Best time to invest in Pepe, expert insights from former Dogecoin millionaire

- Former "Dogecoin Millionaire" has offered insights on the best time to invest in Pepe.

- Glauber Contessoto says investors should wait until the meme coin is 80%-90% down from its $0.00000431 ATH before purchasing.

- Despite the current market downturn, his advice suggests a belief in the potential for PEPE to rebound.

Dogecoin (DOGE) millionaire, Glauber Contessoto, has offered insights on the best time to invest in Pepe (PEPE), the sensational meme coin that made headlines recently with sky-high daily rises.

People ask me when will be the best time to buy $PEPE - I’ll tell you..

— SlumDOGE Millionaire (@ProTheDoge) May 15, 2023

when it’s 80%-90% down from All Time High (1.5 Billion Market Cap)

Based on his expert advice, potential investors should wait until the altcoin is 80%-90% down from its all-time high of $0.00000431 before buying PEPE.

Also Read: PEPE price pulls back as tokens worth $46M hit exchanges

Dogecoin millionaire Glauber Contessoto’s limelight

The DOGE millionaire's insights remain timely despite the waning momentum in Pepe's upside. In the agile and dynamic crypto sphere, defined by extreme market volatility, it is important to know when to buy and when to let the market shifts play out.

Glauber Contessoto came to the limelight through prominent media outlets like CNBC, which showcased his success story that went viral in early 2021. The media outlet revealed his actions by investing his life savings into Dogecoin and earning himself entry into the millionaire's club. Accordingly, Contessoto is famous for his bold crypto strategies and has become a renowned influencer in the crypto arena.

The "Dogecoin Millionaire" nickname came after the largest meme coin by market capitalization experienced a massive rally. However, DOGE has since plunged, with CoinGecko data indicating a 90% drop from its record high.

Pepe has rebound potential, Contessoto

Pepe, the sensational internet Frog meme, had witnessed explosive popularity over the past few weeks, becoming the fastest Ethereum (ETH) token to attain $1 billion in market cap when it peaked above $1.6 billion.

Nevertheless, as is characteristic of meme-based cryptos, PEPE suffered extreme volatility, falling around 60% from its record high.

Still, Contessoto has hope that Pepe could rebound despite the current market downturn and presents a strategy often too common among investors- buy the dip, also know as catching a falling knife. While his insights are indeed tactical, it is always important to understand the risks involved in crypto investing because of this asset category's highly speculative and volatile nature.

Accordingly, investors should not rely on expert advice alone but also perform their own research while remaining mindful of their financial situation.

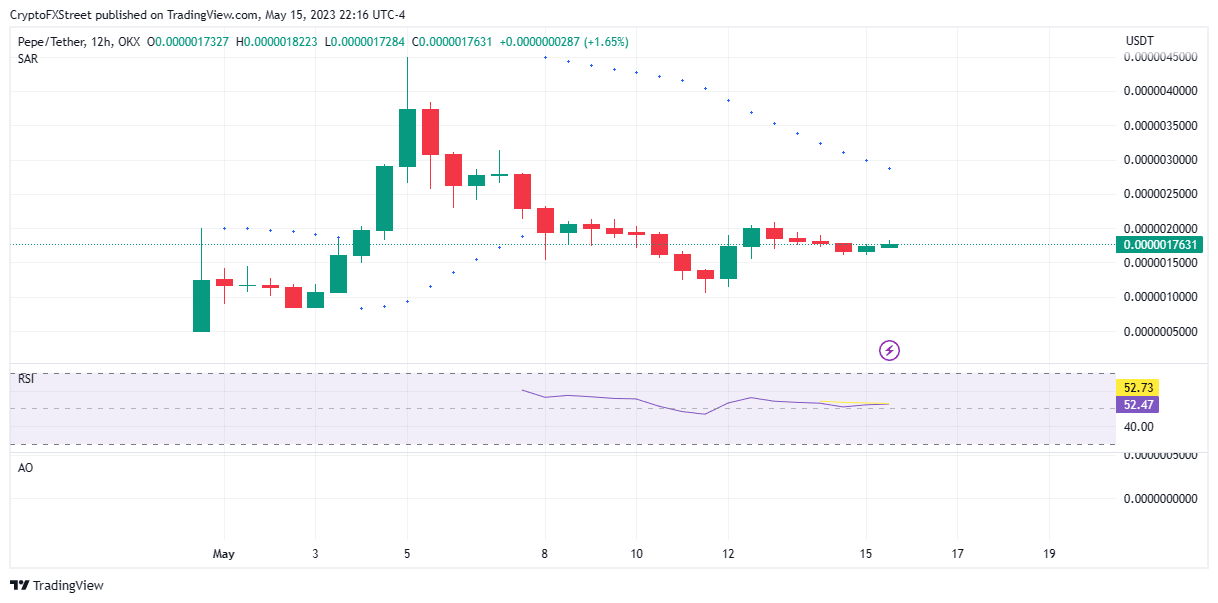

At the time of writing, Pepe (PEPE) price is $0.000001762, a daily rise of 3.75% with bulls taking the lead on the 12-hour timeframe. However, the Parabolic SAR indicator was bearish after flipping above the price on May 8. This indicates the price may pull down in the near term.

PEPE/USDT12-hour chart

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.