This upcoming event could crush SafeMoon price

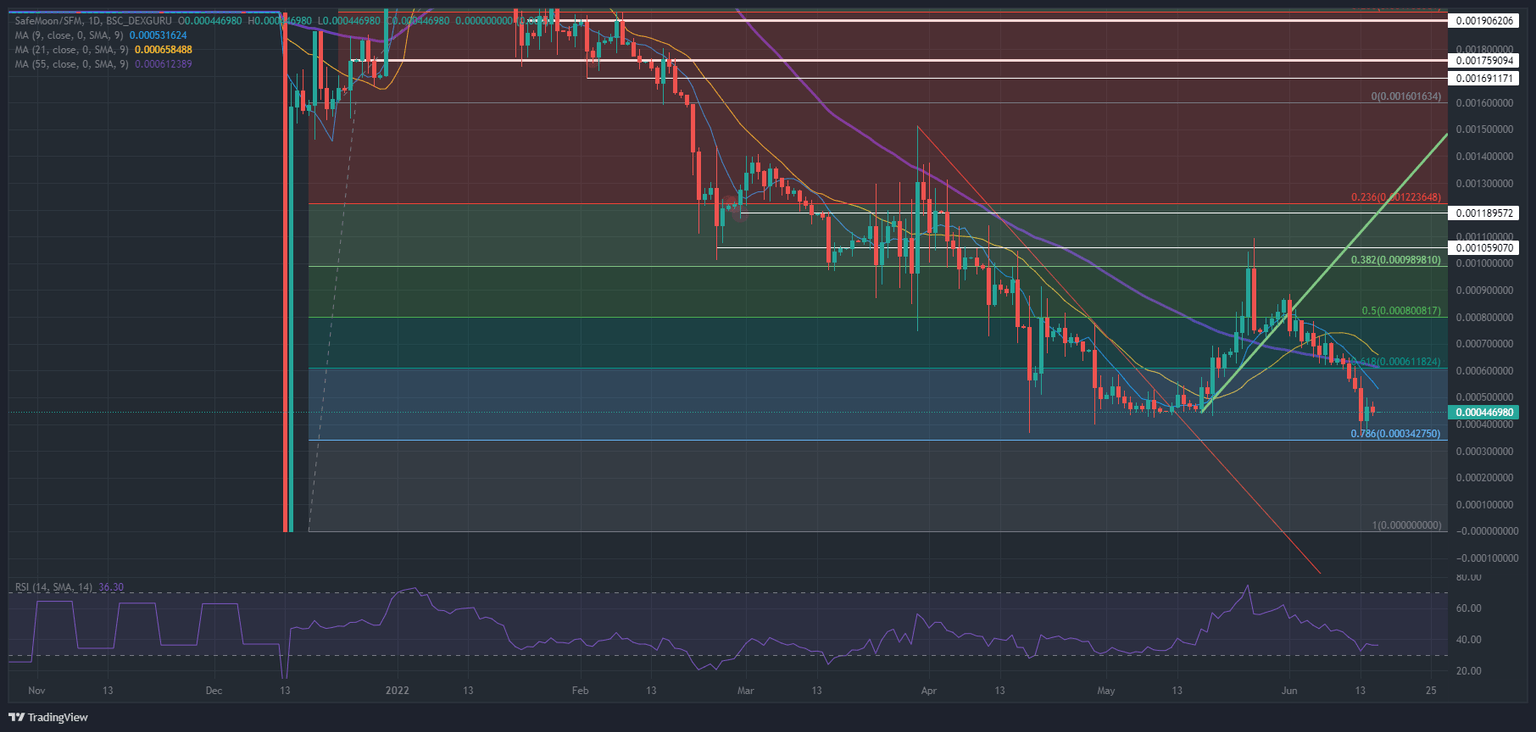

- SafeMoon price is set to continue its descent and break below a fundamental Fibonacci level.

- SFM price could see additional headwinds from the Fed Interest Rate decision on Wednesday.

- Expect to see a possible drop below $0.000300000.

SafeMoon (SFM) price is set to drop further after the market has tried to push against the current downtrend since last week. Unfortunately, a bounce off $0.000342750 was not enough and looked set to get another retest on the back of a significant catalyst this evening. That could be either the outcome of the emergency meeting from the ECB that got announced in early European morning trading or on the back of the Federal Reserve rate hike decision where polls are pointing to 75 basis points or even 100bp hikes to come.

With all these events, markets are tightening, which means less expendable money to put at work in cryptocurrencies, with SafeMoon set to make another leg lower below $0.000300000.

SFM price set to tank 30%

SafeMoon price enters a danger zone on Wednesday with not one but several very sensitive headline risk events that could bring more downside to the price action. The first main headline risk event comes from a surprise announcement that the ECB is holding an emergency meeting, with markets looking carefully at the statement that the European monetary policymakers will issue. The second event is the Fed Interest Rate decision later in the day, where an announcement of another rate hike of 50bp or 75bp will trigger another round of tighter monetary conditions. These events have the potential to trigger another exodus of cash out of cryptocurrencies.

SFM price will be no match for these selling pressures and will see price action drop towards $0.000342750 or the 78.6% Fibonacci level, forming a triple bottom with the low from June 13 and 14. Depending on the size and severity of the headlines, expect to see a breakthrough towards $0.000300000. That level is key because of its psychological effect after a new low for 2022. In total, SFM price could see another 30% of its value going up in smoke.

SFM/USD daily chart

Should either one, the Fed or the ECB, be able to bring some dovishness into the markets, investors would jump on that and try to catch the dip in the price action. SFM price would jump back up towards $0.000500000 before trying to pop above the nine-day Simple Moving Average (SMA), which would be the first hurdle to take. From there, sights are set for the 61.8% Fibonacci level at $0.000611824.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.