Litecoin Price Forecast: LTC consolidates in a triangle as bulls anticipate a 45% breakout

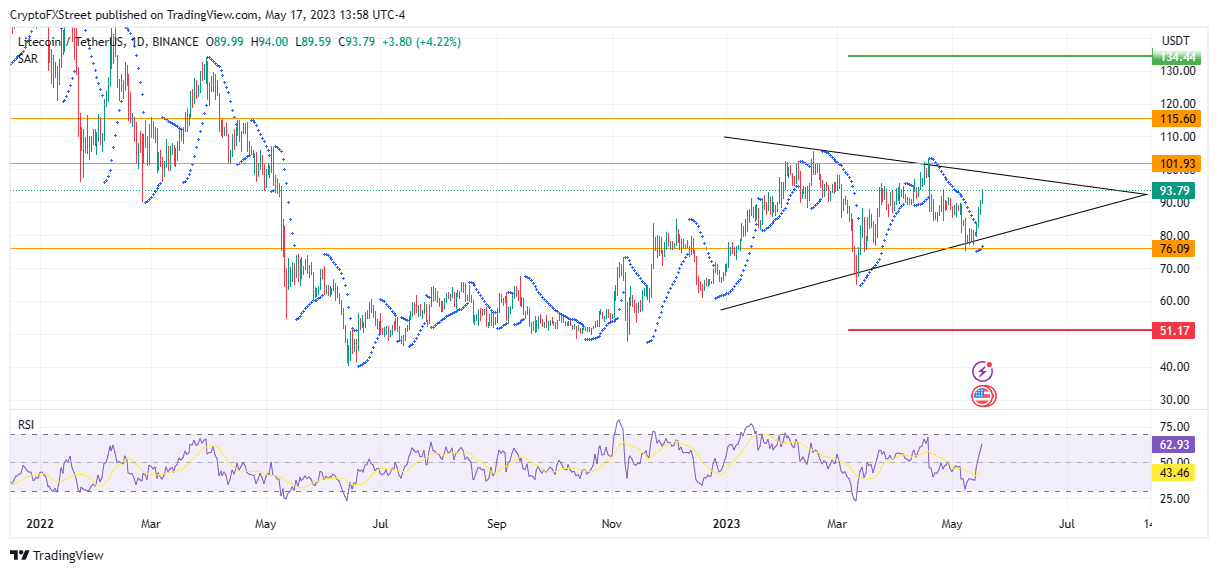

- Litecoin price action had led to the appearance of a triangle on the daily chart.

- LTC could break out 45% in either direction, with the odds favoring the upside.

- If history rhymes, the altcoin could rise to $138 ahead of the next halving before a pullback, confirming expert predictions.

- A decisive daily candlestick close below the lower boundary of the triangle at $76.0 would invalidate the bullish thesis

Litecoin (LTC) price indicates a bullish dominance, an outcome majorly attributed to strong buying pressure from investors as they prepare for the third halving with less than 85 days remaining before the network reduces the block rewards. This could typically boost the LTC price. The bullish momentum also comes after BIT Mining Limited unleashed a new mining infrastructure, as reported, dedicated to Litecoin. Both news has put bears in the rearview.

Also Read: Litecoin price rises by 10% in a day, aiming potential profits worth $2 billion

Litecoin price could rally 45% ahead of the third halving

Litecoin (LTC) price is trading with a bullish bias, with the price action leading to the appearance of a triangle on the daily chart, as shown below.

As Litecoin price consolidates within the triangle, the tapering end indicates decreasing volatility with a possible breakout in either direction. The breakout is confirmed upon a decisive daily candlestick close either above or below the technical formation.

With this in mind, Litecoin price could move upward upon producing a decisive daily close above the triangle's resistance line at $101.9. If this happens, the price could rise above the downtrend line, collecting the liquidity above it by flipping the $115.6 resistance level into support before tagging the optimistic target of the triangle at around $134.4. This would denote a 45% ascension from the current price of $93.2.

This bullish outlook enjoys the support of the Parabolic SAR, tracking Litecoin price from below. Whenever this price-tracking indicator flips below the price, it is interpreted as a bullish sign. When above, the reverse is true.

Also, the Relative Strength Index (RSI) supports the bullish thesis after signaling a call to buy LTC on May 13 when it crossed above the signal line (yellow band). Its position at 61 indicated there was still more room upward before the altcoin was overbought. Hence LTC price could still rise.

Notably, the 45% target aligns with predictions by prominent crypto trader, Pentoshi, who hinted a possible rise of Litecoin price to $138 before a potential pullback to around $92 ahead of the next LTC halving due in the next 8-10 weeks.

$LTC

— Pentoshi euroPeng (@Pentosh1) May 17, 2023

History doesn't repeat itself but it often rhymes

I wouldn't be surprised to see something like this in the next 8-10 weeks pic.twitter.com/FeYa1Opdwq

Nevertheless, even if Litecoin price achieves the 45% climb to the $134.4 target, it would not be enough to cover the losses investors have suffered through the ongoing bear market.

LTC/USDT 1-day chart

Conversely, if buyer momentum wanes, bears could recover the LTC market, driving Litecoin price below the lower borderline of the triangle pattern. A daily candlestick close below the lower boundary at $76.0 would invalidate the bullish thesis. In such a case, the price of 'the silver to Bitcoin's gold' in the crypto world could plummet to the October lows at around $51.1.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.