VeChain Price Prediction: VET at inflection point, reversal may lead to 45% gain

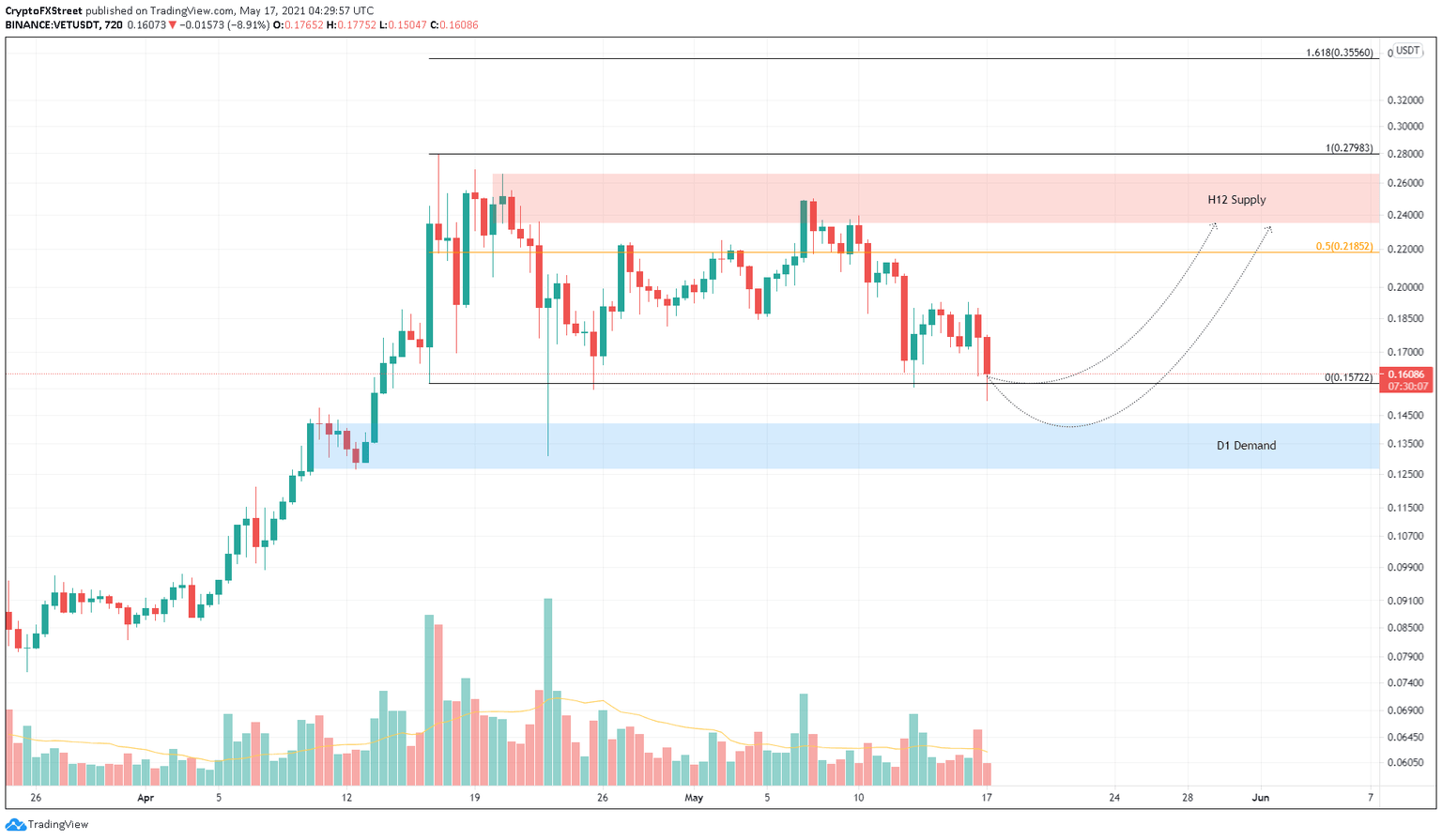

- VeChain price has dropped 20% in under 24 hours and tagged a swing low at $0.157.

- A reversal here, or the demand zone below, could result in a 45% upswing to $0.218.

- A breakdown of $0.126 will invalidate the upswing narrative and result in a 9% downswing to $0.115.

VeChain price has been on an accelerated downtrend since May 7. However, its recent retest of the swing low formed on April 16 indicates hints of reversal.

VeChain price at make or break

VeChain price has crashed roughly 40% since May 7 and is currently testing $0.157. Breaching this support level will lead to a 10% downswing to the demand zone, extending from $0.126 to $0.141. This area of interest was formed between April 10 and 12 and was crucial in building up pressure before rallying 127%. Hence, a dip into this zone will most likely result in a quick upswing.

Therefore, investors can expect a 35% run-up to $0.191. If the buying pressure continues to build up, another 15% rally will push VeChain price to the 50% Fibonacci retracement level at $0.218.

Beyond this ceiling, VET could wick up to the supply zone that stretches from $0.235 to $0.266.

While the upward trajectory detailed above seems straightforward, investors should wait for a close above $0.141 and a retest, which serves as a confirmation of this uptrend. However, if VeChain price produces a decisive close below $0.126, it will invalidate the bullish thesis.

If such a scenario were to evolve, market participants could expect a 9% sell-off to $0.115.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.