Weekly roundup: LADYS and PEPE prices drop, AI tokens recover, Hydra mainnet release drives Cardano higher

- Milady Meme Coin and Pepe prices have declined as the narrative declines and large volumes of tokens hit exchange wallets.

- Artificial Intelligence (AI) tokens Render, SingularityNET and Fetch.AI started their recovery in light of announcements by technology giants.

- Hydra Head, Cardano blockchain’s scaling tool went live on mainnet on Thursday, fueling a recovery in ADA price.

Prices of main crypto assets dipped further this week, with Bitcoin and Ethereum close to two-month lows. In the meme coin space, Pepe the frog had a tough week as Milady Meme Coin took the center stage after Elon Musk tweeted about it.

Meanwhile, big investments in Artificial Intelligence unveiled this week by big US corporate giants could fuel AI-related tokens, and Cardano got some support from the launch of its Layer 2 scaling solution Hydra.

LADYS, PEPE prices decline as meme coin season narrative loses relevance

Milady Meme Coin (LADYS), Pepe coin (PEPE) prices have declined as the meme season narrative loses its popularity among crypto traders. LADYS price nosedived 62% after hitting an all-time high of $0.00000017 on May 11 and PEPE lost 70% of its value from record high of $0.00000431 on May 5.

Experts at Santiment discussed in a recent report on meme coins how these tokens derive their value from speculation and catalysts like social dominance. As other narratives like Artificial Intelligence (AI) and Ethereum layer 2 gain prominence, the hype surrounding the two meme coins is likely to drop lower.

Read more here.

Find out more about PEPE’s competitor Milady Meme Coin here.

As the spotlight shifts from meme coins, Artificial Intelligence (AI) tokens have made a comeback, starting their price recovery.

Key AI announcements from tech giants fueled the narrative

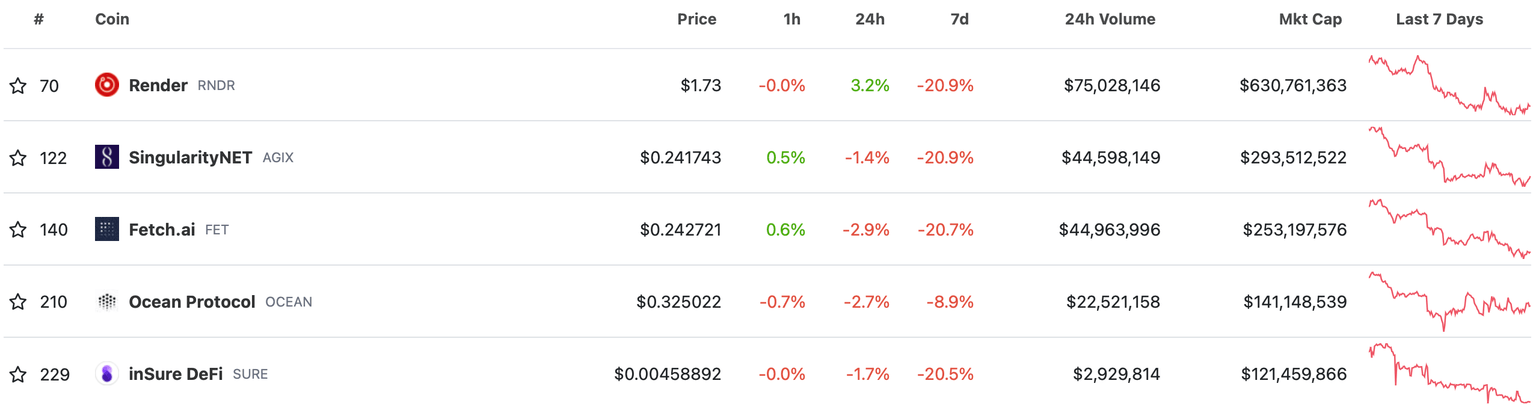

Several tech giants like Meta, IBM and Humane announced updates or released new AI products earlier this week, fueling the AI narrative. Render (RNDR), SingularityNET (AGIX) and Fetch.ai (FET) started their recovery from the pullback that followed the second-week of April 2023.

Top 5 AI tokens by market capitalization

As seen in the chart above, the top 5 AI tokens started their recovery after the recent round of announcements. Find out more about the tech giant’s updates here.

Among cryptocurrencies with a large market capitalizations, Cardano started its recovery with scaling solution Hydra’s mainnet release.

Hydra launches on the mainnet, fueling ADA price recovery

Hydra, Cardano’s layer 2 scaling solution aims to increase speed, scalability and reduce transaction costs for ADA users. The launch of the scalability solution on Cardano’s mainnet acted as a bullish catalyst, driving ADA price higher.

Ethereum-alternative Cardano started its recovery with 3% gains since Thursday. Hydra’s release on mainnet therefore fueled a bullish thesis for ADA.

Find out more about the Hydra release here.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.