Identifying targets for SafeMoon price sell-off

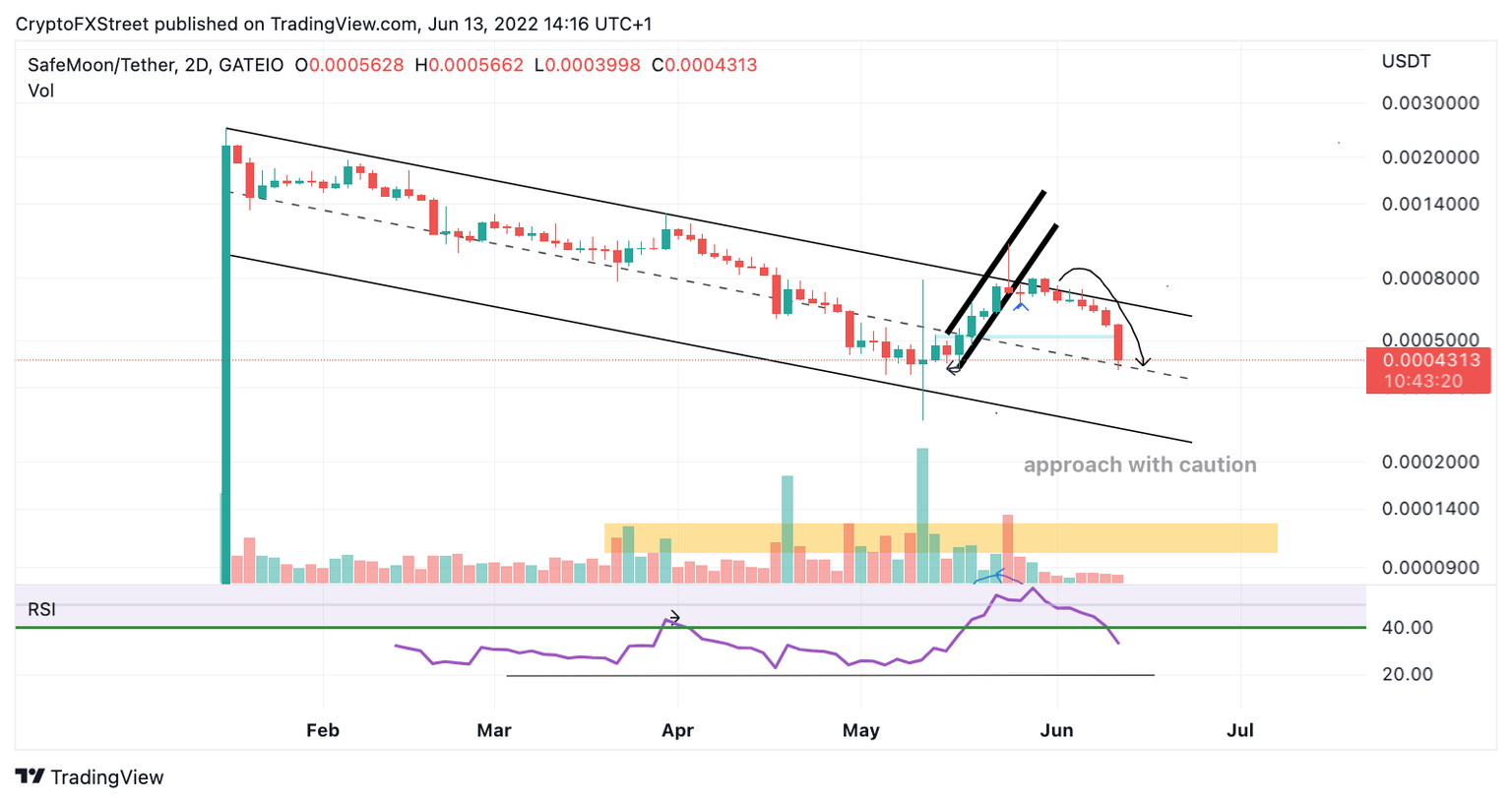

- Safemoon price has seen a significant decline within a trend channel.

- SFM price has marked a new yearly low.

- Invalidation of the downtrend is a breach above $0.00055.

Safemoon price could see more decline in the coming days, but traders should keep a tight invalidation level.

Safemoon price has lower targets

Safemoon price has bullish traders running for the hills as a sharp decline has commenced this week’s trading session. It has been mentioned in previous outlooks that an ultimate target for the controversial cryptocurrency would reside in the $0.00010 price level. Monday’s 30% decline could be the beginning stages of Safemoon’s anticipated demise.

Safemoon price currently trades at $0.00042, the lowest auction price this year. The only contrarian bearish signal to be aware of is that a bearish engulfing candle still hovers above the parallel channel median line and is accompanied by relatively low volume. In a hopeful crypto market, the bulls could keep the price consolidating above the median line before creating a turn. Ultimately Bitcoin’s reaction to $23,000 will be the determining factor for the current Safemoon price action. If BTC fails to hold $23,000, Safemoon will likely fall below $0.0003 in the coming days.

SFM/USDT 2-Day Chart

Invalidation of the downtrend is a breach above $0.00055. If this bullish scenario occurs, a rally back into $0.00075 could ensue, resulting in a 90% increase from the current Safemoon price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.