Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Euphoria and the effects of an overheated market

- Bitcoin price holds steady despite a positive Retail Sales that cheers the US Dollar.

- Ethereum price stalls as it awaits the BTC cue, with falling demand and accumulation indicating a lack of enthusiasm.

- Ripple price movement remains contingent on BTC’s directional bias.

Bitcoin (BTC) price remains undeterred despite a positive macroeconomic report after the US Census Bureau released the Retail Sales measuring the total receipts of retail stores. A 0.4% increase, which inspired an edge in the US Dollar Index, was expected to be bearish for crypto. However, prices remain at bay like BTC, Ethereum (ETH), and Ripple (XRP).

Also Read Breaking: US Retail Sales rise 0.4% in April vs. 0.7% expected

Bitcoin price suffers the aftermath of market euphoria

Bitcoin (BTC) price and the entire crypto playing field are suffering the aftermath of a surge in speculative trading and a frenzy of buying activity around the Pepe (PEPE) and MiLady (LADYS) ecosystem. The subsequent calm in the movements of both of these markets is a sign of peaking euphoria and an overheated market. An overheated market means asset prices have soared to an unsustainable level, driven by excessive optimism and speculation. As a result, investors focus more on the potential for quick profits and overlook the asset’s fundamental value.

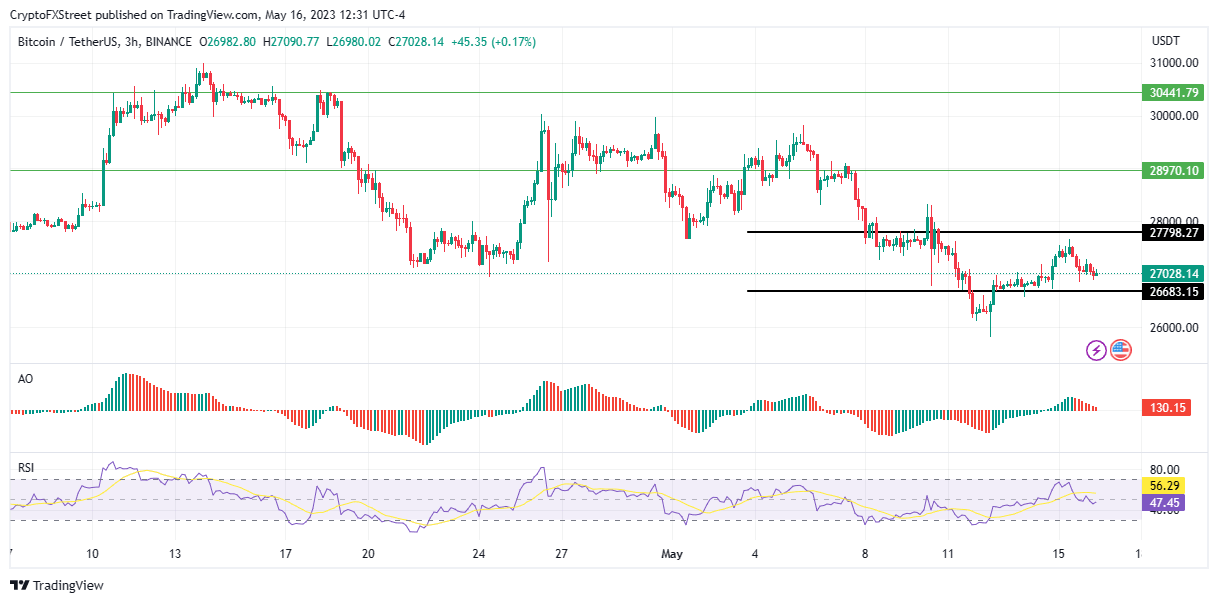

Based on the overall outlook, Bitcoin price remains bearish, and while there is a bullish attempt at a recovery in the three-hour timeframe, buyer momentum remains weak. Accordingly, an increase in profit-taking could see the flagship crypto drop to tag the $26,683 support level before a possible trend reversal.

