Shiba Inu bulls await right timing for top-line breakout

- Shiba Inu price is trading sideways between $0.00002925 and $0.00003785.

- SHIB RSI is almost flat, showing a balanced equilibrium between buyers and sellers.

- Expect volatility to pick up once a catalyst lights a bullish breakout.

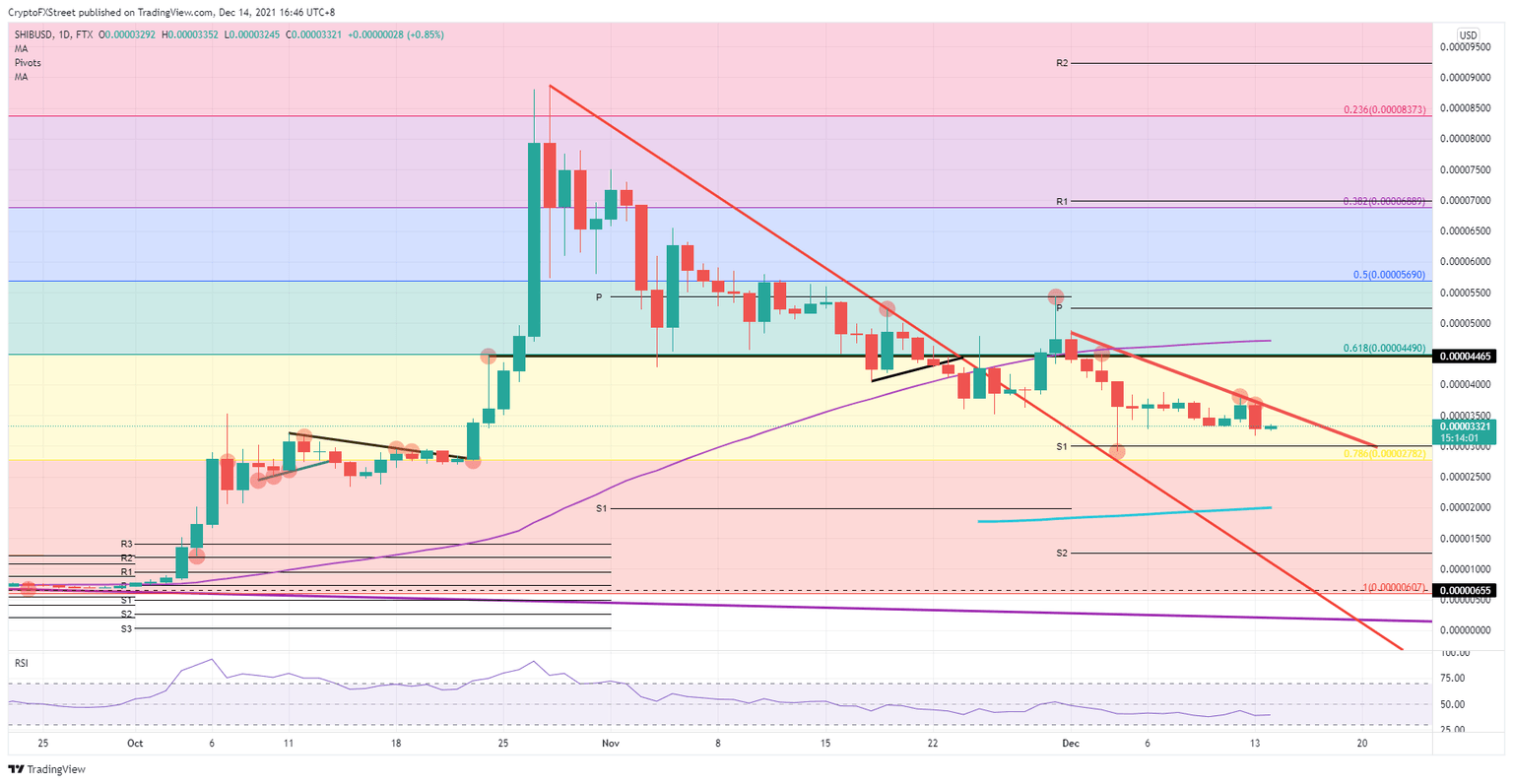

Shiba INU (SHIB) price is trading stuck between a 16% variation bandwidth as price looks for direction with neither buyers nor sellers putting forward any big moves. As equity markets shift further towards gains, expect this to spill over into cryptocurrencies and act as a catalyst for a bullish breakout, taking price above a top line that is capping price action for the moment. Following such a breakout, expect bulls to target a return to the 61.8% Fibonacci level at $0.00004490.

Shiba Inu awaits equities tailwind, sparking 35% rally

Shiba Inu price has been trading sideways since last week as investors find themselves puzzled as to the path forward. Much event risk lies on the horizon with a lot of rate decisions from the most prominent central banks this week and some pending uncertainties over Covid variants. On Monday, European equities already started the week in the green, and in the early trading hours, the US indices are also quoting in the green. This sentiment could be the catalyst cryptocurrency investors are awaiting to spark a late Christmas rally.

SHIB price could see bulls attempting to surmount the red descending top line from December 1st, which price recently respected, leading to several rejections to the downside. A breakthrough would be the cue for sidelined investors to join the rally.. If this is the case – and as buying volume sees a significant uptick – expect the subsequent rally to hit the 61.8% Fibonacci level at $0.00004490 quickly.

SHIB/USD daily chart

Once around that level, it will become increasingly more difficult for investors to drive SHIB price higher as liquidity starts to die down year-end. If most central banks keep their loose monetary policy going, expect a boost of confidence that would spark another leg higher towards the 50% Fibonacci level at $0.00005690. If central banks come out more hawkish, on the other hand, expect a quick deflation of the price as investors cash in on their positions, triggering a sell-off towards the monthly S2 support level at $0.00001260, holding a 60% potential loss.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.