Could Bitcoin price soar in Q3 as BTC becomes retail traders preferred investment after Gold?

- Bitcoin price is expected to flip $30,000 as a support floor as expectations of a mid-cycle rally emerge.

- BTC has surpassed USD as the preferred investment option due to the concerns surrounding US debt.

- Tether reduced its bank deposits by more than 90% owing to the banking crisis.

Bitcoin price has been fluctuating for the last couple of weeks as the macroeconomic market continues to face challenges. Faith in the US Dollar (USD) continues to wane, and concerns surrounding the impact of the debt ceiling standoff will play an important role in BTC's rise going forward.

Read more - Banks deemed investing indirectly in Bitcoin as faith in USD continues to decline

Confidence in Bitcoin grows amid depreciating macroeconomic conditions

Earlier this week, billionaire investor and hedge fund manager Paul Tudor Jones in an interview with CNBC, stated,

"I'm going to always stick with Bitcoin.

While the statement in itself does not inflict any kind of impact on the price action, it speaks to the larger narrative of crypto being a bubble.

As the founder of one of the biggest investment firms in the United States, Jones’ opinion falls in line with many other institutions that have more faith in Bitcoin than the US Dollar right now. Beyond just investment firms, banks themselves are betting on the digital currency as the banking crisis continues to instill fear among citizens.

As reported last month, the Bank of America and Fidelity Management recently purchased over $85 million worth of MicroStrategy's MSTR shares.

Another recent entry in this club is the issuer of the biggest stablecoin in the world - Tether - which has reduced its bank deposits from $5.3 billion to $481 million in Q1 this year to reduce its bank-risk exposure.

In exchange, the USDT issuer added Gold and Bitcoin to its asset reserves for the first time. These investments account for about 4% and 1.8% of its entire reserves, worth nearly $3.2 billion and $1.45 billion, respectively.

This is because people believe that the best way to circumvent the potential damages from a financial crisis is by leaning in on an inflation hedge asset. Plus, Bitcoin already has earned its safe-haven status since it could offset any potential losses it may bear owing to the macroeconomic conditions, thanks to its rising correlation with Gold.

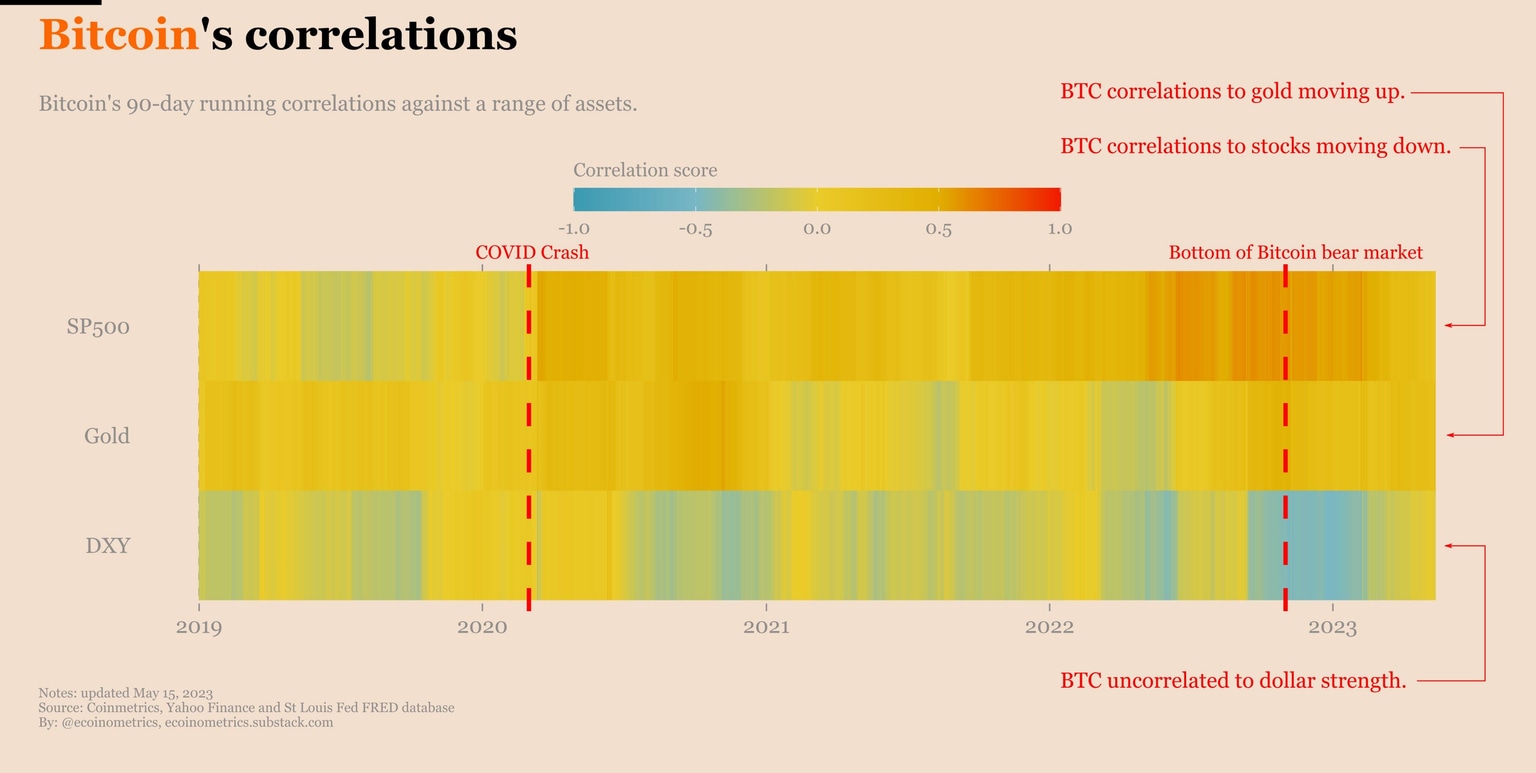

As noted in the image below, following the Bitcoin bear market bottom from November 2022, Gold's correlation with BTC has increased. At the same time, its correlation with the stock markets has declined in the last few weeks, while it stands completely uncorrelated with the Dollar Index (DXY).

