Outlook:

Information overload peaks today with the BoE decision, US tax reform, unit labor costs, and the nomination of a new Fed chief. The FT notes that naming Powell barely moves the needle, but perhaps we are missing that if Taylor gets the Vice Chairman job, it will be a game-changer, assuming the Taylor Rule comes with him. Taylor himself has said the rule should not be applied mechanically, but the market doesn't hear that part.

Bloomberg is running a series of Powell quotes to display his views, including one from Feb this year that "... there is no consensus that any one rule is best, let alone that it would be desirable to require the FOMC to pick and mechanically follow one rule to the exclusion of others." The FT notes that Powell has experience in banking regulation and may be interested in deregulation.

That Powell is hardly a flame-thrower doesn't mean the market won't respond aggressively to his nomi-nation. We say the only noteworthy thing about it is that Powell is an appropriate choice, unlike Trump's other top-job appointments. Somebody must have taken him to the woodshed to insist he couldn't name another wildly unsuitable and unqualified person to high office.

Tax reform is more relevant to the dollar. If we get the draft bill today as promised, it may lift yields, which is dollar-favorable. The markets will probably ignore the provisions that affect ordinary people and focus on the size of the cut in corporate taxes. Nobody actually pays at the full corporate tax rate, but the number has symbolic juice. Talk of 20% is silly, but a cut from 35% to 25% might be enough to rally the dollar.

Productivity and unit labor costs might get lost in the shuffle. Productivity is forecast to be above-trend but unit labor costs to remain modest. The flip side of unit labor costs is labor earnings, and without them, the inflation outlook remains tame.

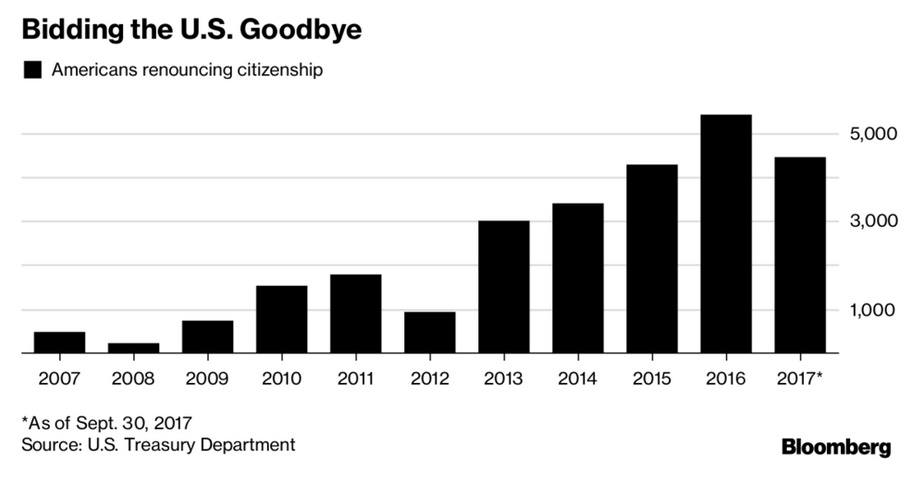

Possibly getting some attention is an online survey by the American Psychological Association on stress. Bloomberg reports "Almost two-thirds of Americans, or 63 percent, report being stressed about the future of the nation... This worry about the fate of the union tops longstanding stressors such as money (62 percent) and work (61 percent) and also cuts across political proclivities. However, a significantly larger proportion of Democrats (73 percent) reported feeling stress than independents (59 percent) and Republicans (56 percent)." The biggie is "social divisiveness" (59% vs. 52% a year ago), although Trump is not named. A large number (59%) say this is the lowest point in our history they can remember. Bloomberg likes to twist the knife by pointing out that 2017 is on track to have the most persons giving up US citizenship, 1376 persons in Q3.

For such a big news day, we have very little to talk about so far. Sterling is the big mover today, despite the BoE delivering exactly what had been forecast, a rate hike but two dissenters and an indication that it might be one-and-done. A big move like this morning's (1.3276 to 1.3097 in a half hour) almost al-ways gets a bounce-back and then a wobble to-and-fro. It's better to stay out of it, if only because from now on, the big boys will be hunting stops.

| Currency | Spot | Current Position | Signal Date | Signal Strength | Signal Rate | Gain/Loss |

| USD/JPY | 114.06 | LONG USD | 10/20/17 | WEAK | 113.35 | 0.63% |

| GBP/USD | 1.3225 | SHORT GBP | 10/03/17 | WEAK | 1.3247 | 0.17% |

| EUR/USD | 1.1646 | SHORT EURO | 10/24/17 | WEAK | 1.1768 | 1.04% |

| EUR/JPY | 132.84 | LONG EURO | 10/20/17 | WEAK | 133.82 | -0.73% |

| EUR/GBP | 0.8806 | SHORT EURO | 10/30/17 | WEAK | 0.8841 | 0.40% |

| USD/CHF | 0.9993 | LONG USD | 09/25/17 | WEAK | 0.9732 | 2.68% |

| USD/CAD | 1.2842 | LONG USD | 09/27/17 | WEAK | 1.2389 | 3.66% |

| NZD/USD | 0.6907 | SHORT NZD | 10/06/17 | STRONG | 0.7088 | 2.55% |

| AUD/USD | 0.7702 | SHORT AUD | 09/25/17 | STRONG | 0.7963 | 3.28% |

| AUD/JPY | 87.85 | SHORT AUD | 10/11/17 | WEAK | 87.35 | -0.57% |

| USD/MXN | 19.0401 | LONG USD | 09/22/17 | STRONG | 17.8066 | 6.93% |

| USD/BRL | 3.2673 | LONG USD | 09/27/17 | WEAK | 3.1670 | 3.17% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.