VeChain Price Prediction: VET heads to $1 next

- VeChain price has been locked in a cumulative zone following an explosive surge in the middle of April.

- The consolidation phase seems to be part of a bull flag pattern developing on VET’s daily chart.

- Slicing through the resistance trendline at $0.22 could see this cryptocurrency retest the recent all-time high or march to new record highs.

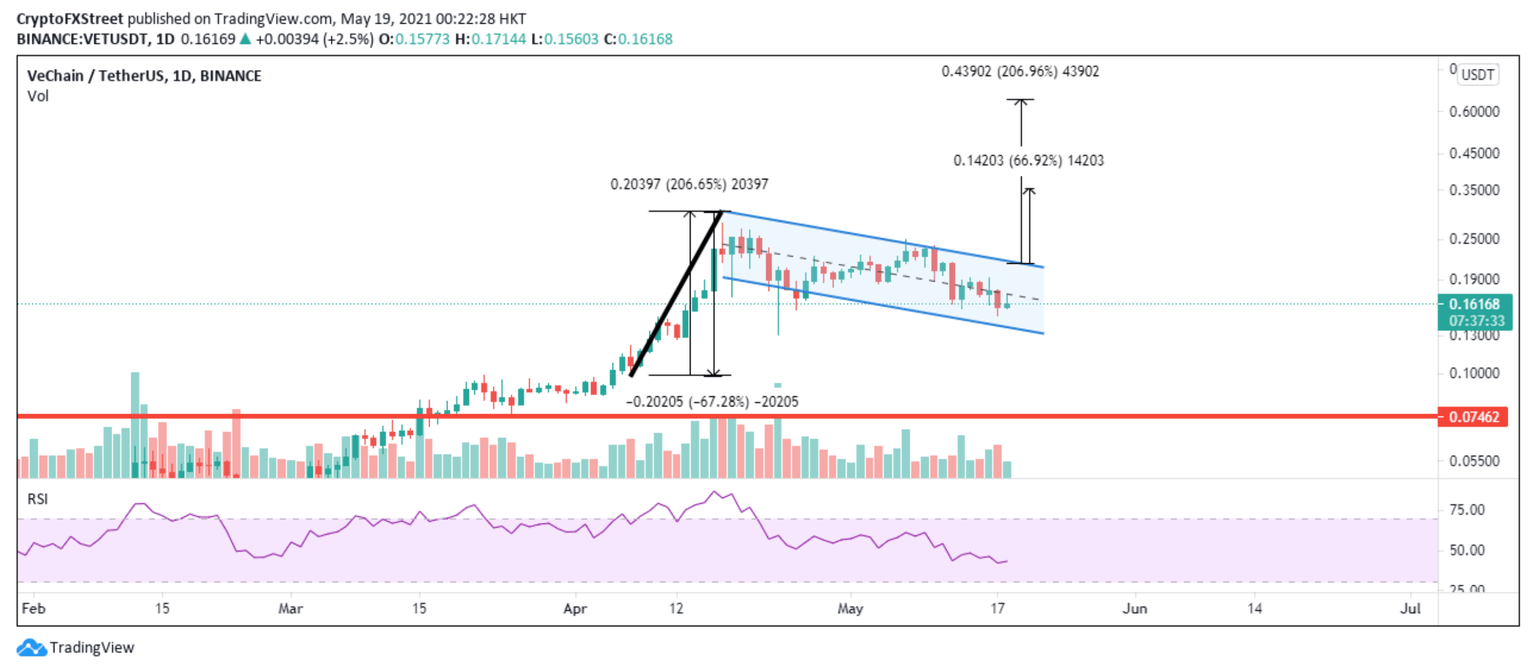

VeChain price surged by over 200% during the first two weeks of April, creating a new all-time high at nearly $0.30. VET has retraced by over 50% since then and is currently trading at $0.16. Now, the digital asset seems ready to resume its uptrend as it tries to break out from a continuation pattern.

VeCahin price consolidates before the next leg up

VeChain price is forming lower highs and lower lows on the daily chart. Joining these pivot points using a trendline creates a flag, where the 200% upswing that preceded this act seems to have formed the flagpole. Such price action appears to have led to the formation of a bull flag pattern, which indicates that VET uptrend is expected to continue.

A breakout above the flag’s resistance trendline at $0.22 could increase the chances for a 68% upswing to surpass the recent all-time high of $0.30 and reach a new one of $0.36. This target is measured by adding the length of the flag pole to the breakout point.

If VeChain price manages to break through its all-time high and flips this level into support, VET could be driven towards nearly $0.70, representing a 207% rally as calculated by the flagpole’s height.

VET/USDt 1-day chart

VeChain price action must remain above the critical support zone at $0.14 to add credence to the optimistic outlook. Otherwise, the bears would win control.

The downswing might result in further selling, pushing VeChain price toward $0.07. This price acted as stiff resistance between March and April, suggesting that it may be a strong support zone in the event of a correction.

Author

FXStreet Team

FXStreet