Palantir Technologies (PLTR) Stock Price and News: Team-up with IBM brings out the buyers

- PLTR technologies has had a great 2021, up 53% and counting.

- IBM and Palantir have just announced a partnership for AI.

- PLTR has been inking multiple new deals, RIO signed an agreement in January.

PLTR shares have been one of the hot plays for 2021 so far, the shares helping themselves to a 50% gain for the year.

Should I buy PLTR?

PLTR has a number of catalysts pushing shares higher. So is it too late to buy or merely time to jump on board the moving train? PLTR has high profile founders and investors with Peter Thiel and Stephen Cohen among them.

PLTR is involved in data analytics with a lot of expertise in the security industry. PLTR counts multiple US intelligence agencies among its clients, as well as US Army and the UK’s NHS.

The Reddit revolution

PLTR has benefited from the retail revolution sweeping through equity markets in the last few months. The rise of /wallstreetbets has been one of the most dramatic shifts in market dynamics for a number of years. Possibly not since the start of electronic trading and the rise of high-frequency algos have we witnessed such a dramatic shift in market dynamics.

PLTR has benefited as it has become one of the more favoured retail stocks. But unlike some of the more volatile moves in names such as AMC and Gamestop (GME), the move in Palantir has been more considered and stable.

New deals signed

PLTR has been signing new deals as it boosts its client base with some high profile names. PLTR and RIO signed a multi-year agreement in January, also in January Pacific Gas and Electricity (PCG) signed up, and on Monday IBM and Palantir announced a collaboration on AI.

It is this deal with IBM that could be transformational. Palantir now has effectively increased its sales force from 30 to 2,500 according to Bloomberg.

The lock-up

Palantir took a slightly different approach to its IPO. Going via a direct method where existing shareholders sell shares directly to retail investors as opposed to the traditional approach. As part of this, PLTR founders, who own 20% of the company, are prevented from selling their shares until after Q4 results. PLTR’s Q4 results are due February 16 and the founders can sell three days later. Given the gains seen since the $10 IPO price, there is the possibility of the founders cashing in.

Q4 earnings will give more clarity and management outlook will be key to maintaining the impressive growth. An entry-level closer to support nearer to $26-30 would be preferred. But the long-term outlook looks strong with savvy, well-connected founders and an impressive client list of government and blue-chip corporates.

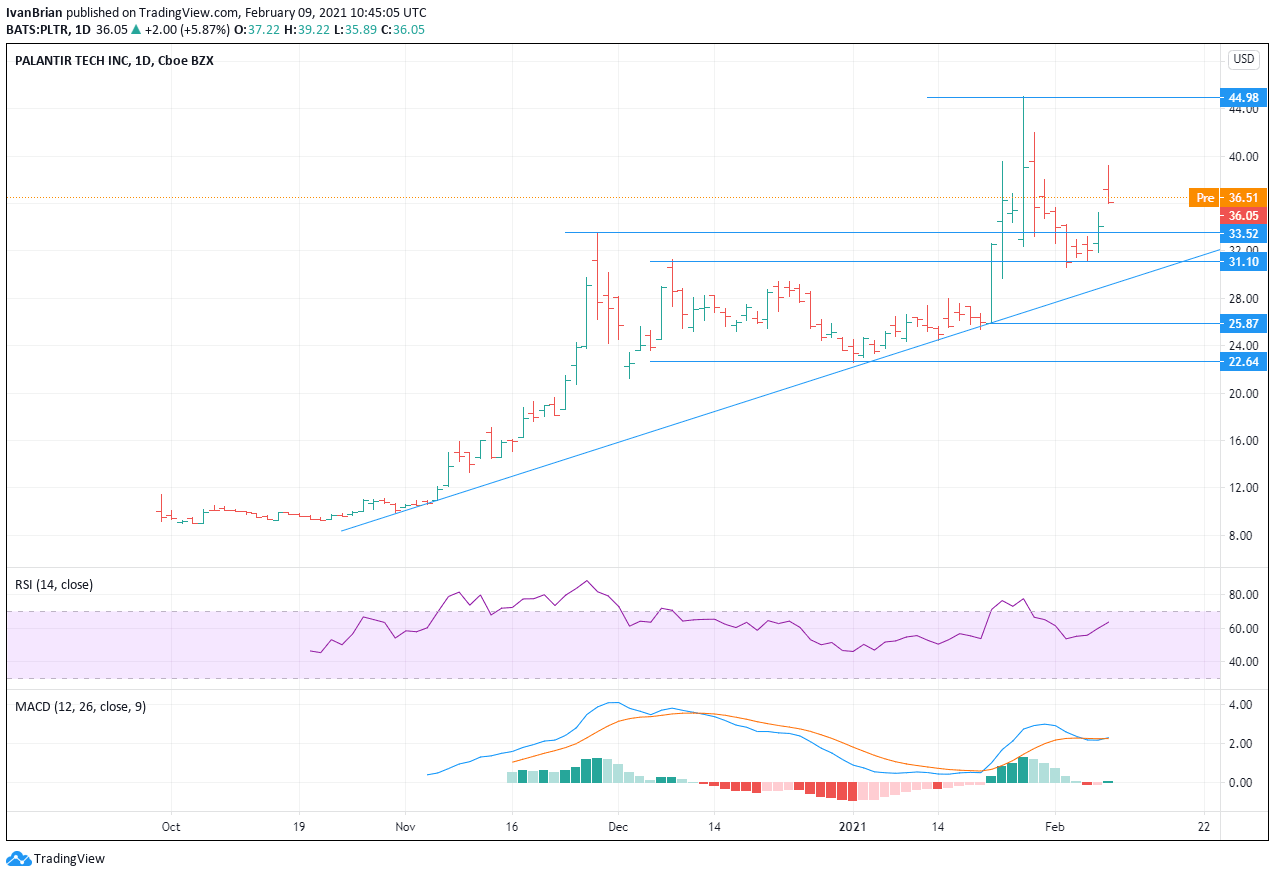

PLTR Technical analysis

PLTR remains in a bullish trend with $25.87 remaining the key support to keep the bullish formation intact. Before that are intermediate supports at $33.52 and $31.10. The first target/resistance is the Jan 27 high at $45.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.