Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Dark clouds abound for BTC, XRP takes new focus

- Bitcoin price enjoyed slight gains amid rising market sentiment on May 17, but dark clouds abound.

- Ethereum price has gained momentum but not enough to break the BTC correlation.

- Ripple price is bullish as victory edges close with 20% gains in sight.

Bitcoin (BTC) price is ready to break out under ideal conditions, but broader macroeconomics threatens the bullish potential. Akin to BTC, Ethereum (ETH) price is also coiling up for a rally, but the PoS token’s correlation with the king crypto will not let it. Nevertheless, Ripple (XRP) broke free from the standoff after a new development indicated victory was edging closer to home in the SEC lawsuit.

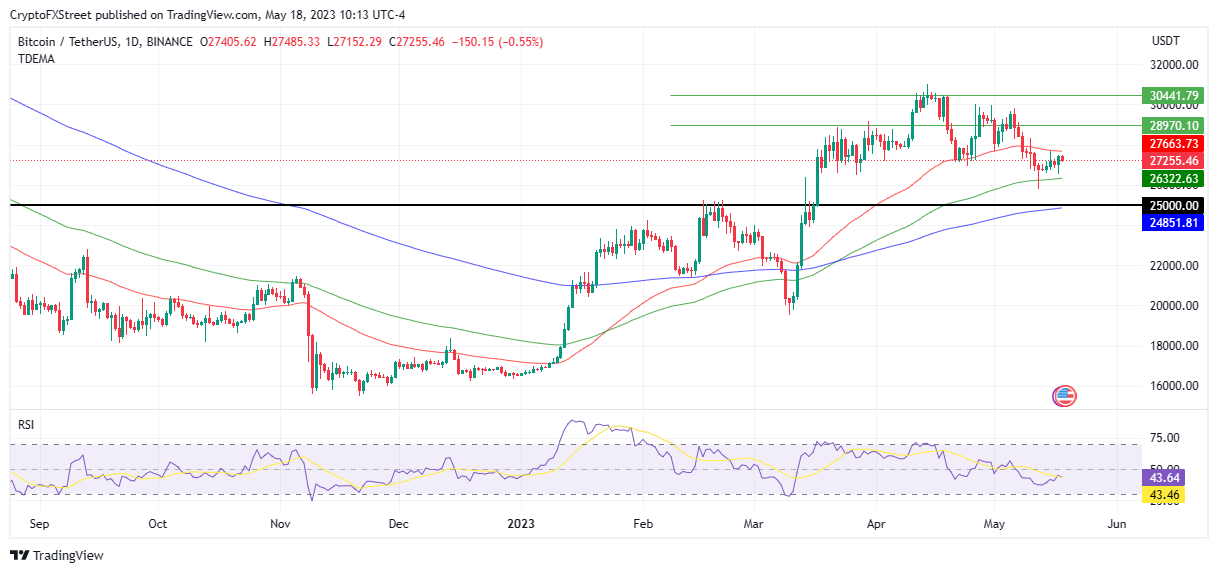

Bitcoin price reacts to shifting market sentiment, 7% losses in sight

Bitcoin (BTC) price turned bullish on May 17, rising 1.5% to breach the $27,400 level before a retraction. The move came amid shifting sentiment after US President Joe Biden commented about the debt crisis in the country.

If America defaults on its debt, our economy would fall into recession and our nation's global reputation would be damaged.

— President Biden (@POTUS) May 16, 2023

MAGA House Republicans should stop playing brinkmanship with the full faith and credit of the United States.

It's a manufactured crisis.

Nevertheless, Bitcoin price risks plunging in May after a gust of strong US economic data, revitalizing the possibility of June’s rate hike. This comes after the country’s industrial output and retail sales leaped 0.5% and 0.4% in April, suggesting consumer spending thrives despite strong economic headwinds. BTC will suffer if the USD strength index resumes considering it trades inversely with the Greenback.

Therefore, Bitcoin price is bearish amid prospects of another rate hike that has lifted US Treasury yields and boosted USD appetite. This explains why chart technicals indicate a bearish target at around $25,000 by June. This is a crucial psychological price level.

Strong selling pressure from the 50-day Exponential Moving Average (EMA) at $27,663 weighs heavy on Bitcoin price and could repel BTC causing a break below the immediate support due to the 100-day EMA at $26,322 before hitting the $25,000 target to meet the next supplier cohort around the 200-day EMA at $24,851 in the dire case.

BTC/USDT 1-day chart

On the flipside, an increase in buying pressure could see Bitcoin price move above the 50-day EMA at $27,664 to tag the $28,970 resistance level. A decisive flip of this hurdle into support could invalidate the bearish outlook, setting the tone for a run-up past $30,000 and tag $30,441 by June.

