VeChain adoption solidifies with ReSea Project as VET price approaches critical reversal point

- VeChain’s blockchain technology is adopted by ReSea Project to end the plastic ocean crisis.

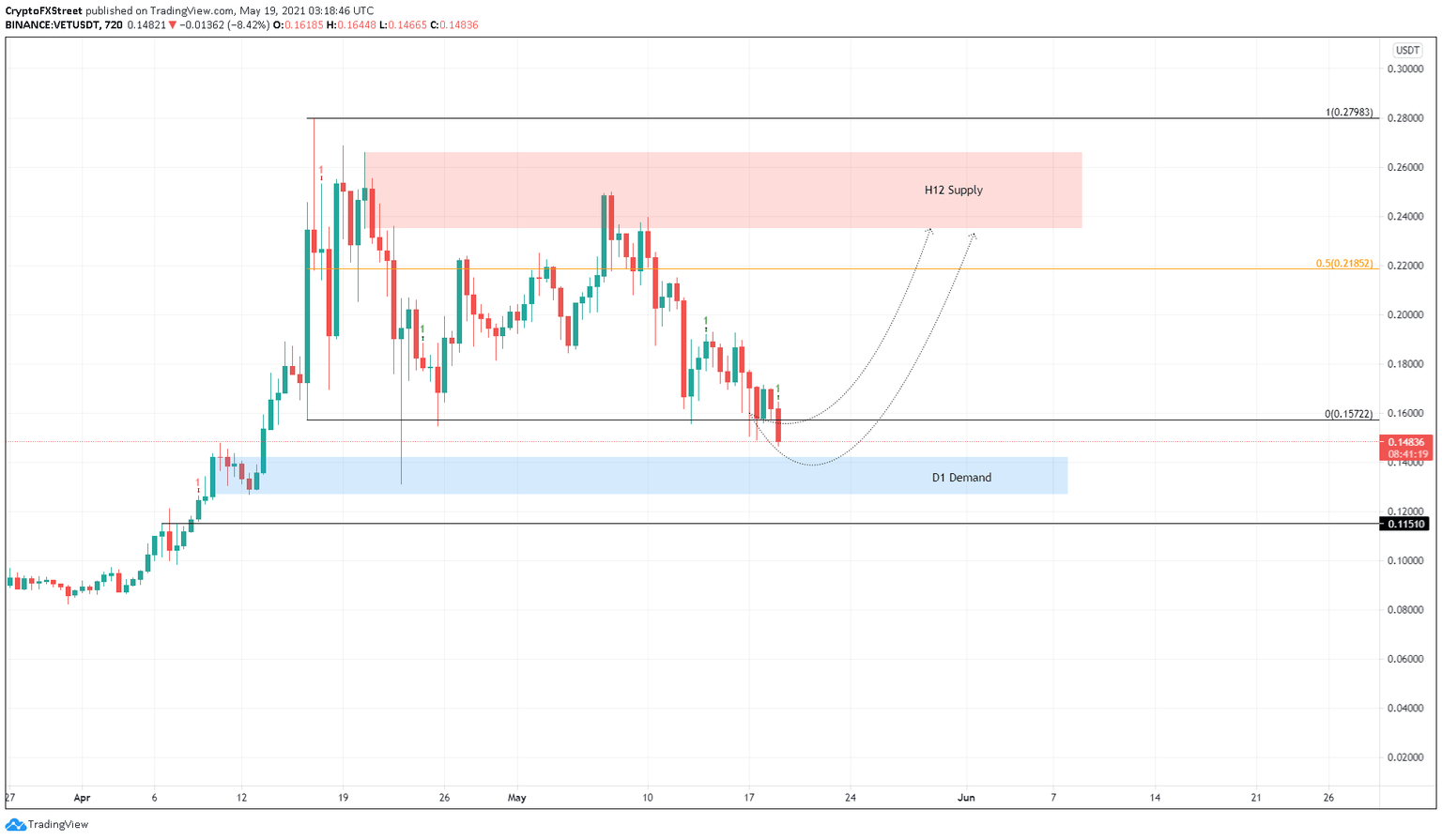

- VET price is approaching a demand zone that could trigger a reversal, resulting in a 65% upswing.

- A breakdown of $0.115 would invalidate the bullish thesis and kick-start a 15% downswing to $0.098.

Despite shedding over 40% of its token value in less than two weeks, the VeChain blockchain has witnessed a palpable adoption by a major environmental group today. At the time of writing, VET price is feeling the brunt of the market downturn but vies to surge higher.

ReSea Project and VeChain blockchain’s impact

According to the recent announcement, ReSea Project has removed 305,240 Kg (672,938 lbs) of plastic from oceans and rivers. This movement has helped prevent more than 15 million plastic bottles from polluting naturally occurring water bodies like oceans, rivers and lakes in four months.

The report further reads,

With the blockchain platform from VeChain Tech used to collect, record, and monitor collection data, we ensure that all data is stored securely, time-stamped, and immutable. The certification from DNV provides independent proof of our progress and traceability of the total collection process.

While VeChain adoption is already bearing fruit, VET price has seen a massive downfall over the past week.

VET price at an inflection point

VET price has dropped nearly 43% over the past 11 days and, as a result, pierced the demand zone extending from $0.126 to $0.141. Between April 10 and April 12, this area acted as a refueling point for buyers, leading to an 82% upswing.

Therefore, investors can expect a resurgence of buying pressure as VeChain price dips into this zone again. Further supporting a bounce from this area is the Momentum Reversal Indicator (MRI), which flashed a buy signal in the form of a green ‘one’ candlestick. This setup forecasts a one-to-four candlestick upswing.

A potential spike in buying pressure could result in a 54% upswing to the 50% Fibonacci retracement level at $0.218. If this bullish momentum persists, investors could see VET price test the lower boundary of the supply zone that stretches from $0.235 to $.266. Such a move would represent a 65% rise.

VET/USDT 12-hour chart

On the flip side, if the said demand barrier fails to support the collapsing VET price, the downtrend will likely continue. A decisive 12-hour candlestick close below $0.115 will invalidate the bullish thesis.

Under these circumstances, market participants could expect VeChain price to slide 14% to the support level at $0.098.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.