Here’s why Chinese coins Filecoin, NEO, Conflux, VeChain are yielding massive gains

- The Chinese coins narrative is gaining momentum after Hong Kong’s announcement to legalize crypto trading effective June 1, 2023.

- Chinese coins Filecoin, NEO, Conflux, VeChain, Qtum among others yielded double-digit gains over the past week.

- Crypto analysts are bullish on massive price rallies in Chinese coins and believe that the narrative is here to stay.

Hong Kong is set to officially make crypto purchasing, selling and trading entirely legal for all its residents effective June 1, 2023 according to reports. The announcement has fueled a rally in Chinese coins and the “China narrative” has gathered steam in the past week.

Crypto analysts believe the China coin narrative is here to stay and holders can expect further gains from Filecoin (FIL), NEO, Conflux (CFX), VeChain (VET) and Qtum (QTUM).

Also read: Is the ChatGPT effect on crypto AI tokens sustainable?

What is the China narrative and what does it mean for cryptocurrency prices?

Hong Kong’s recent announcement for legalizing crypto trading for its residents fueled a bullish sentiment in the crypto community giving rise to the “China” narrative. The narrative gathered steam over the past few weeks as analysts and crypto influencers tweeted about it and shared watchlists of Chinese coins for traders.

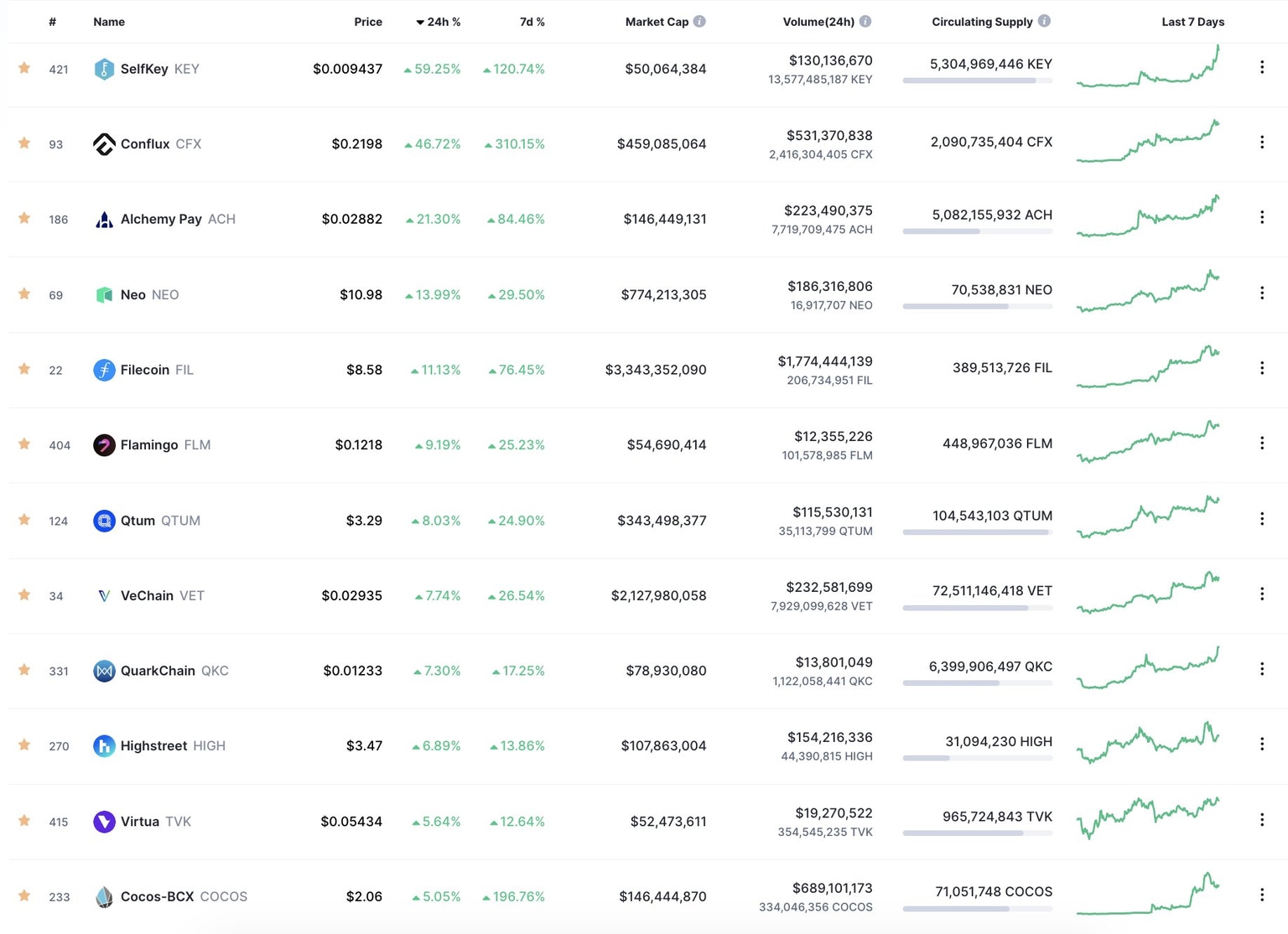

Miles Duetscher, a crypto analyst and trader shared the following list of Chinese coins. The expert believes that the China narrative is here to stay and holders of the tokens can expect further gains until June 2023.

Watchlist of top performing Chinese coins

As seen in the list above, Chinese coins in the top 100 cryptocurrencies by market cap, Filecoin (FIL), VeChain (VET), Neo (NEO) and Conflux (CFX) have yielded 76.45%, 26.54%, 29.50% and 310.15% gains for holders respectively.

The China narrative is the key factor driving the massive price rallies in these tokens, in addition to alpha from Chinese content creators and developments in the respective crypto projects.

Crypto market participants are big on narratives in 2023, after the Artificial Intelligence narrative inspired by ChatGPT, and Metaverse narrative inspired by Meta’s earnings report and its dedication to building crypto’s metaverse, the China narrative has become increasingly popular among traders.

In addition to Hong Kong’s crypto plans, experts on crypto Twitter have noticed that massive liquidity injections by People's Bank of China (PBoC) coincide with the upsurge in crypto market capitalization.

An analyst on crypto Twitter argued that the China easing narrative is real and the central bank ramped up its liquidity injections in February 2023.

The China easing narrative is not some imaginary garbage

— Crypto熊猫 (@NoodleofBinance) February 18, 2023

Look at the liquidity injections China is ramping up in Feb - most recent 835B CNY via reverse repurchase

Monie printer goes brrrr from the EAST

oh, sorry US inflation, China exporting moar pic.twitter.com/LMmNLP1xHQ

Since this move by PBoC is typically followed by a spike in cryptocurrency prices, experts are bullish on Chinese coins and a continuation of their uptrend in the short-term.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.