Churchill Capital Corp (CCIV) Stock Price and News: Moderate decline may prove bullish

- CCIV merger speculation keeps investors thinking!

- CCIV one of Reddit-driven retail stocks for 2021.

- Churchill Corp subject of merger speculation with Lucid Motors.

Update February 11: Churchill Capital Corp IV (NASDAQ: CCIV) have closed Wednesday's session with a small decline of 1.32% to close at $32.87 – and further falls may follow on Thursday according to premarket data. Nevertheless, the relatively moderate declines of the blank check company's shares – despite no news from the merger with Lucid Motors – are proof of resilience. Most buyers are holding tight to their gains, awaiting additional ones down the line. CCIV is closer to the 52-week high of $36 than the 52-week low of $9.60. See CCIV and Lucid Motors news, a deep dive

Update February 10: Shares of Churchill Capital Corp IV (NYSE: CCIV) reversed the intraday rebound and fell nearly 2% in the post-market trading on Tuesday, closing below $33. Despite the U-turn from higher levels, the shares of the blank-check company managed to hold comfortably above the $30 mark. The upside attempts appear elusive, as industry experts believe that the SPAC firm is currently in a mania, drawing big premium only on speculations of a likely merge with Lucid Motors. Although, the overall market optimism amid growing US stimulus expectations could keep the bargain hunters motivated, cashing on any corrective dip.

Update February 9: Bargain seekers may jump on Churchill Capital Corp IV after CCIV share have shed more ground on Tuesday. The SPAC firm is changing hands at just above $31 after dipping to lower ground earlier on. Some investors might have cold feet, weak hands – or impatience – as the much-discussed merger with Lucid Motors has yet to become reality. Previous such dips have proven an opportunity to buy NYSE: CCIV. Will it happen again? At some point, both firms will come out with a statement about their intentions, and that would be a gamechanger – either a good one or a bad one. However, the current speculation game may result in another upswing rather than an extended drop.

Update: Churchill Capital Corp IV (NYSE: CCIV) dropped nearly 6% to settle below the $33 mark on Monday, having found strong support just above $30. The shares of the blank-check company corrected lower after the recent rally to the all-time-highs of $36. The pullback could be associated with the investors’ anxiety amid a lack of clarity on the likelihood of a merger with Lucid Motors. This comes after Lucid Chief Executive and Technology Officer Peter Rawlinson said that he couldn't confirm or deny the rumors of a merger that would take Lucid public.

Update: Churchill Capital Corp IV (NYSE: CCIV) extended its slide after opening in the negative territory and touched a session low of $32.66 before staging a modest rebound. As of writing, the stock was trading at $33.50, losing 3.3% on a daily basis. Nevertheless, Monday's decline seems to be a technical correction of last week's impressive rally, during which CCIV rose more than 50% and notched a new record high of $36. In fact, the stock is up nearly 175% since the beginning of the year as investors remain focused on prospects of a merge with the electric-vehicle startup Lucid Motors Inc.

Churchill Capital Corp IV (NYSE: CCIV) has kicked off the week with a marginal decline of nearly 3% to $33.65 at the time of writing. Despite this retreat, shares of the blank-check company are still substantially higher, buoyed by expectations of a SPAC merger with Lucid Motors. Investors might be assuming that such a move is a done deal. Broader markets are moving higher, with the S&P 500 topping 3,900 points.

CCIV has been in the news again on Friday, as investors try to work out the cryptic clues in relation to a merger between CCIV and Lucid Motors. However, the first rumours of the proposed merger came to light on Jan 11 after Bloomberg reported the two were in talks in a deal that would take Lucid motors public. The deal could be for as high as $15 billion and would establish Lucid as a true competitor to Tesla (TSLA).

Investors jumped on the news, quickly pushing the share price of CCIV dramatically higher. CCIV shares closed that day Jan 11, 30% higher at $13.20. But this was merely the beginning as the retail-led rally played out, driving CCIV to $36.

CCIV Stock forecast

Is CCIV ready to charge higher? Or is it a case of buy the rumour, sell the fact? Either way, it has been a short sharp rise, in tandem with a lot of retail-led moves in 2021. But unlike a lot of other Reddit driven stocks, shares in CCIV have yet to pull back in any meaningful way. Investors would be advised to exercise extreme caution. Further news re the proposed merger probably needs to come to light this week to sustain the rally. Any delays or simple lack of information will probably result in the price sliding back.

The rise of retail and /wallstreetbets!

The timing was perfect for the jump start to the rally. January was peak /wallstreetbets and CCIV quickly became one of the most discussed stocks on the site. Retail investors piled in, taking the merger news, and running with it. Shares in CCIV nearly tripled over the next two weeks with CCIV shares peaking at $36 on Friday.

