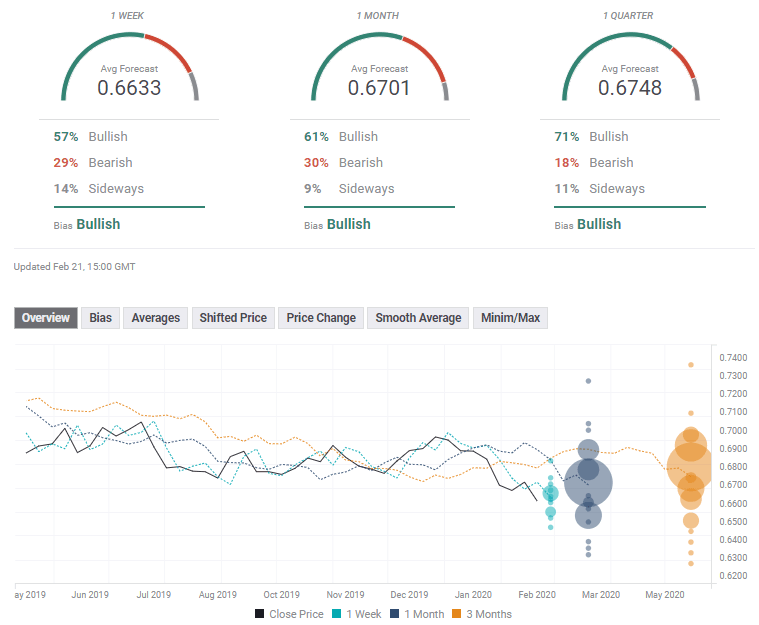

- The FX Poll is pointing to recovery from the lows.

While the pace of new coronavirus cases has decelerated, the economic damage is accumulating – taking its toll on markets and weighing on the Aussie. At 11-year lows, can it continue or will oversold conditions eventually trigger a bounce?

This week in AUD/USD: Coronavirus has an economic impact

When Apple issued a warning related to its guidance, the world finally seemed to catch up with the economic damage wrecked by the coronavirus outbreak, and markets began shivering. Other companies, analysts, and policymakers have started reassessing economic forecasts and considering a longer-term impact than first perceived. Hopes for V-shaped dip in the Chinese economy have been replaced by talk of a U-shaped one, and some fear an L – a significant downturn.

The soggier market mood has taken its toll on the Aussie despite Chinese reports of a deceleration in the number of new cases, especially outside Hubei – the epicenter of the respiratory disease.

The Reserve Bank of Australia's meeting minutes also referred to the outbreak as a substantial risk factor, but mostly reaffirmed the bank's messages that Governor Phillip had already conveyed. The RBA stands ready to act but may keep its powder dry until it receives more domestic data.

Lowe and co. may change their minds in response to the rise in Australia's Unemployment Rate. The increase to 5.3% was the spark that sent AUD/USD to the lowest in a decade. However, the details of the report show that the increase was partially fueled by an expansion of the workforce, a positive development.

On the other side of the Pacific, the Federal Reserve's meeting minutes have shown that the world's most powerful central bank remains on hold for the foreseeable future. Markets are pricing in one or two rate cuts this year. The Fed's firm stand is also helping the dollar.

US economic figures have also been mostly supportive of the dollar. Housing figures, producer prices, and the Philly Fed Manufacturing Index all exceeded estimates. However, Markit's Services Purchasing Managers' Index shocked with a drop to 49.4 points – the lowest since 2013 – triggering a dollar correction.

Australian and Chinese events: Chinese industrial output stand out

Further coronavirus headlines are set to dominate trading also in the last week of February. The focus will likely continue shifting to the economic impact – such as warnings from companies – than the number of infections. However, if the disease spreads and causes a scare in major global cities, markets may worry.

Conversely, if Beijing's more optimistic estimates that victory near prevails, there is room for an improved market mood and for an upswing in the Aussie.

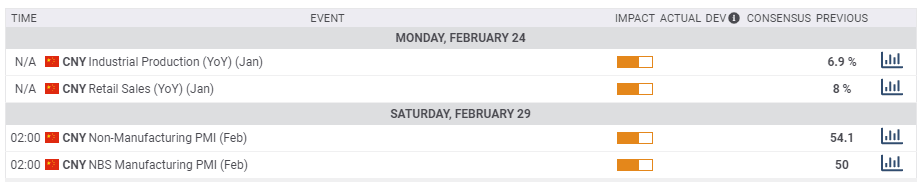

Australia publishes no economic figures in the last week of February, leaving the scene to China. The all-important Industrial Production and Retail Sales figures for January are due out – but they have been previously delayed. Data from the world's second-largest economy is always hard to analyze in January due to the lunar new year. Adding the impact of the disease, the figures may be even more confusing.

The more interesting figures are out only when markets close. China's official Purchasing Managers' Indexes for February may shed light on business sentiment and may plunge. If the statistics remain above 50 – reflecting growth – investors may cast down on their integrity.

Here the most prominent Australian and Chinese releases on the economic calendar:

US events: Revised GDP and durables eyed

The last week of February kicks off with several housing figures. The construction sector has been growing at a satisfactory pace and housing price indexes and also new home sales.

Thursday is a busy day with updated Gross Domestic Product figures for the fourth quarter expected to confirm an annualized growth rate of 2.1%. Investors will have one eye on GDP and another on Durable Goods Orders figures for January. Investment remains a weak spot in the US economy, which is mostly driven higher by consumption. The Nondefense Capital Goods Orders figure – the core of the core – is of the most interest.

The Federal Reserve's preferred measure of inflation – Core Personal Consumption Expenditure Prices (Core PCE) – will likely show that prices remain tame and below the bank's 2% target. Other statistics, such as Personal Income and Personal Spending, are also of interest.

The primaries in the Democratic Party are heating up ahead of "Super Tuesday" in early March, with a battle between the moderate camp and the left-leaning one. Markets have ignored developments so far but may tune in ahead of the contest in 15 states.

Here are the top US events as they appear on the forex calendar:

AUD/USD Technical Analysis

The Relative Strength Index on the daily chart has dropped below 30 – indicating substantially oversold conditions. Will the Aussie bounce?

Momentum remains deeply to the downside, and the A$ is trading well below the 50, 100, and 200-day Simple Moving Averages.

Overall, there is a likelihood that an upswing is on the cards, but that the trend is to the downside.

The new low of 0.6585 provides initial, yet weak support. Further down, 0.6550 and 0.65 may slow the fall. They are followed by 0.6330.

Looking up, initial resistance awaits at 0.6625, which capped a recovery attempt in February. The 0.6660 level is of higher importance after providing support twice in recent weeks. 0.6680 and 0.6720 are next.

AUD/USD Sentiment

Estimating the subsequent developments of the virus is difficult, and assessing the market reaction to the news is trickier. Any temporary relief due to oversold conditions or hopes for containment may be followed by a further downfall.

The FX Poll is showing that experts expect a rebound from current lows, with higher targets on all timeframes. Nevertheless, average targets have been downgraded in the past week.

Related Forecasts

- AUD/USD Price Forecast 2020: May the Aussie live in exciting times

- GBP/USD Forecast: Brexit, coronavirus, and slippery support open door to 1.2700

- EUR/USD Forecast: Interim bottom not yet confirmed

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637178884244253490.png&w=1536&q=95)