Further south, investors could wait to knife-catch Bitcoin price around the psychological $25,205 and $24,300 support levels, where buyers could likely make a comeback.

The Relative Strength Index (RSI) was still below the mean line, and the Awesome Oscillators (AO) were pulling toward the zero line and could potentially transition to the negative zone, adding credence to the bearish analogy.

BTC/USDT 3-hour chart

Conversely, if buyer momentum increases, Bitcoin price could ascend toward the $27,798 resistance level. A decisive 3-hour candlestick close above this level would resume the uptrend.

In highly bullish cases, Bitcoin price could target the $28,970 resistance level next, or in overly ambitious cases, breach the $30,000 psychological level to tag the $30,441 resistance level.

Also Read: Could Bitcoin price soar in Q3 as BTC becomes retail traders preferred investment after Gold?

Ethereum price shows a lack of enthusiasm

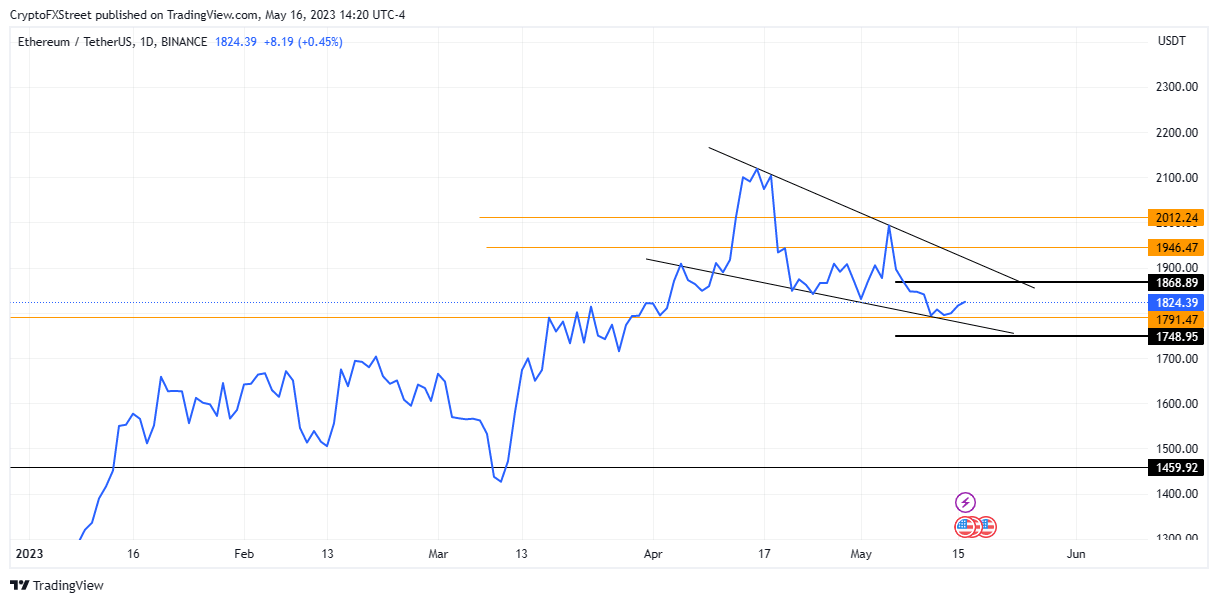

Ethereum (ETH) price shows a lack of ambition, awaiting the cue before a breakout to either side. The current price of $1,829 has ETH battling the immediate barricade at $1,868. While breaking above the $1,800 level was a plus, signs of falling demand and accumulation indicate a lack of enthusiasm among buyers. This explains why the Proof-of-Stake (PoS) token is trading horizontally.

Unless ETH abandons the BTC correlation, Ethereum price could head south toward the $1,791 support level, or the dire case, extend a leg down to tag the $1,748 swing low.

This negative outlook draws support from the Relative Strength Index (RSI), which had tipped downward with an inclination to extend into the region below the mean line. Take note that the RSI was about to signal a call to “sell ETH” once it crossed below the signal line (yellow band). This would favor the downside.