Also Read: Bitcoin trader predicts end of dip within weeks as BTC price adds 3.5%

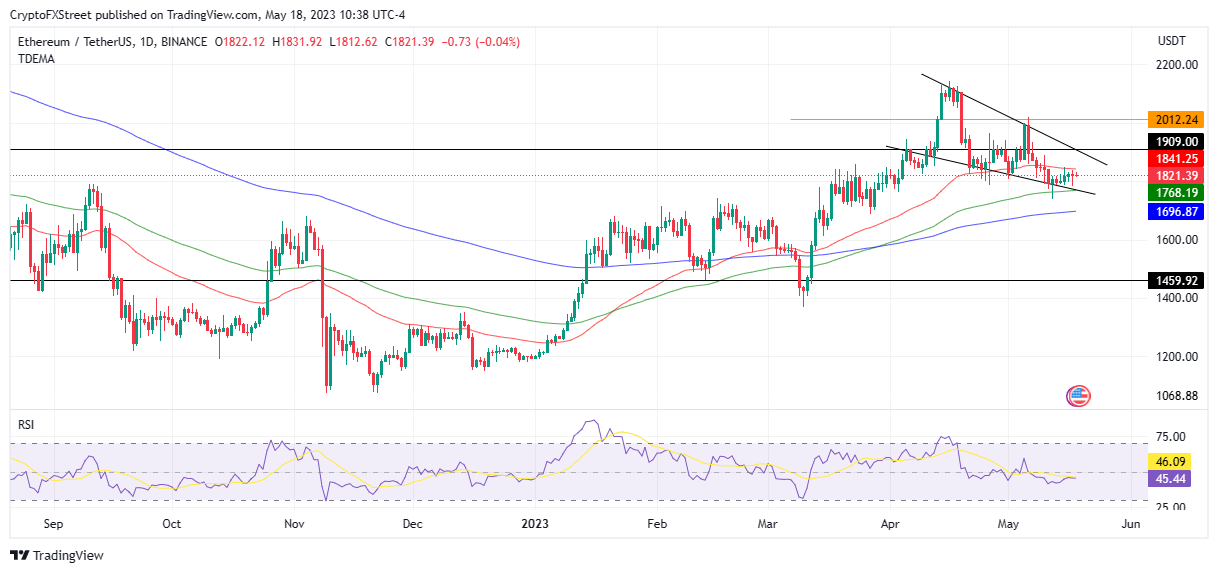

Ethereum price bullishness will not manifest unless BTC calls

Ethereum (ETH) price action has formed a falling wedge pattern, coiling up for a breakout. However, this potential appears limited owing to the PoS token’s correlation to BTC. As such, investors may not reap this bullish technical formation until Bitcoin price takes control.

In the meantime, as selling pressure from the 50-day EMA at $1,841 abounds, Ethereum price could break below the immediate support confluence between the lower boundary of the downtrend line and the 100-day EMA at $1,768. The subsequent price action could be a free fall to 200-day EMA at $1,686, where buyer momentum may provoke a rebound.

ETH/USDT 1-day chart

Conversely, a rally in BTC could initiate a bullish recovery in Ethereum price to confirm the optimistic outlook of the governing chart pattern. A decisive flip of the resistance confluence between the horizontal line and the upper boundary of the descending wedge pattern at $1,909 could top the odds in favor of bulls to pursue the $2,012 resistance level next.

Also Read: Binance Coin likely to outperform competitors as Wrapped Beacon ETH gets warm welcome

Ripple price enjoys positive progress in the XRP-SEC lawsuit

Ripple (XRP) price turned bullish on May 14 after a bullish takeover, but the price managed to overcome selling pressure due to the 200-, 100-, and 50-day EMA at $0.435, 0.443, and $0.454 respectively, after a positive development reported in the lawsuit against the SEC.

Auctioning at $0.463 at the time of writing, Ripple price could tag the $0.492 level before June as buying pressure increases, evidenced by the 5% daily rise in price. A daily candlestick close above this level would mark the remittance token’s recovery of the April highs and hopes.

The narrative makes a 20% rally to the $0.559 hurdle plausible as XRP bulls anticipate a summary Judgment from Judge Analisa Torres and the ultimate conclusion of the case. With the same optimism, the network is advancing its new XRP ledger-based CBDC platform despite privacy concerns.

The Relative Strength Index (RSI) bolsters this bullish outlook with an explosion above the mean line and more room to cover before XRP was deemed overbought.

XRP/USDT 1-Day Chart

On the other hand, greed could cause early profit-taking, or FUD inspires traders to book profits after breaking even. Under the bearish overwatch of the three EMAs, the ensuing selling pressure could see Ripple price revisit the May 10 lows around $0.408.

Also Read: XRP lawsuit: Victory edges toward Ripple after Judge Torres denies SEC motion

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.