Hasbro Inc (HAS) Stock Price and News: Mattel posts strong results, read across for Hasbro

- Mattel (MAT) reported Q4 2020 results after the market closed on Tuesday.

- MAT reported strong results, beating expectations, shares rallied.

- Hasbro has been laggin rival Mattel for the last eyar.

Update Wednesday, Feb 10: Hasbro rival, Mattel (MAT) announced strong results after the bell on Tuesday. EPS came in at $0.40 versus a $0.23 analyst expectation. Revenue was up by 10% beating expectations, $1.63 billion versus $1.58 billion expected. Shares in Mattel rallied during Wednesday's pre-market and are currently at $19.48, up over 3%.

Hasbro (HAS) is a child-focused, toy and entertainment company, producing toys and board games. Well-known products include Nerf, Transformers, Monopoly and TV programs Peppa Pig and PJ Masks.

HAS shares suffered a tough 2020, closing out the year down nearly 12% from where it started 2020.

Should I buy Hasbro (HAS)?

So a tough 2020, understandable, but why such underperformance versus the sector and Mattel (MAT)?

Hasbro is more focused on a broader range of products, it has a more diversified revenue stream, which has meant a broader range of struggles during the pandemic. While gaming was seen as benefiting from the global lockdowns and board games became more popular, other Hasbro products have struggled. Nerf play guns need social interaction, Transformers product sales need movie releases to bump sales, licensed products from Disney also need movies for a bump. So while the toy market did well, other areas struggled for growth.

In any market, it is always worrying to see good news not result in higher prices. Monday's solid earnings release did not result in any follow-through, as shares in HAS suffered a sharp fall.

Why did Hasbro (HAS) shares fall?

Hasbro (HAS) released Q4 2020 results on Monday. The results were solid if unspectacular with EPS of $1.27 beating analyst estimates of $1.14 and sales of $1.72 billion beating the $1.69 estimate. HAS shares rallied early during Monday’s pre-market and were up 4%, but weakened as Monday progressed. HAS shares closed at $93.15, a loss of 4% for Monday.

So why the turnaround? Well, Hasbro did not issue guidance for 2021 which may have disappointed investors as markets loath uncertainty. Bank of America also weighed in saying the stock was a long-term play, despite increasing its price target for the stock!

Hasbro is a solid, steady business with stable revenues and a generous dividend in the current negative rate environment. As the economy reopens and entertainment comes back on stream, shares in Hasbro (HAS) should benefit. HAS shares will never deliver explosive returns as it is a mature company in a mature industry but as Bank of America said it is a long term stock, suitable for a buy and hold strategy.