ETH/USDT 3-hour chart

A peep at Ethereum price action in the one-day timeframe (below) suggests a bullish move is underway. ETH price action showed a downward wedge pattern at the time of writing. This is a bullish technical formation indicating a potential price reversal to come.

In such a case, Ethereum price could break above the $1,868 resistance level. A decisive flip of this hurdle into support could pave the way for a potential recovery.

ETH/USDT 1-day chart

Also Read: Ethereum researcher proposes MEV burn to protect ETH blockchain from manipulation

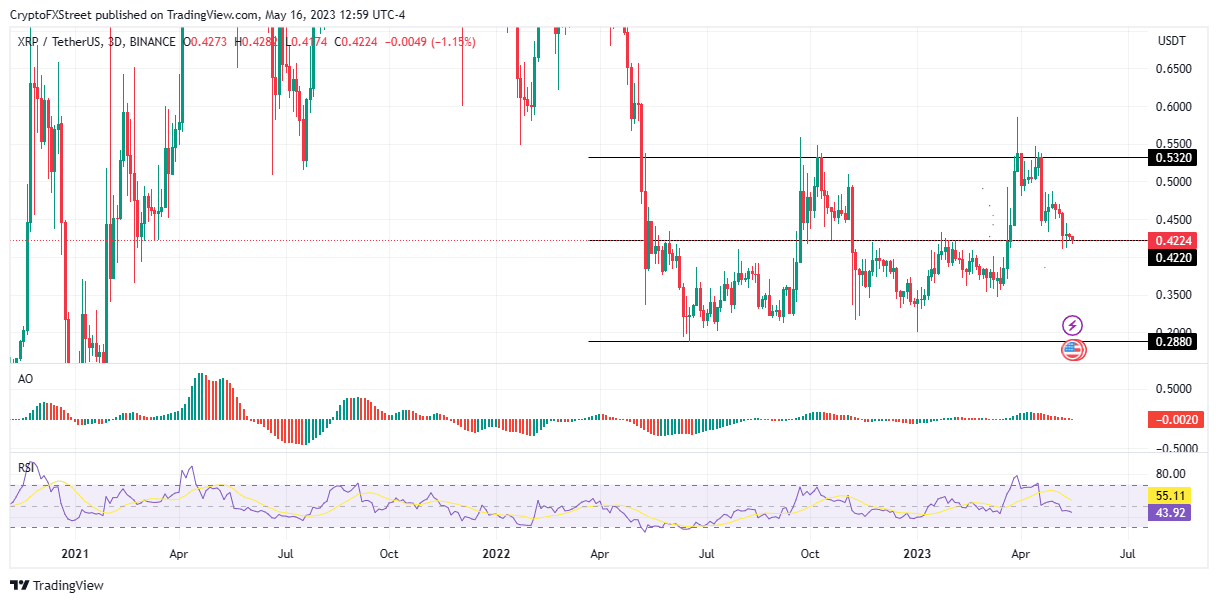

Ripple (XRP) price is trading with a bearish inclination after falling almost 20% in the three-day timeframe between April 16 and May 16. A bullish attempt to recover around later April proved premature as bears quickly fastened their grip on XRP.

As a result, Ripple price now fights to defend the $0.422 support level, with everything depending on Bitcoin’s ability to inspire a trend reversal across the market. This comes amid a stall in the XRP lawsuit, leaving investors unhinged.

An increase in seller momentum could see the remittance token shatter the current support level, slip through the $0.350 psychological support and find solace around the $0.288 support floor.

The RSI position below the mean line and the negative AO support this outlook.

XRP/USDT 3-day chart

Conversely, a positive move in Bitcoin price could salvage XRP, fueling a recovery rally for Ripple price. The likely target would be a restoration to $0.532 resistance level in such a case.

Another factor that could influence a trend reversal in Ripple price is a positive development in the XRP lawsuit against the US Securities and Exchange Commission (SEC).

Also Read: Ripple Chief Legal Officer slams US SEC’s argument against the payment giant

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.