VeChain adoption takes another step as VET price ponders 26% ascent

- VeChain use-case soars as My Story is the second significant adoption.

- VET price rose 30%, showing signs of life for the first time after the market crash on May 19.

- A 26% upswing piercing the upper band of the supply barrier seems likely.

VeChain has been making headway when it comes to real-world applications of its blockchain. My Story is one such recent development that presents the use of blockchain to address specific problems. VET price seems to be rising after the recent debacle and hints at a continuation of the trend.

My Story, verifying marketing buzzwords via blockchain

My Story is a blockchain-based solution that helps an ecosystem of companies turn “marketing buzzwords into a true, verified story.” As the name indicates, the assurance solution allows companies to tell their stories and prove the authenticity of their products and services using distributed ledger technology, where data can be safely stored without worrying about manipulation.

The announcement reads:

The solution used for My Story™ is based on a public, decentralized and distributed ledger provided by Vechain, a leading blockchain provider and DNV partner. It is implementable for companies, as it is an ecosystem that includes user management and connectivity options for IoT devices, for example, and it is a scalable and affordable enterprise solution.

While the applications of this are plenty, My Story is working with two companies to tell the story of Italian wines from grape to bottle and guaranteeing the authenticity of fashionable clothes.

Recently, VeChain’s blockchain was also leveraged by ReSea Project to end the plastic ocean crisis. The data collected from this community-driven solution is stored on the blockchain.

Additionally, ReSea received certification from DNV, a VeChain partner, as proof of the initiative’s progress and traceability of the total collection process.

VeChain price continues to exude strength

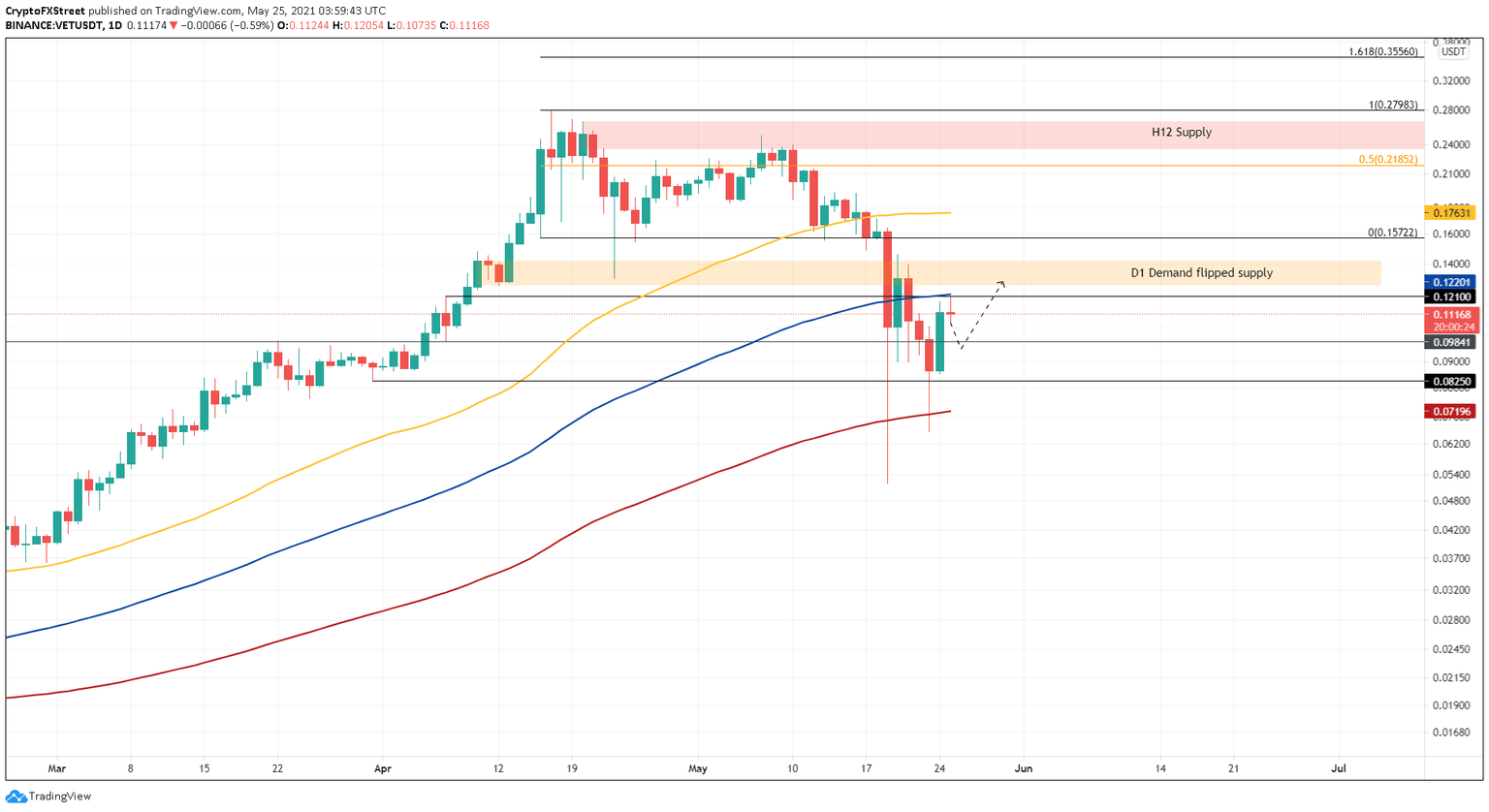

VeChain price surged roughly 30% on May 24, signaling the increase in buyers. However, this rally slowed down as profit-booking intensified around the resistance level at $0.121, which coincides with the 100-day Simple Moving Average (SMA).

Now, VeChain price could either retrace 12% to the support barrier at $0.0984 and then advance higher or continue its climb from the current position ($0.110).

If the first scenario comes to pass, the buyers will have more time to accumulate, allowing the upswing to have more oomph. In this case, VET will first encounter the ceiling at $0.121, coinciding with the 100-day SMA. Breaching this confluence will signal the presence of massive buying pressure, which may help extend this ascent to the supply zone, ranging from $0.127 to $0.142.

All in all, this move would represent a 45% upswing.

However, if the retracement mentioned above fails to manifest, Vechain price might surge 26% to tag the resistance area’s upper boundary at $0.142.

VET/USDT 1-day chart

While the VeChain adoption seems to be going well, things might go awry if VET price slices below the $0.0825 support level. Such a move would invalidate the bullish thesis detailed above and trigger a 13% sell-off to the 200-day SMA at $0.0720.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.