Uniswap price crashing by 15% in two weeks has led to UNI holders resorting to this

- Uniswap price has been in a consistent downtrend since mid-February, shedding 30% of its value in two months.

- The lack of velocity is acting as a boon and a bane since UNI is making minimal growth even during bullish moments.

- The absence of profit is driving investors away, as over 75% of UNI holders are suffering losses at the moment.

Uniswap price has had a rather dull time over the last two months, which is beginning to bear a negative impact on the altcoin’s loyal holders. While the altcoin is bound to follow the broader market cues, the lack of movement at the hands of investors might be holding UNI back from noting gains.

Uniswap price needs its investors to let go

Uniswap price over the last two months has witnessed a consistent downtrend despite attempts at recovery. As a result, the altcoin has come down by nearly 30% to trade at $5.3 at the time of writing. This lack of growth can not be attributed to the broader market conditions since the leader of cryptocurrencies, Bitcoin, has been performing exceptionally in this period.

UNI/USD 1-day chart

One of the reasons behind the minimal growth noted in the case of Uniswap is the transfer of capital from decentralized exchanges (DEXes), such as Uniswap, to liquid staking decentralized applications (Dapps) that occurred after Ethereum’s Shanghai upgrade. In the Decentralised Finance (DeFi) world, liquid staking protocols are close to surpassing the total value locked (TVL) on the DEXes ending a two and half year long domination.

This has resulted in UNI holders becoming sitting ducks waiting on profits. This is visible in the velocity of UNI tokens which is currently at a 12-month low, suggesting that the altcoin has not been moved around all that much. While a low velocity indicates a conviction, extending periods of the same also point towards potential contractions, which is the case with Uniswap price right now.

Uniswap velocity

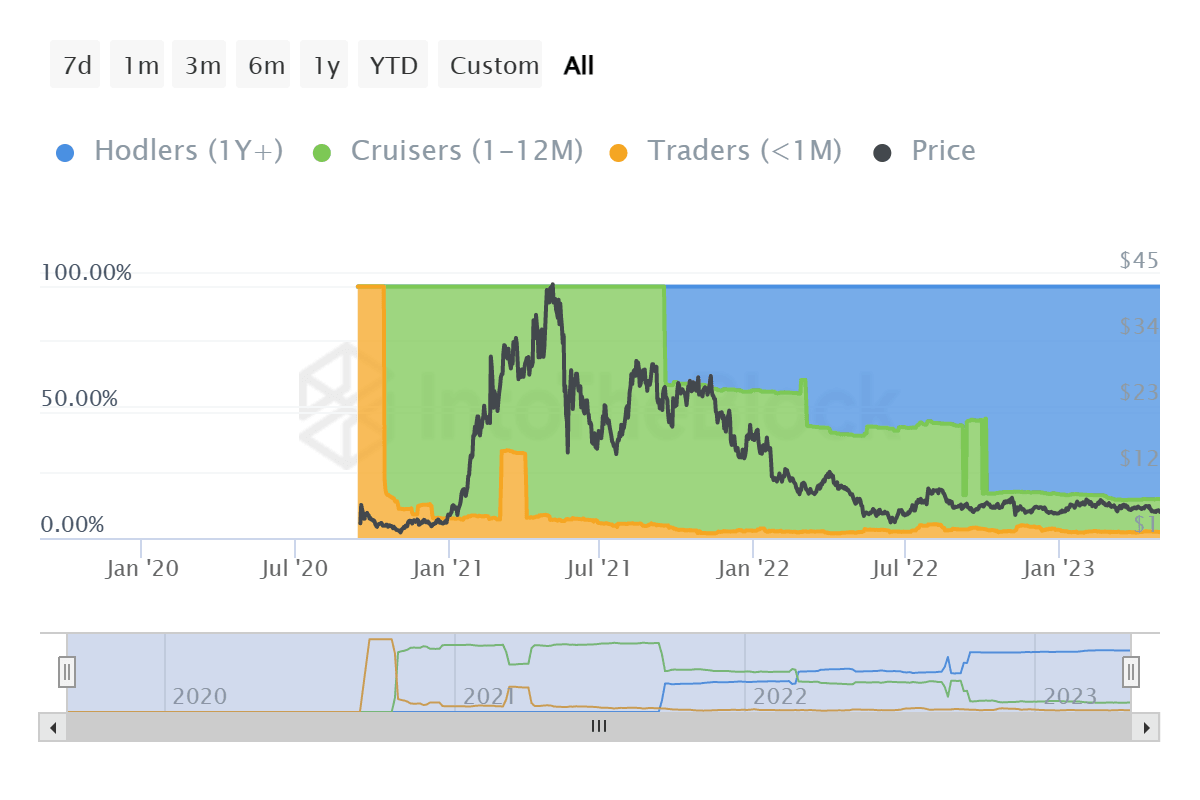

A high velocity is usually associated with a healthy rotation of capital which is also important for an asset. However, this change might be difficult to come by since almost 85% of the entire UNI supply is currently held by HODLers. HODLers, also known as long-term holders, are the cohort of investors that have not moved the balance in their wallets for more than 12 months.

Uniswap balance by time held

Thus for these holders to move their supply around again, the investors must be presented with an incentive of either profits or absolute losses. But given that more than 77% of the investors actually are facing losses right now, their conviction will keep them from shedding while still being underwater.

Uniswap investors at a loss

The best chance Uniswap price has right now to reawaken movement among its investors is to recover the recent losses and chart a new 2023 high beyond the $7.3 mark.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B22.02.29%2C%252002%2520May%2C%25202023%5D-638186430148049173.png&w=1536&q=95)