Bitcoin Price Outlook: Will new wave of capital inflows into BTC ETFs catalyze rally to new all time high?

- BlackRock head of digital assets says new wave of investors is likely to pour into the BTC ETF space.

- After 71 days of capital inflows into Bitcoin ETFs, markets witnessed an unusual lull that denied tailwinds for BTC price.

- Bitcoin price holds above $59,000 after an intraday low of $56,552 on Wednesday.

Bitcoin (BTC) price ticked north on Thursday following reports that BlackRock has been approaching different investor classes on matters to do with BTC exchange-traded funds. According to the firm's head of digital assets, markets could see a new investor segment come into the space soon.

Daily digest market movers: BlackRock has been talking to different sorts of institutions on Bitcoin ETF investments

Speaking to a news site, BlackRock head of digital assets Robert Mitchnick said they anticipate a new wave of inflows from “a different type of investor.” This assertion comes after a period of significant lull in terms of capital inflows into the BTC exchange-traded funds (ETFs) market.

❖ BLACKROCK SEES SOVEREIGN WEALTH FUNDS, PENSIONS COMING TO #BITCOIN ETFS

— *Walter Bloomberg (@DeItaone) May 2, 2024

Don't be fooled by the first break in inflows into spot bitcoin exchange-traded funds (ETFs) after 71 straight days. The current lull is likely to be followed by a new wave from a different type of…

Specifically, Mitchnick says the new players could include financial institutions like sovereign wealth funds, pension funds and endowments. If these classes of investors begin to trade spot ETFs, the BlackRock executive said it would signify “a re-initiation of the discussion around Bitcoin.”

Further, Mitchnick revealed that BlackRock, the world’s largest asset management firm, has been talking to different sorts of institutions, including “pensions, endowments, sovereign wealth funds, insurers, other asset managers, and family offices,” among others, about BTC for several years.

Elsewhere, a filling (13F report) from the US Securities & Exchange Commission (SEC) indicates that the second largest European bank (by assets), BNP Paribas, purchased BlackRock BTC ETF shares (IBIT).

The portion of BNP Paribas’ investment into IBIT was very small, 1,030 IBIT shares in Q1 of 2024 at $40.47 a share, for a total of $41,684.10. This is less than the value of a single BTC at current prices. Nevertheless, it is still significant because it points to one of the first confirmed instances where a major financial institution has purchased shares of a spot Bitcoin ETF.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

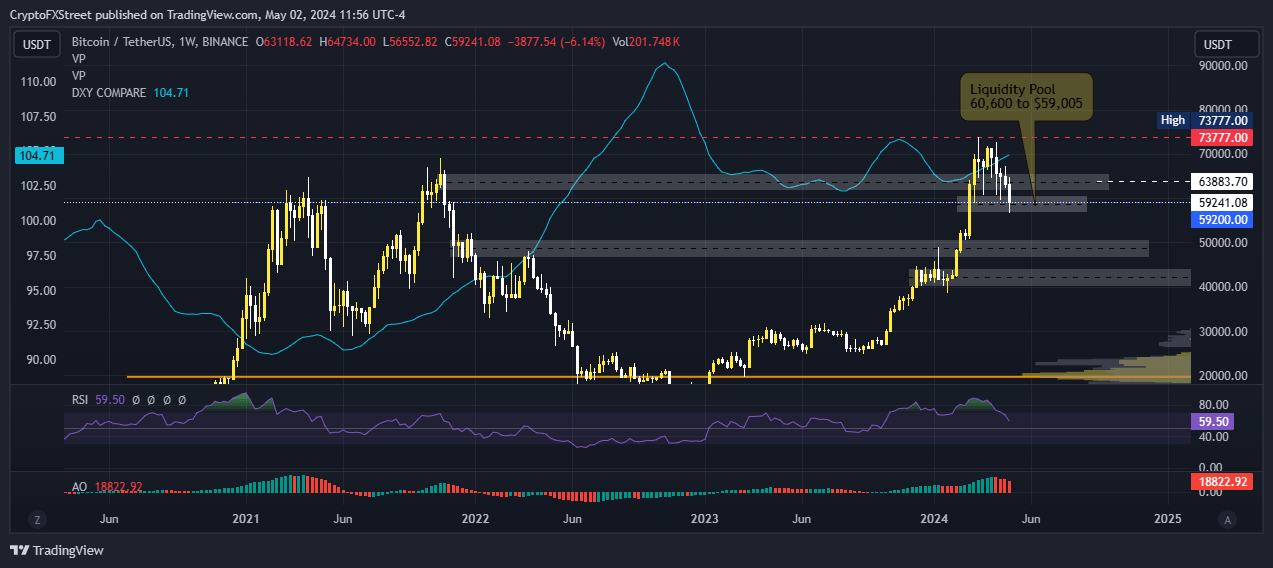

Technical analysis: Bitcoin price reclaiming $59,200 would signify a recovery

Bitcoin price is trading with a bearish bias, showing lower highs since early April. With the liquidity pool between $60,600 and $59,005 holding as support, BTC could recover. Traders looking to take new long positions for BTC should probably wait for a candlestick close above the $59,200 threshold.

For now, the market is still favoring the bears. First, the Relative Strength Index (RSI) is nose-diving, showing falling momentum, with its lower highs pointing to a growing bearish sentiment.

The DXY Compare indicator also maintains a countercurrent directional bias to Bitcoin price, adding credence to the bearish sentiment.

Increased seller momentum, enough to see BTC record a lower low below the Wednesday bottom of $56,552, could see Bitcoin price drop all the way to the $50,000 range before a possible correction.

BTC/USDT 1-week chart

Conversely, that the RSI continues to hold well above the mean level of 50, and its accompanying Awesome Oscillator (AO) still in positive territory is a good sign. It shows that although the market is on a vertical chop, buyer momentum continues to abound. If the RSI bounces above the mean level and proceed to record two higher highs, it would indicate a shift in sentiment in favor of the bulls.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.