What’s next for SafeMoon as 200% gains come undone?

- SafeMoon price has undone the 197% upswing seen between April 18 and May 26, indicating a panic sell.

- Investors can expect a continuation of the recovery rally to the $0.000511 to $0.000636 buy zone.

- A daily candlestick close below $0.000356 will invalidate the bullish thesis.

SafeMoon price has been trading inside a tight range formed as the altcoin more than doubled in May. The recent correction undid all of the gains seen over the last two months or so.

SafeMoon price needs to decide

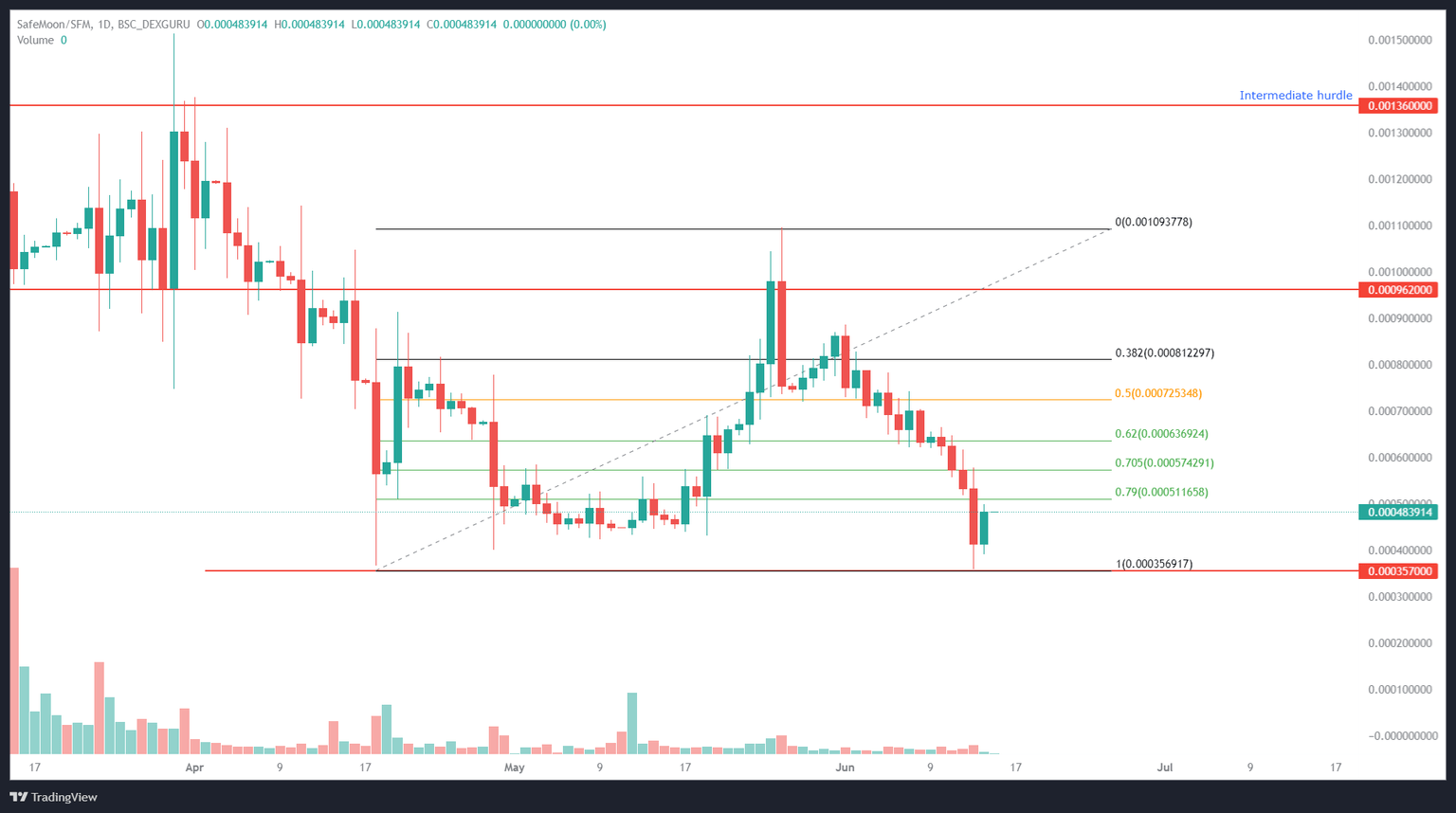

SafeMoon price rallied 197% between April 18 and May 26 and set a swing high at $0.00109. Since this move, SAFEMOON has been retracing, however, trying to find stable support levels. As reported earlier, the buy zone, extending from $0.000511 to $0.000636 was supposed to be that platform.

Due to the ongoing market conditions, however, things worsened for SafeMoon price, leading to a swift breach through this area. As sellers kept offloading their holdings, SAFEMOON retraced the nearly 200% upswing that occurred between April 18 and May 26.

As a result, SafeMoon price retested the range low at $0.000356 and is bouncing higher, attempting a recovery rally. So far, SafeMoon price has bounced 33% and is likely to continue heading higher.

A rejection inside the buyer zone, ranging from $0.000511 to $0.000636 seems likely and is where the upside will be capped for SafeMoon price. This thesis is bullish and assumes the possibility of a minor extension of the ongoing relief rally.

SAFEMOON/USDT 1-day chart

Regardless of the bullishness surrounding altcoins, including SafeMoon price, a sudden downturn in Bitcoin price could put a dent in bulls’ plans. In such a case, a daily candlestick close below $0.000356 will invalidate the bullish thesis.

This development will knock SafeMoon price into price discovery mode to new all-time lows.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.