GBP/USD Forecast: Brexit, coronavirus, and slippery support open door to 1.2700

- GBP/USD has rocked in response to mixed figures before succumbing to dollar strength.

- Investors will likely focus on upcoming Brexit talks and coronavirus headlines.

- Late February's daily chart is pointing to further falls.

- The FX Poll is pointing to short term falls followed by advances later on.

The dollar's surge has proved unstoppable – sending cable to new 2020 lows. The pound has struggled to capitalize on mostly upbeat data as worries about Brexit crept in. The upcoming talks and the ongoing global health crisis are eyed now.

This week in GBP/USD: Dollar dominates, data unhelpful

The "Boris Bounce" was alive and kicking – until it vanished. The pound initially showed its strength, shrugging off a deceleration in wage growth to 2.9% – for the month of December. That figure relates to the turbulent end of 2019 before the election of Prime Minister Boris Johnson's landslide victory triggered some calm in markets.

Then came better figures for January. The Consumer Price Index jumped to 1.8%, beating expectations and raising chances that the Bank of England raises rates. Retail Sales statistics surprised with a monthly increase of 0.9% – and on top of an upward revision. Finally, Markit's Purchasing Managers' Index for the manufacturing sector returned to growth with 51.9, above expectations, in the read for February. The services sector consolidated its previous gains with 53.3 points.

However, while certainty about the first stage in Brexit may have given the economy a shot in the arm, concerns about the next phase have weighed on sterling. EU ambassadors have failed to agree on a common position regarding the bloc's policy on future relations with the UK. The differences may cheer supporters of Brexit, but for markets, this implies a potential delay and more protracted talks.

The larger downside factor for GBP/USD came from the dollar side of the equation, causing GBP/USD to fall to the lowest since November 2019. Several factors are behind the greenback's gains. A long list of economic figures such as Building Permits, Housing Starts, Producer Prices, and the impressive Philly Fed Manufacturing Index all strengthened the view that the US economy is outperforming the rest.

However, Markit's PMI ruined the dollar party late in the week as the services sector gauge pointed to an outright contraction with 49.4 points – the lowest in nearly seven years. The publication triggered a correction and allowed GBP/USD to recover.

Coronavirus fears also benefited the dollar. The world's largest economy has been primarily safeguarded from the respiratory disease, which is raging through China and also other countries in Asia. Moreover, the greenback receives safe-haven flows. Apple, the world's largest company, issued a warning about iPhone production and sales, weighing on market mood.

So far, the Federal Reserve has reaffirmed its stance that it plans to leave interest rates unchanged. The Fed's meeting minutes provided another confirmation of this position and also contributed to boosting the greenback.

UK events: Brexit speculation set to increase

The British economic calendar is almost void of significant releases, leaving room for politics to move the pound. Tension is mounting ahead of the official start of talks in March. In the upcoming week, the EU is expected to finalize its position at a ministerial level. The stricter the bloc's stance – the worse the impact on the pound. A softer position may boost the pound.

UK politics may also come into play ahead of the new budget due out in mid-March. Rishi Sunak, the new Chancellor of the Exchequer, is set to present infrastructure spending. Hints of a deeper budget deficit could drive the economy – and the pound – forward. A more conservative expenditure plan, closer to his predecessor Sajid Javid's thinking, would weigh on sterling.

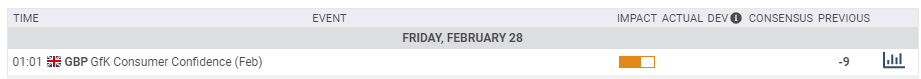

The only noteworthy economic figure due out is the GfK Consumer Confidence gauge for February, which had a score -9 in January. A similar figure is likely now.

Here is the list of UK events from the FXStreet calendar:

US events: GDP, durables and coronavirus

Coronavirus headlines are set to continue clogging the news flow for another week. Throughout the crisis, the greenback's reaction had flipped between rising with safe-haven demand to sliding when these flows to US bonds lowered their yields – making the dollar less attractive. At this point, the dollar seems to benefit from rising concerns about the disease.

Markets are more focused on economic damage – which carries a higher degree of uncertainty than the mysteries of the virus. If new companies follow Apple with warnings, the mood may sour.

The economic calendar features housing figures early in the week, and they will likely remain upbeat. The Conference Board's Consumer Confidence gauge for February will probably continue showing robust sentiment.

The most critical releases await traders on Thursday when the US economy is forecast to confirm its 2.1% annualized growth rate in the fourth quarter. For comparison, the UK economy stagnated in the last three months of 2019.

At the same time, Durable Goods Orders for January will shed light on the American economy's weak spot – investment. The nondefense, ex-aircraft statistic – the core of the core – carries expectations of a second consecutive decline.

