Ripple CEO addresses XRP community members amidst SEC v. Ripple lawsuit

- Ripple’s legal battle with the US Securities and Exchange Commission rages on, while CEO Brad Garlinghouse takes a moment to thank the XRP community.

- Garlinghouse thanked XRP Army of holders and investors for their support in the legal battle with the SEC.

- XRP yielded 2% gains for holders over the past two weeks, as the altcoin begins its recovery.

The US financial regulator’s legal battle with Ripple drags on as CEO Brad Garlinghouse addresses the XRP community. The altcoin started its recovery, yielding 2% gains for holders since April 22.

Also read: Cardano whales accumulate ADA as Layer 2 scaling solution Hydra goes live

Ripple CEO Brad Garlinghouse addresses XRP community members

Amidst the ongoing legal battle with the US SEC, Ripple CEO Brad Garlinghouse expressed his gratitude to the XRP community. Garlinghouse thanked the army of XRP holders who supported Ripple in its legal battle against the SEC.

Garlinghouse thanked the XRP community for their show of support at Las Vegas 2023, thanking XRP holders in his recent tweet:

Great to meet so many folks from the XRP community at #XRPLasVegas2023 – the camaraderie is remarkable (and an amazing feeling in person vs Twitter!) This community has stood by and supported Team Ripple as we have fought the good fight…I can’t adequately express my gratitude pic.twitter.com/lb9TCURv3C

— Brad Garlinghouse (@bgarlinghouse) May 6, 2023

There have been several key developments in the SEC’s battle against Ripple. Coinbase’s Chief Legal Officer Paul Grewal met Ripple’s Stuart Alderoty recently. The two had a conversation regarding regulation in the crypto ecosystem and informed community members of more such meetups in the future.

An XRP proponent and community member narrowed down key dates for Judge Analisa Torres’ final verdict on SEC vs. Ripple, identifying July 4 as one of the most likely dates when the lawsuit could draw to an end.

Ripple continues to enjoy support from the XRP community and proponents like Attorney John Deaton while holders await a verdict on the prolonged lawsuit.

Experts await XRP price recovery to $0.50

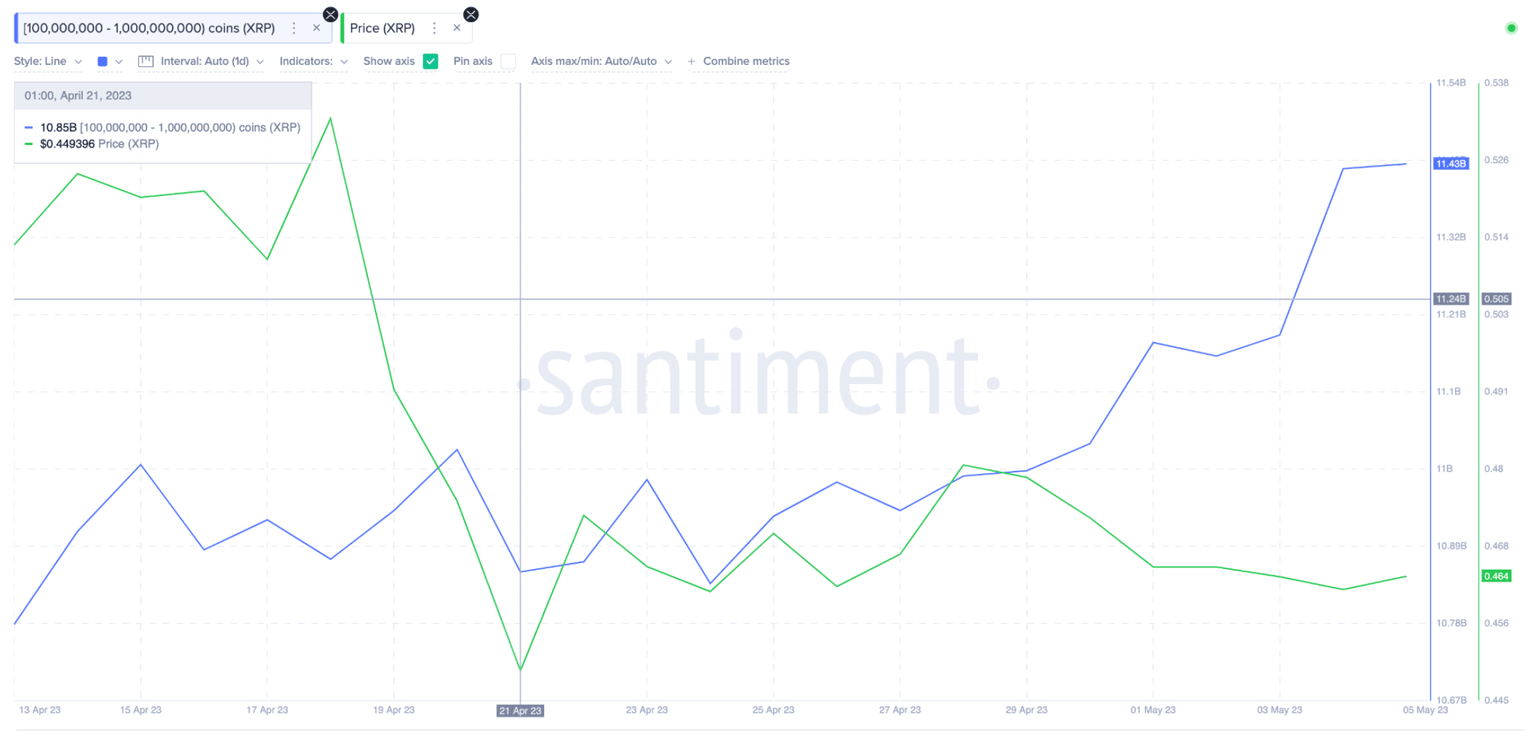

XRP whales continued accumulating the altcoin according to data from crypto intelligence tracker Santiment. Large wallet investors holding between 100,000,000 to 1 billion XRP tokens scooped up 610 million XRP tokens worth approximately $287 million.

XRP whale accumulation

Between April 21 and May 5, whales scooped up the XRP tokens, increasing their wallet holdings of the altcoin. Typically, whale accumulation is considered a bullish sign for the altcoin’s price.

Experts are awaiting XRP’s recovery to the $0.50 level, a key resistance for the altcoin that it failed to hit since April 14.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.