Uniswap price sets eyes at recovery as whales accumulate retail investors’ mid-April dump

- Uniswap price bounced off the six-month-old support floor at $4.87, preventing a crash bigger than 10% over the week.

- Whales holding 100,000 to 1 million UNI tokens accumulated 2 million UNI worth $10 million in the last seven days.

- UNI holders may refrain from selling since more than 82% of all investors are in losing positions.

Uniswap price barely saved itself from facing a major drawdown in the last few days and might actually recover, provided it finds support from its investors. Coincidentally by the looks of it, UNI holders are not only rooting for recovery but also might be potentially doing their part in ensuring a rise.

Uniswap price in the trenches

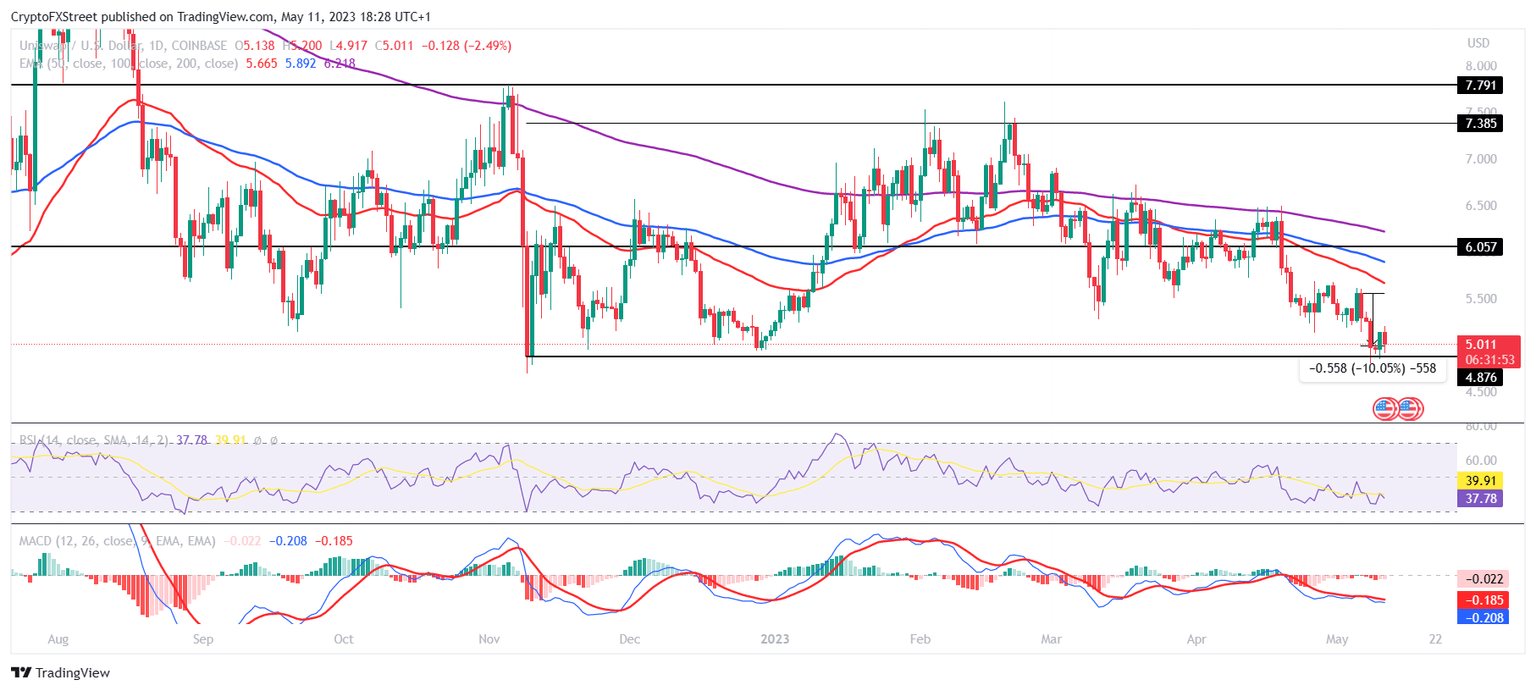

Earlier this week, following the broader market cues, UNI fell by a little over 10% on the charts to test the six-month-old critical support level at $4.87. In the end, the coin did not fall through that level. Oddly enough, despite the decline, investor behavior actually turned bullish.

UNI/USD 1-day chart

This is noticeable in the activity of Uniswap whales, who have been consistently accumulating throughout the previous week in order to offset the decline in price. The addresses holding a balance between 100,000 UNI to 1 million UNI observed an increase of 2 million UNI worth $10 million as their supply increased from 85 million to 87 million UNI.

