SNAP Stock Price and News: Should I buy SNAP? Snap it up on upgrades?

- SNAP shares are weaker on Monday after a surge on Friday.

- Investors SNAP up shares after solid results on Thursday.

- Morgan Stanley adds to the recent upgrades for SNAP.

Update: Shares in SNAP were softer in early trading on Monday after the stock surged 9% higher on Friday. The catalyst had been the solid results released by SNAP on Thursday. Analysts upgraded the company following the release of results and this trend continued on Monday with Morgan Stanley raising its price target to $50. At the time of writing, shares in SNAPare trading at $62.45, down 1.7%.

SNAP is Snapchat, the eponymous social media upstart beloved of millennials, Generation Z! Snapchat is a WhatsApp, Instagram and Facebook competitor and has been growing steadily under the radar of its bigger competitors. Snapchat has nearly 300 million daily active users and generates most of its revenue from advertising.

SNAP Stock Forecast

SNAP reported fourth-quarter results last Thursday. Results were positive, beating analyst expectations. Earnings per share (EPS) came in at $0.09 versus Wall Street expecting $0.07. Revenue was $911 million ahead of analyst expectations for $857 million. Revenue gained 62% year on year, daily active users jumped to 265 million, a gain of 22% on the year.

Snapchat (SNAP) also guided revenue to climb to $720-$740 million for Q1 2021. SNAP said it is to strengthen its advertising to help further monetize the app.

Analysts and investors SNAP it up!

Investors clearly liked what they saw as shares in SNAP climbed 9% on Friday to close out the week at $63.64.

Analysts also liked the announcement with multiple upgrades coming though from Wall Street firms on Friday.

Rosenblatt increased its price target to $70, KeyBanc increased its price target to $63. Needham and Raymond James maintained their hold and market perform rating respectively.

Pandemic boom, privacy concerns

SNAP appears to be riding the pandemic induced communication boom well with CEO Evan Spiegel saying “Our team has worked tirelessly to help people stay close with their friends and family even while they are physically apart, and we're proud of the strong results we delivered for our advertising partners this quarter and over the full year.”

The only caveat is the increasing user attention on privacy concerns. This increased privacy awareness could “present another risk of interruption to demand”, according to SNAP CFO Derek Anderson.

SNAP Technical analysis

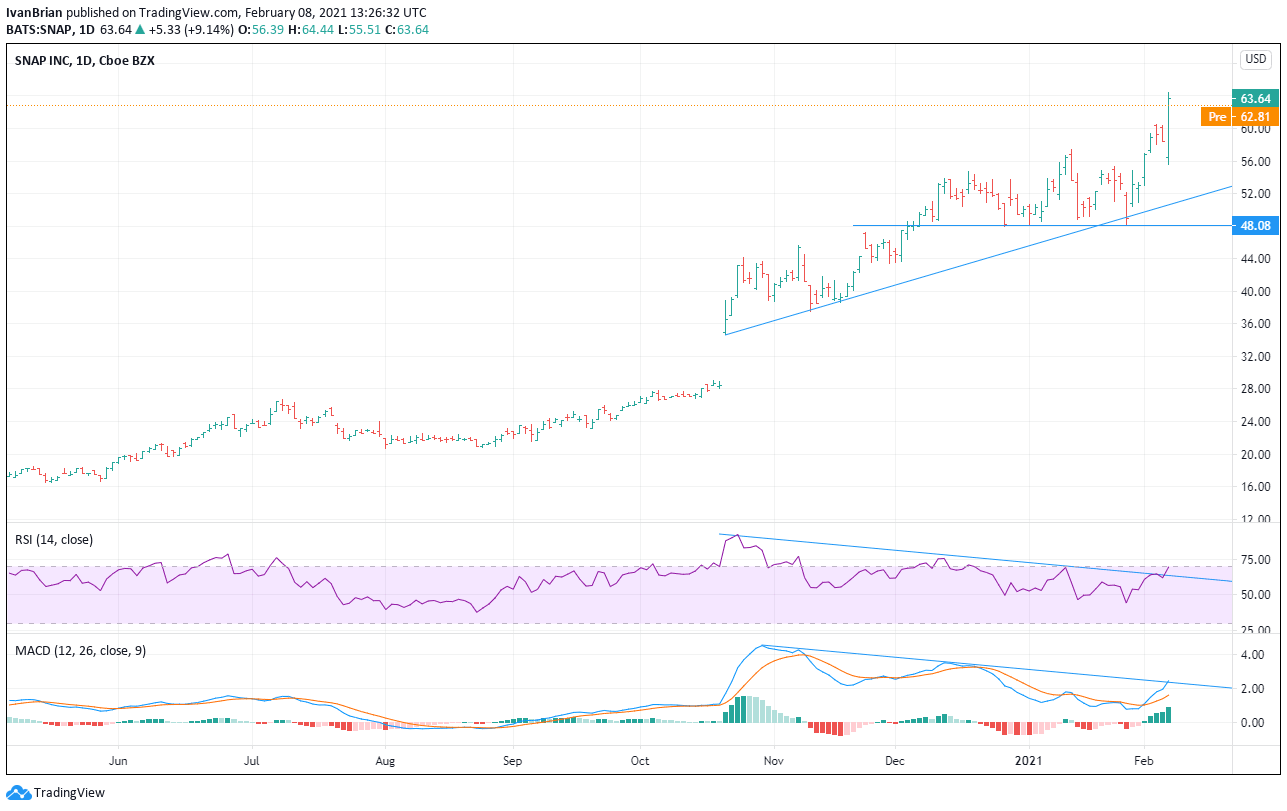

SNAP is clearly in a powerful bullish trend with new record highs on Friday. Key support for this trend continuance is at $48.08, the last major low. RSI and MACD have both just broken downtrend lines. MACD has crossed the signal line on Feb 1 to confirm the start of the bullish move.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.