Vechain price could trigger a vicious 30% nosedive below this critical level

- Vechain price tanks 4% intraday on Wednesday as altcoins take a turn for the worse.

- VET bulls are betting on crucial support to come in and halt the bear push.

- Should price action break below, a 27% bear market could be activated.

Vechain (VET) price action has bulls hanging in the ropes as the altcoin is very near to falling into bear market territory. The continuous sell offs occur as cryptocurrencies see more negative setbacks from the Silvergate Capital debacle and proves to be a big challenge for investors. Faith in altcoins is broken again, with a decline to $0.017 at risk.

Vechain bulls are getting a cold shower as bear market fears loom

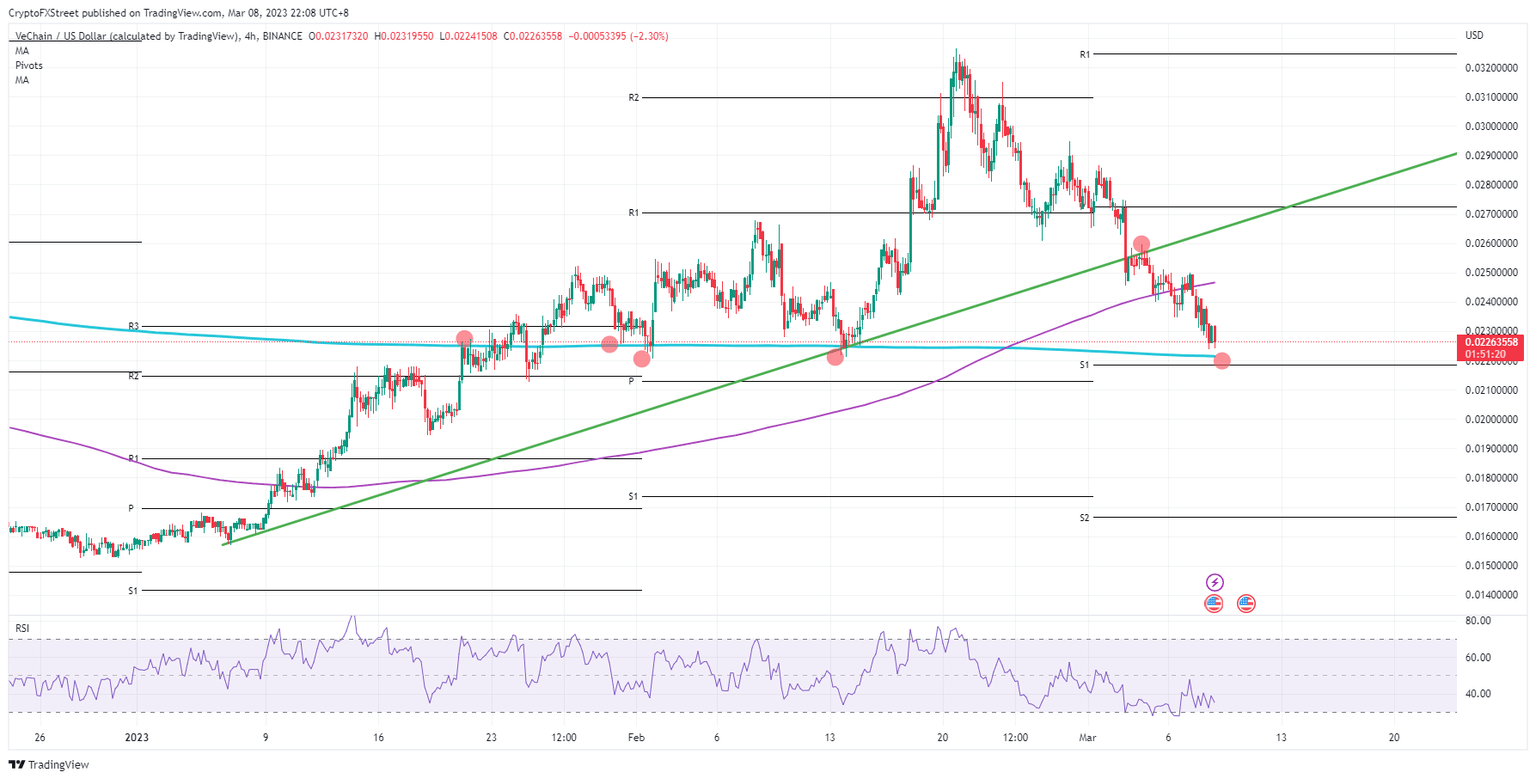

Vechain price is tanking yet again after bulls already had to give up on the green ascending trend line and the 55-day Simple Moving Average (SMA). With already two strikes, the third one could be the final straw that ends the game for bulls. Just like in baseball, bulls could get a third strike and enter a bear market.

VET sees bulls trying a hail mary as only the 200-day SMA and the monthly S1 support level are gearing up near $0.022 as the last line of defense. With bearish pressures mounting, bulls need to get out once that level breaks down. The most accurate projection from the chart is that price action in VET can tank as much as 27% towards $0.017.

VET/USD 4H-chart

A bounce to the upside would make sense here, seeing that the Relative Strenght Index (RSI) is again nearly oversold. Some upside moves could be seen hitting $0.025, with this time the 55-day SMA as resistance on the top side. In that case, a nice gain of roughly 11% would be at hand for bulls to feast on.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.