Bitcoin price recovery likely undeterred by $1.3 billion BTC sale of long-term holders

- Bitcoin long-term holder addresses that held the asset for more than a year sold nearly 50,000 Bitcoins on May 15.

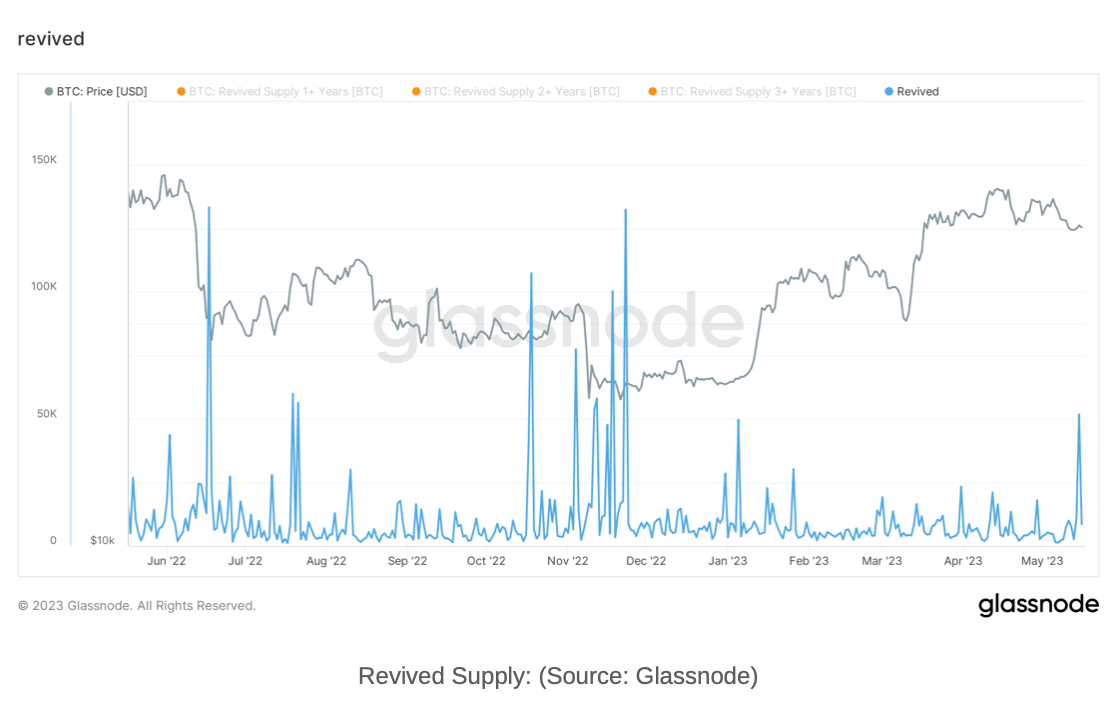

- The sale of long-term Bitcoin holdings represent the BTC supply that re-enters circulation, also known as revived supply.

- BTC price recovered in June and November 2022, when nearly the same dollar value in Bitcoin was sold by long-term holders.

Nearly 50,000 Bitcoin held by long-term wallet addresses have entered the market again. While BTC sale by long-term holders is typically considered bearish, past experience shows that revived supply entering the market has led to a recovery for BTC in the long-term.

Bitcoin long-term holders shed 50,000 BTC holdings

Bitcoin wallet addresses holding the asset for more than a year shed their BTC holdings earlier this week. While a decline in BTC supply held by long-term holders is typically considered bearish for an asset, in the case of Bitcoin, “revived” supply usually precedes a price recovery.

When Bitcoin held by long-term holders (users that held BTC for greater than a year) enters the market, it is defined as “revived supply.” On May 15, nearly $1.3 billion worth of Bitcoin reentered the market, and similar levels of revived supply were seen twice over 2022.

In June and November 2022, 100,000 BTC and 205,000 BTC entered the market, representing more than $1.3 billion in dollar value at the time. These spikes in revived supply were followed by a recovery in the asset’s price.

Bitcoin revived supply in June and November 2022

While the volume of BTC revived in May is relatively lower compared to previous spikes, the dollar value is comparable. The chart above shows the steady recovery in Bitcoin price, in the two to three months after the revived supply entered the market.

If history repeats, Bitcoin price could recover from its decline below the April peak of $30,899.

The supply on exchanges, a key metric showing the volume of Bitcoin that hits exchange wallets, reflects the recent increase in revived supply.

%2520%5B14.17.35%2C%252017%2520May%2C%25202023%5D-638199150219514415.png&w=1536&q=95)

Bitcoin supply on exchanges

Bitcoin supply on exchanges was 1.13 million as of May 15, when long-term holders sold BTC, according to data from Santiment. Since then, it has fallen to 1.11 million as demand on exchanges absorbed the sale of BTC by long-term holders. In this context, the asset’s price could recover from its recent pullback.

Bitcoin price analysis

Bitcoin price is in an upward trend that started at the beginning of 2023. The asset hit an April 2023 peak of $31,028 (on Bitstamp) and witnessed a correction thereafter. In its path to recovery, BTC price faces resistance at $28,459 and $29,480, levels that acted as resistance between March and mid-May.

BTC, which trades around $26,800 at the time of writing, is below its 10-day and 50-day Exponential Moving Averages (EMAs) at $27,278 and $27,677, respectively. These price levels could act as immediate resistance to Bitcoin price.

BTC/USD one-day price chart

If Bitcoin price plummets to the 200-day EMA at $24,837, it is likely to invalidate the bullish recovery thesis for the asset. The downside target is $24,342, a level that acted as support throughout March and April.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.