US Stocks Today: Records are there to be broken, again and again!

Here is what you need to know on Tuesday, February 9:

US stock indices set fresh record highs on Monday as stimulus looks set to pass and the US records the lowest number of new Covid-19 cases since November. Tesla boosted bitcoin, the dollar struggled and oil prices continued to rise.

Europen markets are all lower on Monday as markets pause after 6 straight days of gains in the US. The EuroStoxx is down 0.4%, FTSE down 0.2% and the Dax is down 0.5%.

Asian markets were positive on Monday with the Nikkei pushing to new highs, closing up 0.4% and the Hang Seng up 0.5%.

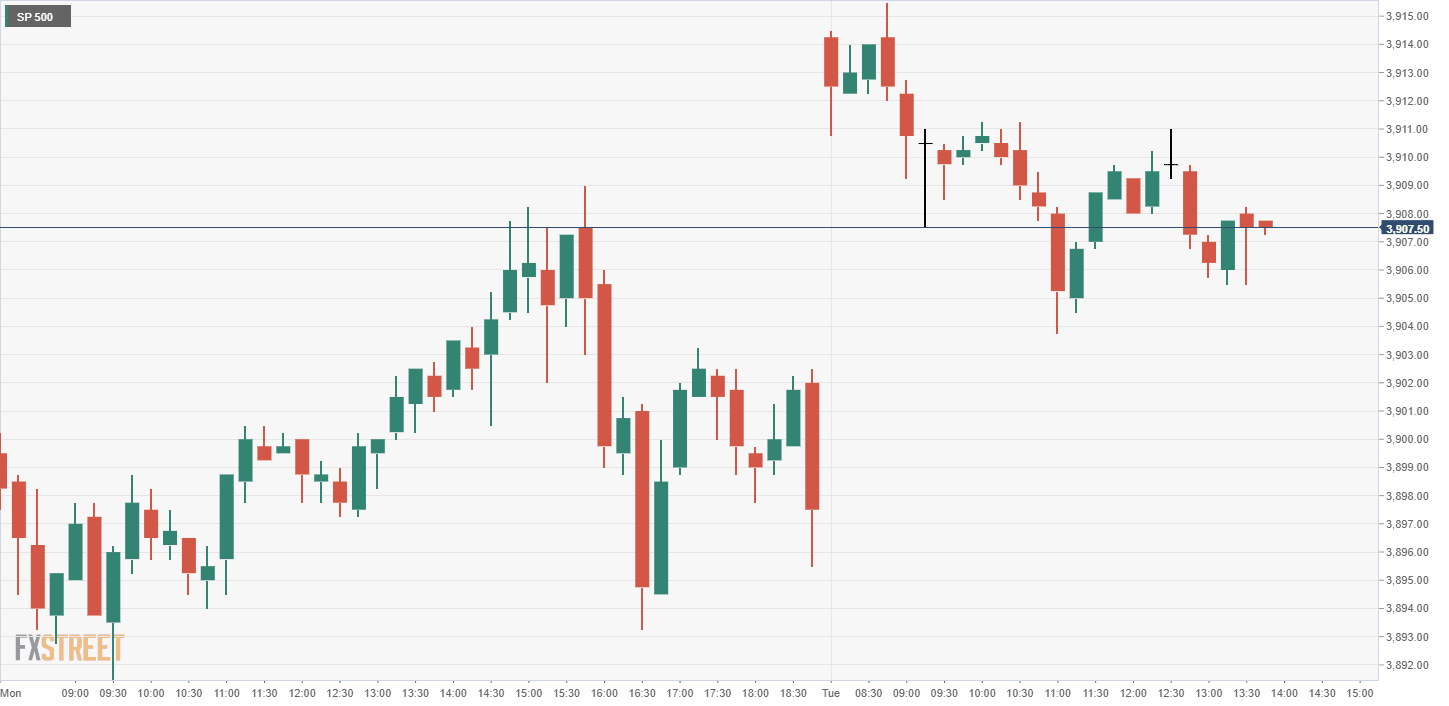

US futures are pointing lower with Nasdaq down 0.1%, Dow down 0.2% and S&P down 0.2%

S&P and EuroStoxx

Asian stocks were strong with Hong Kong shares boosted by no new Covid-19 infections in mainland China and Chinese auto sales showing a 30% rise.

European stocks are lower on Tuesday as concerns over the pace of vaccine rollout and worries over effectiveness against the South African strain weighed on markets.

The EU signed up for an additional 300 million doses of the Pfizer BioNTech vaccine as the EU lagged behind the US and UK in inoculating its population.

Energy giant Total (TOT) reported strong earnings.

US futures were finally looking lower after six straight days of gains.

Optimism over the passing of the $1.9 trillion stimulus bill, strong corporate results, and dropping US infections have combined to push US indices to record highs again on Monday.

The WHO dismissed the idea that Covid-19 originated from a lab leak saying it was likely from animal to human origin.

Former President Trump’s impeachment trial is set to begin on Tuesday.

A report from the Congressional Budget Office puts the cost of raising the minimum wage from $7.25 per hour to $15 as per President Biden's proposal, would cost 1.4 million jobs but raise 900k people out of poverty.

Eli Lilly announced its CFO was stepping down.

Electronic Arts (EA) announced it was to buy Glu Mobile (GLUU) for $2.4 billion.

Sony is to launch the Playstation 5 in China in Q2 2021.

Ups and Downs

DA Davidson increased Hasbro (HAS) to a $115 target.

Keybac increased UBER to $63 target.

Goldman Sachs added Constellation Brands (STZ) to its conviction buy list.

JPMorgan increased its price target for Twilio (TWLO) from $300 to $465 and raised it to overweight from neutral.

JPMorgan also reiterated Disney (DIS) as one of its top picks.

Stocks covered at FXStreet

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637484753769265230.png&w=1536&q=95)