- Payrolls expected to return to positive at 50,000 after -140,000.

- Initial Jobless Claims continued December's rise into January.

- Purchasing Managers' Indexes in services and manufacturing maintain expansion outlook.

- Business spending has remained steady despite pandemic increases.

- Dollar, improved in January, will swing with payroll performance.

The US labor market recovery was interrupted in December by the return of the pandemic and the reaction of a few states, particularly California with the largest economy, sent payrolls into a tailspin.

The shutdown of the Golden State and revived restrictions in a few others drove initial jobless filings up almost 100,000 a week from November to December, an increase that has continued into January.

Nonfarm payrolls dropped from 336,000 in November to -140,000 in December, the first job losses since the March and April calamity.

Has the notable decline in case loads and hospitalizations in January and the ending of California's shutdown been enough to encourage employers to begin hiring again?

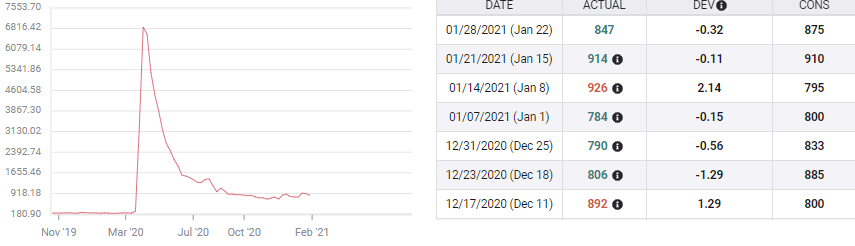

Initial Jobless claims

Claims have been the telltale for the pandemic economy. They heralded the collapse in payrolls in March and April and again in December.

From November to December the monthly average of unemployment filings jumped from 740,500 to 837,500. Nonfarm Payrolls, as above, contracted for the first time since April.

Initial Jobless Claims

Initial filings have continued to rise in January. The average of the first four weeks is 867,750. If the 830,000 forecast for the final statistic is correct the average drops to 860,200.

Purchasing Managers Indexes

Manufacturing PMI from the Institute for Supply Management (ISM) has been substantially better than forecasts since June, beating estimates in five of those eight months and averaging a healthy 56.6.

For January the overall index at 58.7 missed its 60 estimate but the three-month moving average of 58.96 is the best since October 2018.

The Employment Index rose to 52.6 in January, the highest score since June 2019. It has been positive for three of the last four months after 14 below the 50 division between expansion and contraction.

The New Orders Index slipped to 61.1 in January from 67.5, but December's three-month moving average of 66.7 was, but for December 2003 and January and February 2004, the highest in twenty-five years. The Manufacturing Employment Index increased in January to 52.6, its best level since June 2019, from 51.7.

Reuters

Optimism also pervades the far larger services sector. The Services Employment Index came in at 55.2 for January, its highest level since February 2020 and a unexpected jump from its 49.7 forecast and December's revised 48.7 (initially 48.2).

The overall Services Index climbed to 58.7 in January its highest score since November 2018. New Orders rose to 61.8 from 58.6, also its eighth month of robust expansion.

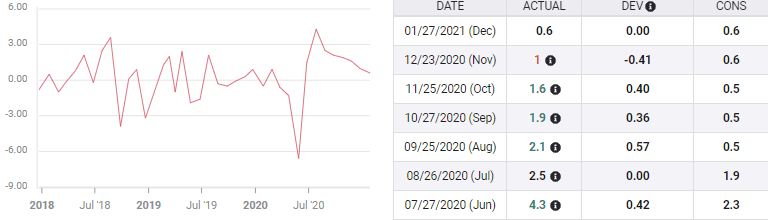

Business investment

Executives have been anticipating a full-blown recovery for six months. Attitudes have remained positive through the fall and winter surge of COVID-19, now in sharp retreat. Business have spent in accordance with their view of a pending economic expansion.

Nondefense Capital Goods ex-aircraft, the business investment proxy category of Durable Goods, averaged a 1.62% monthly increase from July through December. Spending in October, November and December was lower at 1.07%, even as viral counts were spiraling across the country.

Nondefense Capital Goods

Conclusion

Initial Jobless Claims, being weekly, are the most up-to-date US labor statistic but for once they may be behind the curve in the fast-moving events of the pandemic. Since early January US positive tests are down 35%, hospitalizations 28% and ICU occupied beds 20%.

Except for the rise in case numbers and California's attendant closure at year end, the labor market would have continued to improve in December. Initial claims are the consequence of that action not a precursor of greater layoffs.

In that environment it is possible that businesses may have resumed their planning for recovery, extending it this time to their employees.

The dollar has had a modestly successful New Year, gaining 1.6% against the euro 1.8% versus the yen and 0.6% from the Canadian dollar. Gradually rising Treasury interest rates and the prospective US recovery have been the twin propellers. If the potential recovery moves closer to reality with strong January payroll the dollar will receive another bid.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.