- GBP/USD has been extending its gains after the BOE signaled no negative rates.

- US Nonfarm Payrolls carry high expectations and may trigger a dollar downfall.

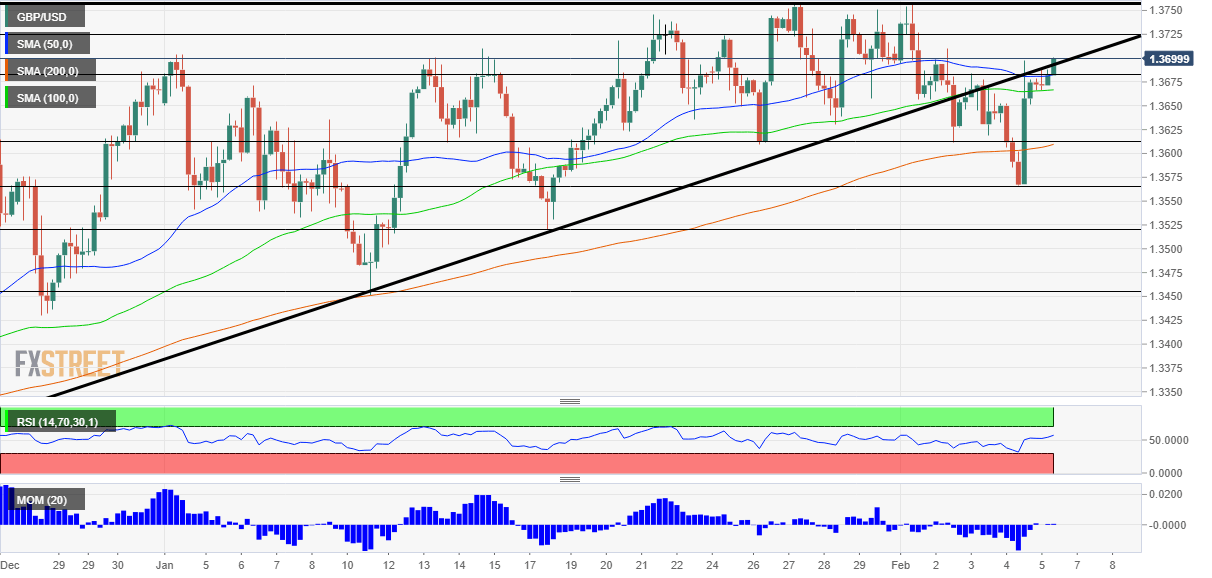

- Friday's four-hour chart is showing cable has recaptured the uptrend support line.

Prime Minister Boris Johnson may be a "comeback kid" – returning to the government and at the top job – and the pound is making similar moves. After having returned to 1.37, the cable needs a minor miss on US Nonfarm Payrolls to attack the 2021 high of 1.3752.

Sterling shot higher on Thursday in response to the Bank of England's announcement that negative interest rates are off the agenda. While the BOE continues examining the technicalities of such a move, Governor Andrew Bailey stressed it is not imminent. Moreover, the "Old Lady" as the bank is known, seemed upbeat after the economy handled the recent lockdowns well and as Britain's vaccination campaign is moving at a rapid clip.

The pound was able to defy dollar strength – related to upbeat jobless claims and hopes for a large stimulus package. US figures have been robust throughout the week, raising expectations for Friday's Nonfarm Payrolls report and boosting the greenback. Are "whisper numbers" too high?

While the economic calendar is pointing to an increase of 50,000 jobs, investors are eyeing higher levels and that may trigger a "buy the rumor, sell the fact" response weighing on the dollar. That could send GBP/USD to new highs.

See

- Nonfarm Payrolls Preview: Dollar needs a strong number to keep rallying

- Nonfarm Payrolls January Preview: Waiting for the dollar bid

After the NFP, markets may return to the following developments related to President Joe Biden's relief package. While the White House continues talking with moderates, Democrats are advancing legislation to approve a stimulus package on their own – potentially a larger one. Higher prospects of a generous package may send investors away from bonds, raising yields, and supporting the dollar. However, that may come over the weekend.

All in all, GBP/USD has room to extend its gains unless a large stimulus package is approved in Washington.

GBP/USD Technical Analysis

Pound/dollar has recaptured the broken uptrend support line that accompanied it since late 2020 and also surpassed the 50 Simple Moving Average on the four-hour chart. Moreover, momentum has flipped back to the upside.

Resistance awaits at 1.3725, a high point in January, followed by 1.3752, the 2021 peak. The next levels to watch are 1.3810 and 1.40, dating back to 2018.

Support awaits at 1.3680, which is where the 50 SMA hits the price. It is followed by 1.3614, a support line from early in the week, and then by 1.3565, Thursday's low point.

More GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.