USD/CAD Weekly forecast: Omicron keeps markets on edge

- Last Friday's Omicron panic remains the market background.

- WTI loses 2.8% on the week, 15.3% from last Friday's open.

- US Federal Reserve officials talk up inflation interest rate policy.

- FXStreet Forecast Poll sees vulnerability in the USD/CAD.

The Omicron market panic remained the besetting feature of this week’s trading. Dollar-Canada * managed a modest 51-point gain over last Friday’s finish and its 1.2837 close was the highest since February 1 of this year.

Fundamental trends continue to be favorable to the American dollar and the USD/CAD.

West Texas Intermediate (WTI) lost another 2.8% from Monday to Friday, ending at $66.17 and bringing the price decline from the $78.10 open on November 26 to 15.8%.

Treasury yields in the US and Canada extended their swoon from last Friday’s open. The 10-year bond return in the US has lost 28.7 basis points to 1.356%, its lowest conclusion since September 22. The Canadian 10-year has dropped 32.7 points to 1.437%, its weakest finish since September 27.

Over the past two weeks, the spread between these bonds has narrowed from 14 basis points on November 23 (Canada 10-year 1.807%, US-10 year 1.667%) to Friday’s 8.1 basis points.

This declining advantage has undermined the Canadian dollar and reflects the Federal Reserve’s recent rhetorical shift toward inflation control.

Fed Chair Jerome Powell notably commented that it might be time to retire the term 'transitory’ that the bank has used to characterize inflation for the better part of a year.

Several other Fed officials joined the newly formed inflation chorus this week.

San Francisco Fed President Mary Daly said the bank might need to craft a plan for raising rates. Atlanta Fed President Rafael Bostic observed that it might be “appropriate to full forward the [rate] lift-off.” Cleveland Fed President Loretta Mester said that if inflation remained elevated, “we are in a position to be able to hike if we have to.”

The coordination of these public statements is a strong indication that the Federal Open Market Committee (FOMC) meeting on December 15 is preparing for an official shift in rate policy.

Canadian economic data was excellent. The November Net Change in Employment Report listed 157,700 new hires, almost five times the 35,000 forecast and an even greater improvement on October’s 31,200 positions. The unemployment rate came in at 6%, much better than the 6.6% prediction and September’s 6.7%.

The contrast to the US November NonFarm Payroll report, with only 210,000 new employees on a 550,000 forecast, was striking but did not change the markets tilt toward the USD/CAD.

Other US labor market data was encouraging. Unemployment fell to 4.5% and underemployment dropped to 7.8%, both far better than predicted, and the lowest of the pandemic. The labor participation rate climbed to 61.8%, its highest since March 2020.

Purchasing Managers’ Indexes (PMI) for the manufacturing and service sectors were strong. Overall PMI in service set an all-time record at 69.1 and the New Orders Index was unchanged at 69.7, another record and much better than the 64 projection. Initial Jobless Claim rose to 222,000 in the latest week from 194,000 prior, indicating that the labor market continues to heal.

Canadian industrial prices accelerated in October. Industrial Product prices rose 1.3% after a 1% increase in September and the Raw Material Price Index nearly doubled to 4.8% from 2.5% the previous month.

*Currency market terminology for the USD/CAD

USD/CAD outlook

The Bank of Canada (BOC) meets on Wednesday. While no policy change is expected, the bank has already ended its bond purchase program, surging inflation could bring much stronger rhetoric from Governor Tiff Macklem. The Consumer Price Index (CPI, YoY) has jumped from 1% in January to 4.7% in October. The close ties of the American and Canadian economies ensures that the Fed’s vast bond purchase program exacerbates inflation on both sides of the border.

In the US, CPI for November on Friday will be the main event. The overall rate is expected to rise to 6.8% from 6.2% and core to reach 4.9% from 4.6%. These results will reinforce the Fed's taper prospects, regardless of Omicron developments.

The Federal Reserve’s pending official change to inflation-fighting at the December 15 FOMC meeting will have a greater market impact than any potential change from the BOC short of a rate hike.