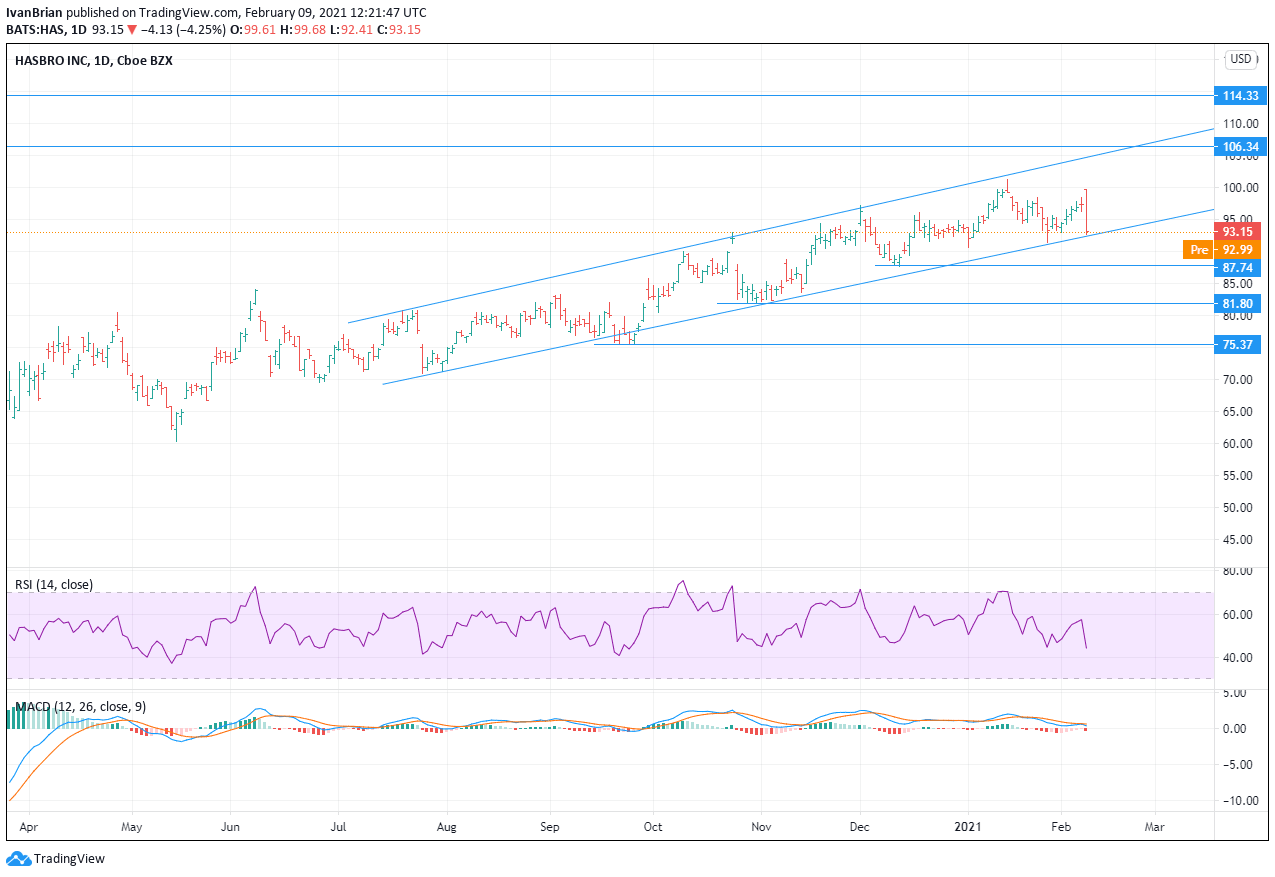

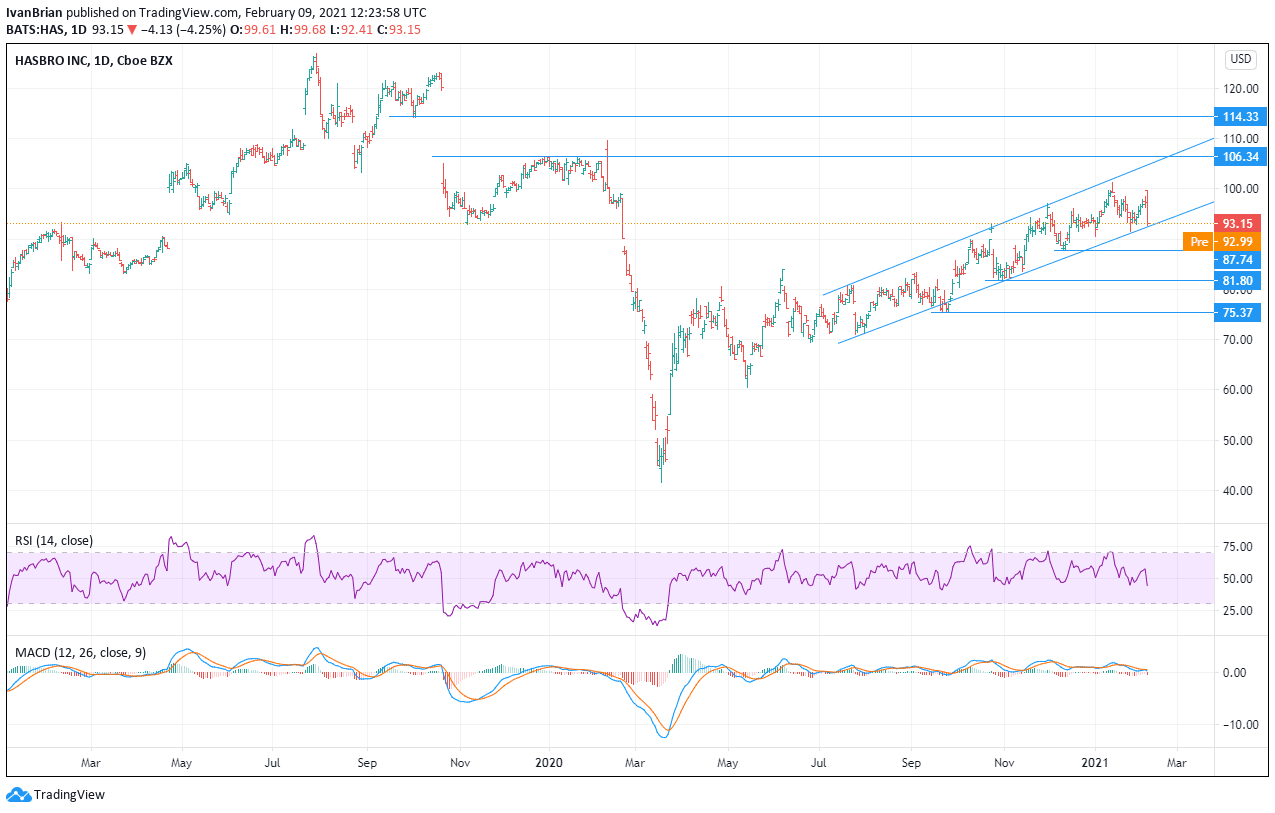

Hasbro (HAS) Technical analysis

HAS shares have been recovering and are in a bullish trend. Key support is being tested after Monday's sharp fall post-earnings. $87.74 is the more important level than trendline support. Resistance at $106.34 is an old series of highs from November/December 2019 and a break of this leaves a vacuum with little price and volume activity until $114.33.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.