Uniswap price action tells traders it is time to say goodbye to $5 handle as more downside pressure underway

- Uniswap price makes a steep recovery before falling back to the ground on Friday.

- UNI flirts again with a break below $5.

- Expect another 10% devaluation as big brother Bitcoin also cracks under pressure.

Uniswap (UNI) price is the sum of everything that is going on in altcoins and cryptocurrencies. First and foremost, the element that Bitcoin is slipping further and has no outlook of getting back above $30,000 anytime soon is weighing on the overall performance of most common cryptocurrencies and altcoins. Add to that the almighty US Dollar that is roaring back after a long absence in 2023, and Uniswap is a sitting duck for bears to attack.

Uniswap price sees other elements in its price action overshadowed by BTC, US Dollar

Uniswap price was on its way to breaking above $5.20 in the ASIA PAC trading session, but the recovery was very short-lived. Bears came back in hard and squandered the opportunity for the Bulls to pare back some losses. The doom and gloom come from Bitcoin, which is sinking toward a two-month low.

UNI traders might detach themselves from Bitcoin’s performance, though unfortunately as a standalone altcoin Uniswap is facing another difficulty. The strong greenback is gaining strength with the Dollar Index back above 102 and the US Dollar advancing against several major G7 currencies. This makes UNI unable to make a fist against these overpowering bearish elements. This market rather values it at $4.60, which is another 10% lower on this Friday.

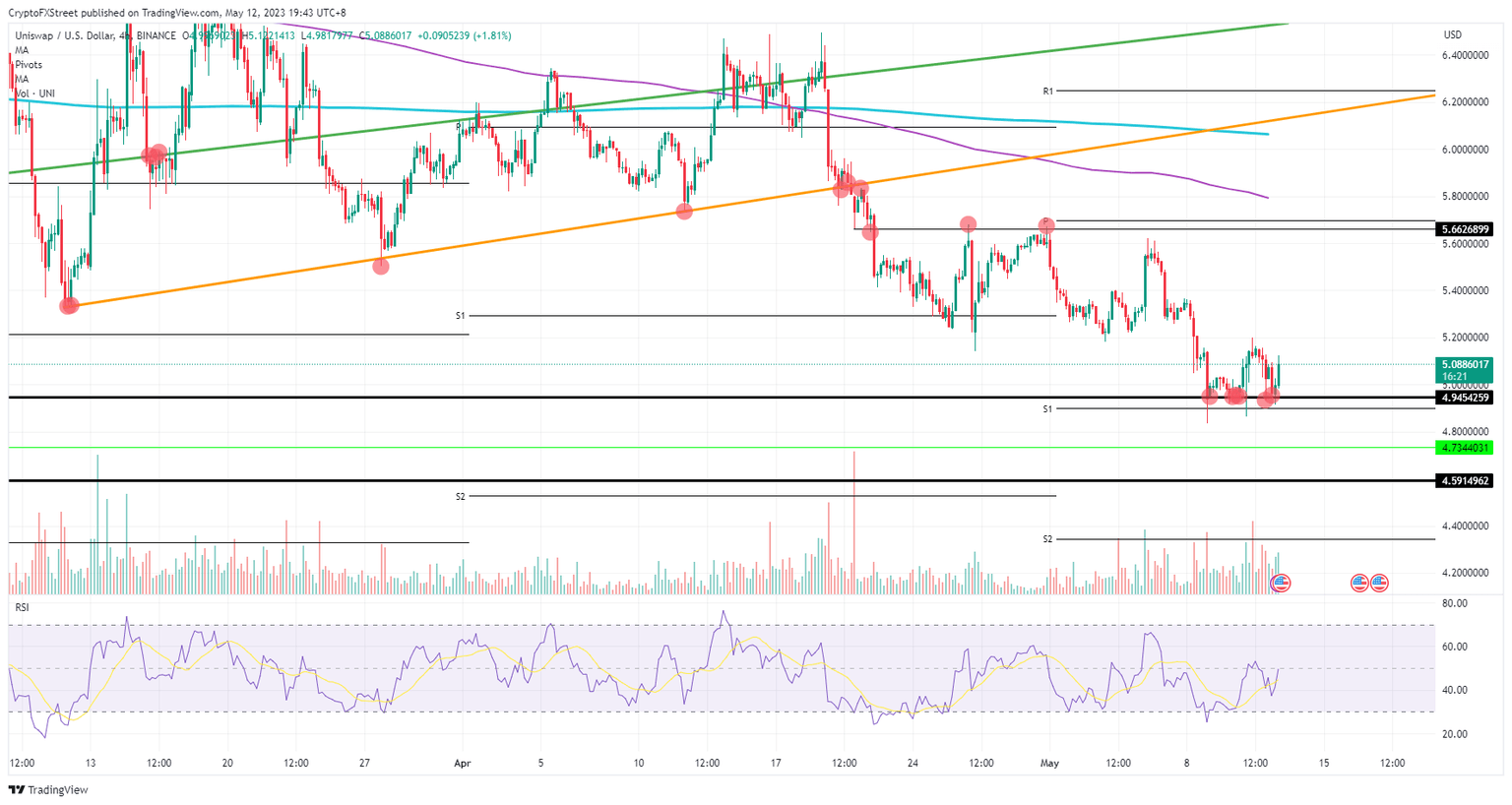

UNI/USD 4H-chart

One very small element here could still salvage the situation, and that is from a purely technical angle. The fact that the past three dips were each time higher could point to massive buying from investors that saves it from a breakdown. Look for $5.20 to be broken as confirmation, and from there UNI will rally quickly toward $5.67.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.