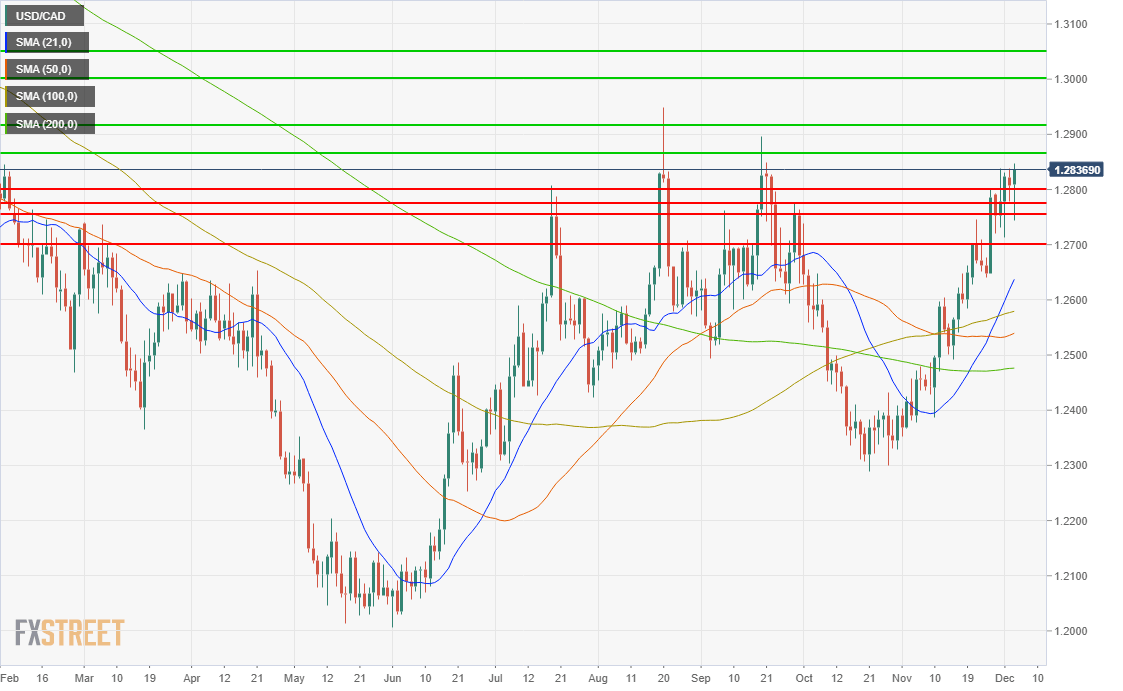

The ascending channel that dates to the end of October is the dominant chart feature.

The 10-month high close on Friday provides clearance for further gains, though it is far from the 1.2949 high of August 20. Relatively sparse resistance between the current market and 1.3000 makes motion higher the path of least resistance. A particular goal is the 38.2% Fibonacci retracement line at 1.2972 of the March 18, 2020 (1.4651) to June 2, 2021 (1.2035) decline.

The bias in the USD/CAD is higher but the steepness of six-week rise makes it vulnerable to profit-taking.

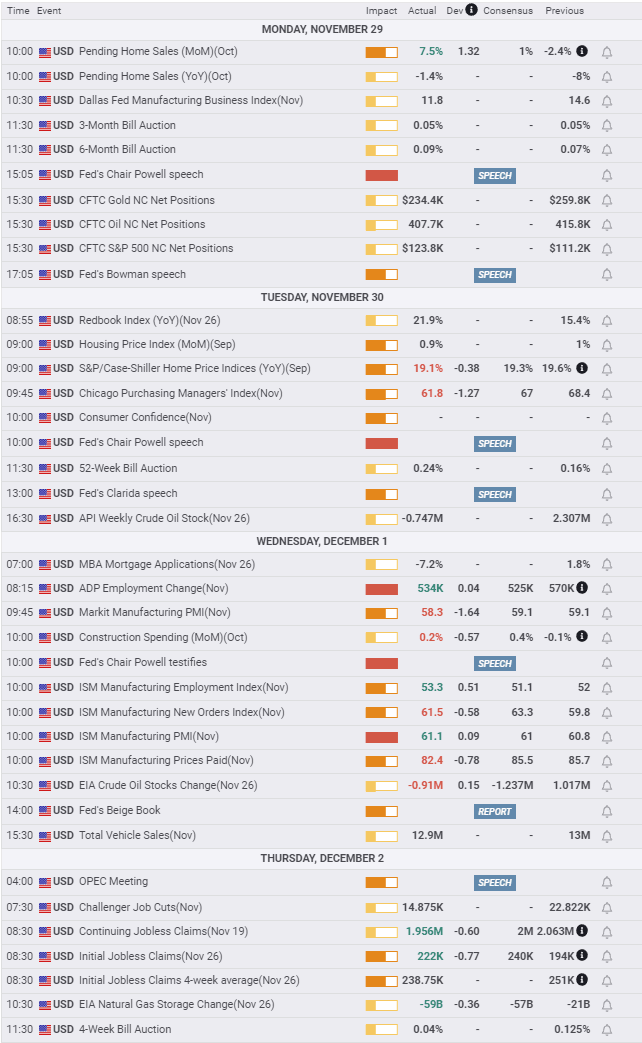

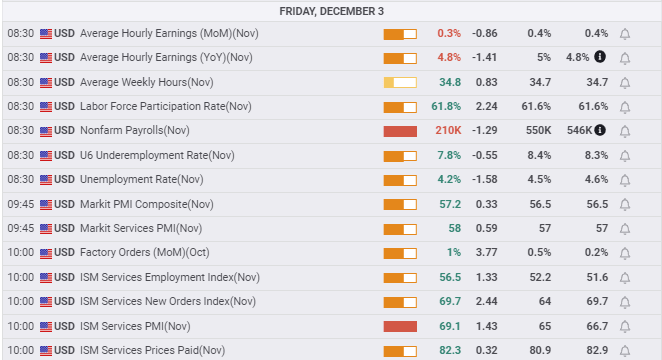

Canada statistics November 29–December 3

US statistics November 29–December 3

FXStreet

Canada statistics December 6–December 10

US statistics December 6–December 10

USD/CAD technical outlook

The MACD (Moving Average Convergence Divergence) has been a buy signal since the cross of the signal line on October 29. The lessening of the divergence at the end of the week is a warning sign that the steepness of the ascent is ripening toward profit-taking. The Relative Strength Index (RSI) reaching overbought status is an identical sign. Momentum in True Range revived on Friday but is still well below the surge on November 26.

The 21-day moving average (MA) has crossed the 50-day, 100-day and 200-day moving averages during November's USD/CAD rise. In addition, the 100-day MA has crossed the 50-day MA, drawing from the trading levels of August and September, and indicating that short and medium-term prospects for the USD/CAD are positive.

Resistance: 1.2865, 1.2915, 1.3000, 1.3050

Support: 1.2800, 1.2775, 1.2755, 1.2700

FXStreet Forecast Poll

The FXStreet Forecast Poll expects the recent prosperity of the USD/CAD to be overtaken by profit-taking sales.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.