The Fed's preferred measure of inflation, the Core Personal Consumption Expenditure (Core PCE) for January, may edge up from 1.6% yearly recorded in December but remain below 2%. Other related figures published at the same time on Friday, such as Personal Spending and Personal Income, are also of interest.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

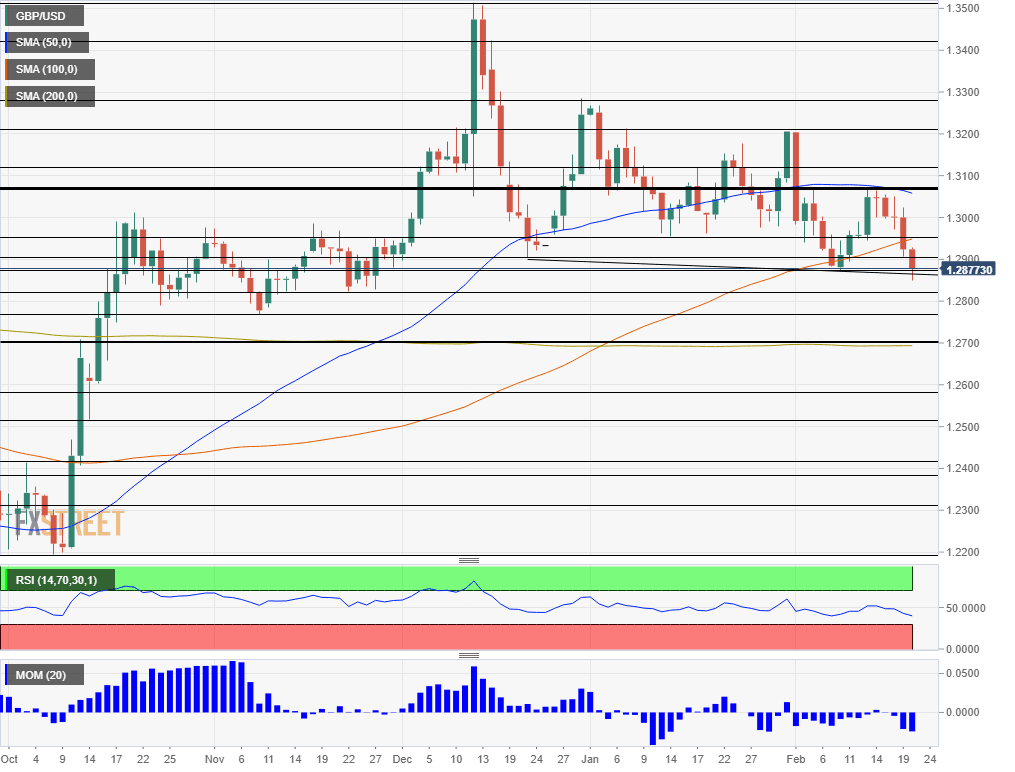

The pound/dollar daily chart has turned bearish as downside momentum strengthened and GBP/USD dropped below the 100-day Simple Moving Average after being rejected at the 50-SMA. The Relative Strength Index is well above 30 – far from oversold conditions.

Pound/dollar also slipped below a moderate downtrend support line extending from the late December trough at 1.29 to the mid-February low of 1.2875. The next big target is the 1.27 level which is where the all-important 200 SMA converges with a swing high from early October 2019.

Initial support awaits at 1.2820, which was a low point in late November. It is followed by that month's trough at 1.2820. Below 1.27 mentioned earlier, the next cushion is only at 1.2590.

Resistance above 1.29 awaits at 1.2940, a former double bottom seen in January. The next level to watch is 1.3070, which was a stubborn top in February – and converges with the 50-day SMA. 1.3110 and 1.3210 are next.

GBP/USD Sentiment

Even if the British economy has found its feet and may recover thanks to an expansionary budget, GBP/USD has room to fall amid Brexit and coronavirus concerns. The dollar may occasionally retreat, but the wind seems to be in the greenback's back.

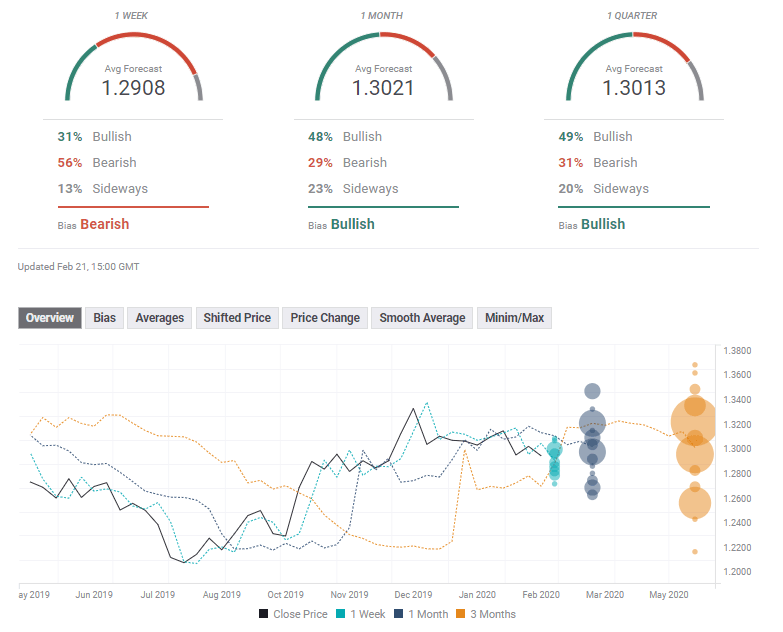

The FX Poll is showing potential for some short-term pressure, followed by a gradual recovery. Average targets have been downgraded in the past week, with experts seeming to adapt to the US dollar's strength.

Related Forecasts

- GBP/USD Price Forecast 2020: Pound may continue to fall on hard Brexit deadline

- AUD/USD Forecast: Oversold conditions may provide (temporary) relief from coronavirus carnage

- EUR/USD Forecast: Interim bottom not yet confirmed

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.