SafeMoon price exposes weak spot; can bulls fix it?

- SafeMoon price underwent a firm rejection on Monday after a bearish cross in the moving averages.

- SFM price sees the sell-off contained with price action underpinned at the fibo-level.

- Expect to see a pop higher as bulls squeeze out bears and rally 36%.

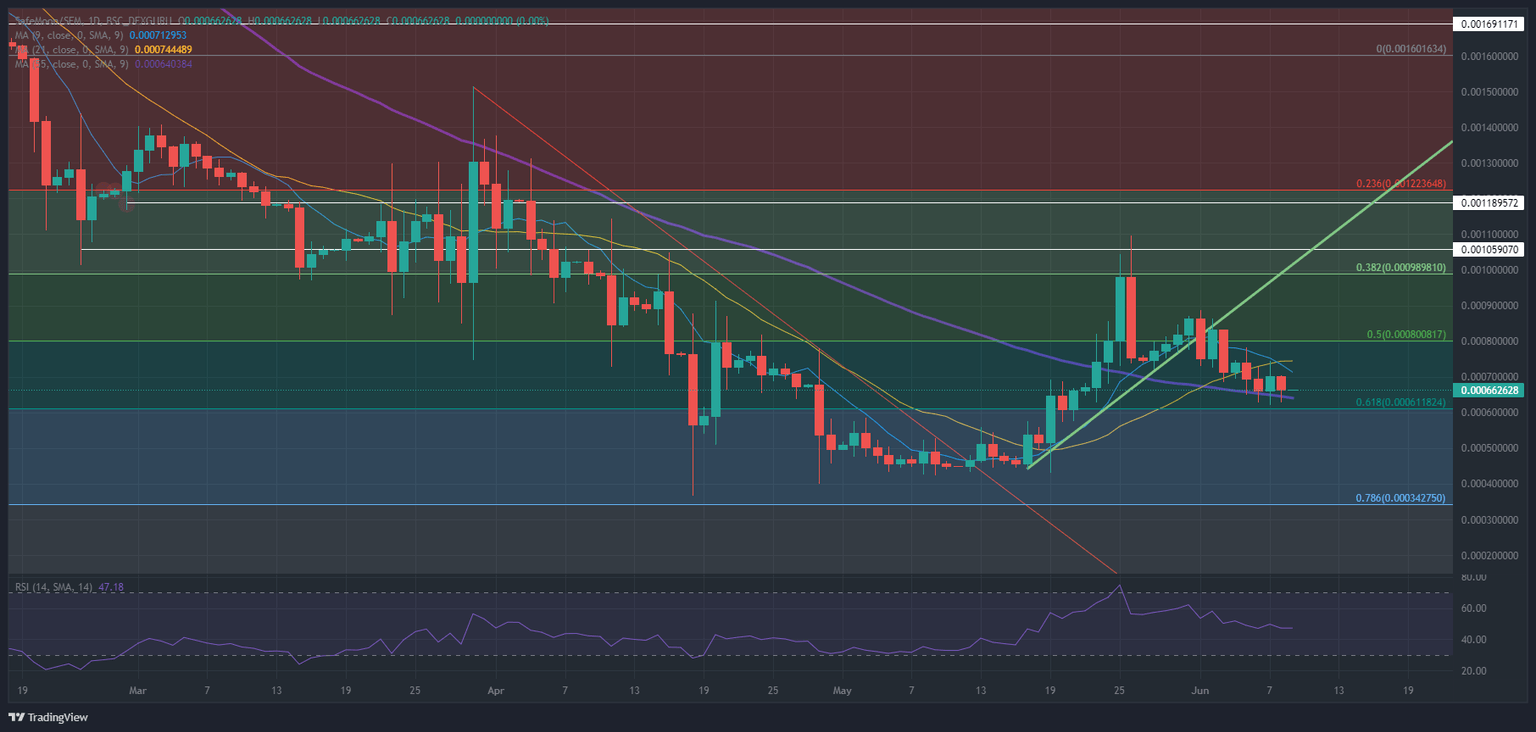

SafeMoon (SFM) price is set to continue its stalled rally after a break below the green ascending trend line in mid-May. Although price action has been trading to the downside, it remains underpinned, even after the rejection by the 21-day Simple Moving Average (SMA) and although the 9-day SMA has crossed below the 21-day SMA, in a short-term death cross, considered a bearish signal by traders. Expect to see a pop higher, as markets shift to risk on and price action remains underpinned around the 61.8% Fibonacci level. The Relative Strength Index (RSI) is also flatlining, ready to jump higher again which would fall in line with SafeMoon popping back to $0.000900000.

SFM price set to rally 36%

SafeMoon price has been in a downtrend since Sunday after price action got caught between the 9-day SMA and the 55-day SMA. Since then, price action has been trading lower, but without a daily close below the 55-day SMA. This is clear evidence that bulls are still paying and a factor underpinning price action. That said, bulls are now aware that they need to look out for the small death cross which has formed after the 9-day SMA moved below the 21-day SMA. The 21-day SMA is also a difficult moving level as price action already failed to break above on two consecutive days with a clear rejection of the daily candle on both Sunday and Monday.

SFM price is likely to see bulls fighting back, with support in their corner coming from that 55-day SMA and the 61.8% Fibonacci level at $0.000611824. Expect bears to get squeezed-out with bulls needing to execute a daily close above the 21-day SMA at $0.000744489. SFM price would then be able to rally another leg higher towards $0.000900000 and make a possible new high for June. That would translate into an 18% gain from the level of the 21-day SMA or 36% from where the SFM price is trading currently.

SFM/USD daily chart

Another rejection from the 21-day SMA would be fatal for the bulls and could see them squeezed out against that double floor of the 55-day SMA and the 61.8% Fibonacci level at $0.000611824. A break below would open the door to further declines, and in a worst-case scenario see a drop of 45% back to $0.000342750, in the process erasing all incurred gains for 2022. But that scenario would need a global market catalyst that triggers massive risk-off across the board.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.