Bitcoin correlation with Gold on the rise

All these instances are signs that Bitcoin price may witness a rise over the next few months.

Bitcoin price has immense potential

Going forward, Bitcoin price might make it back above the June 2022 high of $30,000, which also marks a key psychological level. The chances of such a rally are high since the digital asset is still in high demand.

According to a survey from Bloomberg, BTC has surpassed USD as the preferred asset for investment. This is due to the concerns surrounding the US national debt, as raising the debt ceiling continues to be a matter of discussion.

NEW: #Bitcoin flips USD as preferred asset if the US defaults on debt - Bloomberg pic.twitter.com/RpjNYXRLCz

— Bitcoin Archive (@BTC_Archive) May 15, 2023

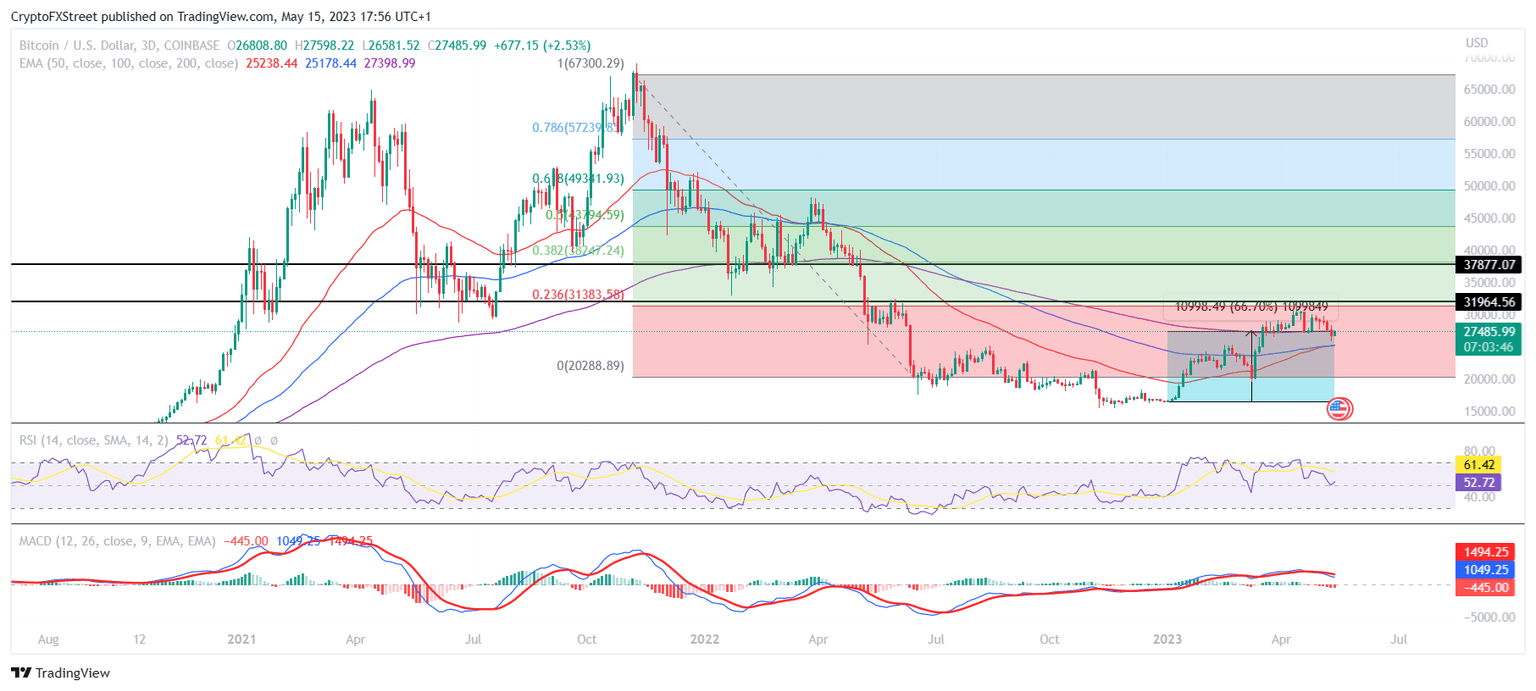

This would be a boon for Bitcoin price, which has increased by more than 66% since the beginning of the year and is potentially preparing for a bull market in 2024. According to popular trader Inmortal, the rest of 2023 is set to note a mid-cycle rally.

This makes $32,000 and $37,800 the next major targets as they coincide with the 23.6% and 38.2% Fibonacci Retracement of $67,300 to $20,288.

BTC/USD 1-day chart

However, some resistance from bearish broader market cues could impact the potential of Bitcoin price to reach these targets.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.