The whales are probably soaking up the tokens which retail investors dumped back in mid-April.

The cohort holding 100 to 1,000 UNI sold off nearly 4 million UNI throughout April but has since been HODLing on to the remaining 10 million UNI supply.

Uniswap supply distribution

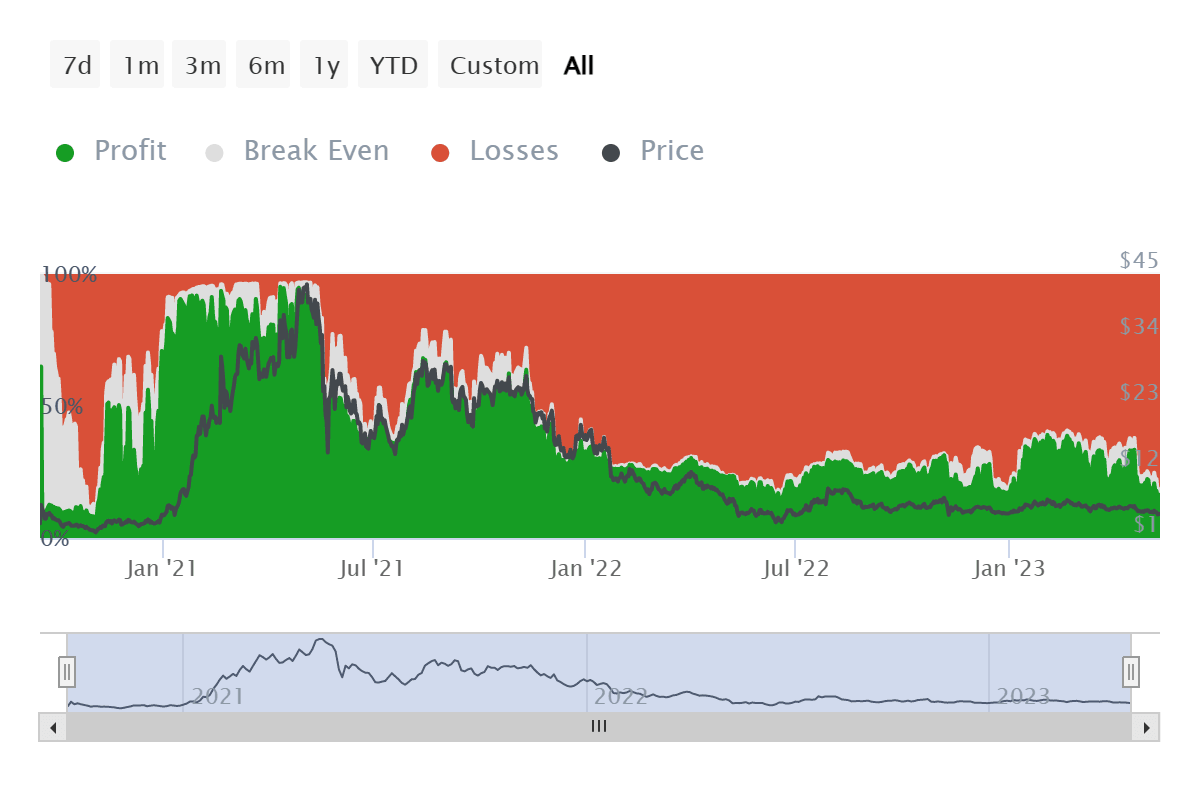

Going forward, this HODLing attitude may be significant as investors are currently heavily underwater. At the moment, less than 17% of the investors are in profit, as more than 82% of all addresses are yet to realize gains. This is the highest observed percentage of addresses in loss since November 2020.

Uniswap investors at a loss

Investors who are underwater generally hold onto their losses in the hope that price will rally back up again. The overall supply on exchanges also stopped rising recently and noted a downtick signifying accumulation.

Uniswap supply on exchanges

Should this scenario play out, Uniswap price will have more than enough incentive to rise back up, pushed by investors themselves, eager to drive their positions back into profit. The 50-day (red) Exponential Moving Average (EMA) line at the $5.66 mark is the next target for UNI, and flipping it into a support floor could potentially trigger a recovery.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B23.01.37%2C%252011%2520May%2C%25202023%5D-638194315257628478.png&w=1536&q=95)

%2520%5B00.53.54%2C%252012%2520May%2C%25202023%5D-638194315866201766.png&w=1536&q=95)