A rocky road

Investors in Churchill Corp. (CCIV) have had a few potholes along the way. On Wednesday, Feb 3, a report in the Wall Street Journal put the rally on pause. The merger was “not imminent” according to the Wall Street Journal. CCIV shares closed 8% lower on Wednesday, Feb 3.

Are CCIV and Lucid fully charged?

The situation was to quickly change however with CCIV shares recovering strongly on Thursday and Friday. CCIV shares closed out the week at a record high of $34.65, having touched $36 earlier on Friday.

The catalyst was a cryptic comment from Lucid Motors CEO Peter Rawlinson. During an interview with CNBC on Friday, Rawlinson said he could neither “confirm, nor deny” that the merger between Lucid Motors and CCIV was going ahead. Investors took this as a more positive sign than the Wall Street Journal article and piled back into CCIV shares.

CCIV Technical analysis

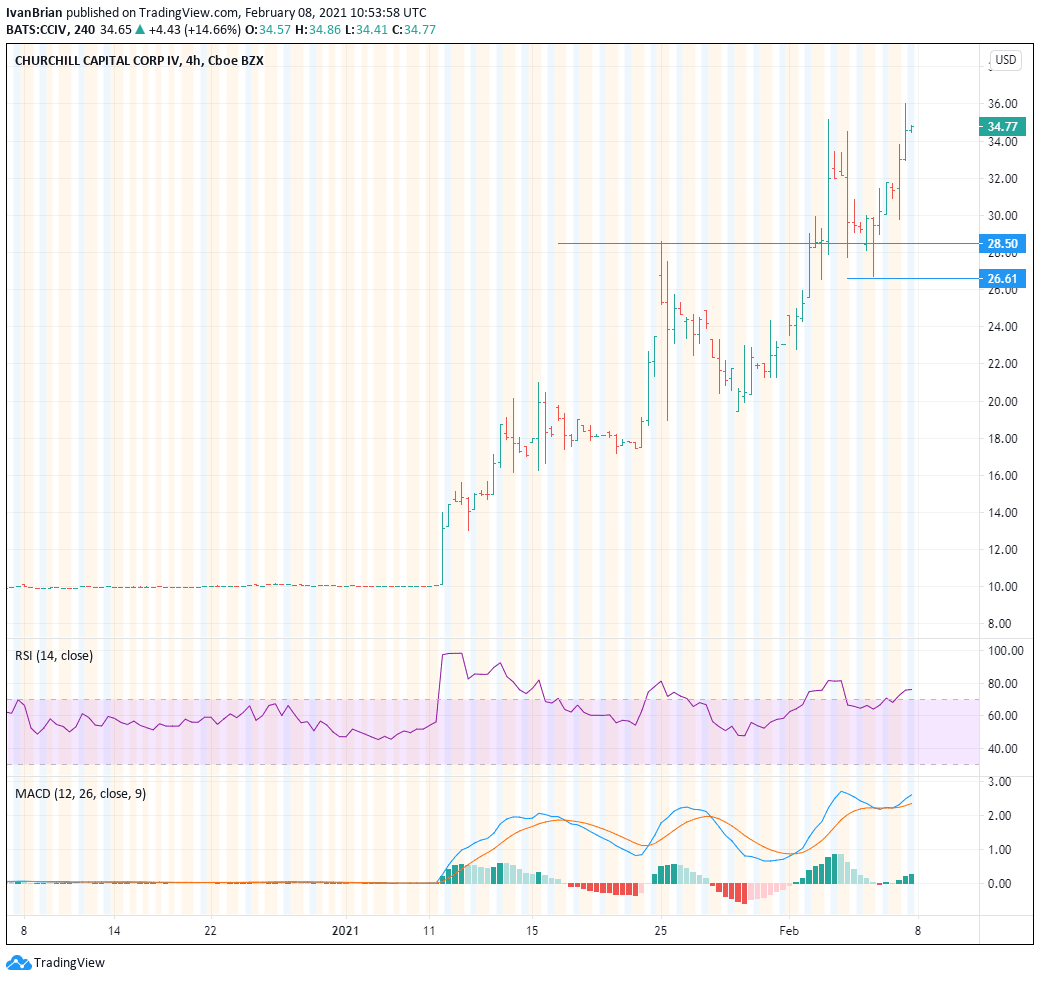

CCIV shares have had a short sharp rally, in tandem with a lot of retail stocks in 2021. The difference with CCIV is that there has not been a pullback. CCIV shares hit new record highs on Friday. But how much of the news is priced in. Technically support is at $28.50 and $26.61 is a key support to keep the bullish trend alive. Both RSI And MACD are at elevated levels but not yet showing overbought levels.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.