Vechain Price Prediction: Traders need to watch this element to secure 182% uptrend by August

- Vechain price is set to tank in search of much needed support.

- Bulls will need to respect a specific element to secure an uptrend.

- If respect and support is met, expect Vechain price to trade near $0.07 by August.

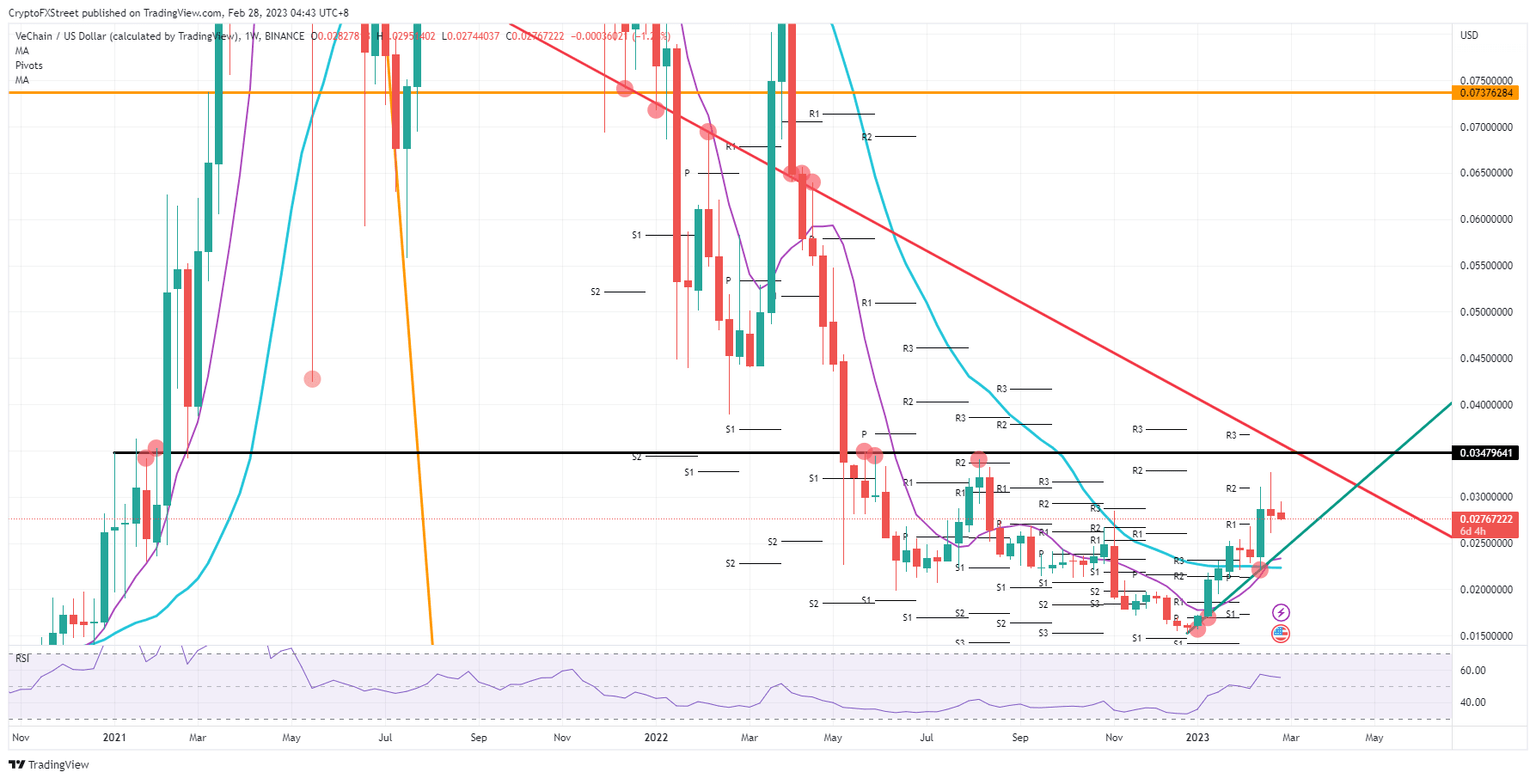

Vechain (VET) price action is set to jump substantially higher later this year as a cocktail of tailwinds is building among altcoins. Even when ignoring macro forces and drivers in global markets, Vechain price still has plenty of tailwinds from a technical point of view. The longer term forecast points to a possible 182% inclination with VET trading near $0.07 by the end of the summer.

Vechain price is set to make a killing this year

Vechain price is currently on the back foot, but can offer longer-term investors a window of opportunity. That opening comes as VET is trading lower currently but is set to find support at a crucial level. The big price tag to watch is $0.023. This price bears some quite substantial elements that can only pull price action up.

VET will be able to continue its rally as long as the green ascending trend line on the weekly chart remains well-respected. Even should Vechain price slip below it, both the 55-day and the 200-day Simple Moving Average (SMA) are present to provide ample support and redirect price action higher. Once $0.03 and the red descending trendline are broken, expect the uptrend to stretch as far as $0.07 by the end of the summer.

VET/USD weekly chart

Substantial risk to the downside comes in case the circuit brakes from both moving averages failing. A full unwind of the rally of 2023 becomes a potential scenario. That would mean that price action could fall roughly 30% and hit $0.01 at some point.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.