Grayscale buys $76 million worth of Ethereum in anticipation of CME’s Ether futures launch

- Grayscale's purchase of more ETH comes after reopening the Ethereum Trust to investors.

- CME Ethereum futures contracts are set to launch on Monday, February 8.

- Ethereum whales are on a buying spree as they capitalize on the bull run.

Grayscale Investments, the world's leading digital fund manager, has bought more Ethereum. The firm's uptake of Bitcoin from late last years was connected to the bull run the pioneer cryptocurrency experienced in December and January. There seems to be a consistent shift to Ethereum as the asset rallies to a new high after a new high.

Are investors shifting the focus to Ethereum?

Ethereum Trust (OTCQX: ETHE) is the vehicle investors use to get into the cryptocurrency market with Grayscale. The company reopened the trust on Monday, allowing new investors to come while others increase their shareholding.

According to the investment firm, Ethereum Trust had over $4 billion in assets by January 29. This week's $76 million purchase came before the reopening of the trust, implying that investor interest in Ethereum was growing at an exceptional rate.

Ethereum goes ballistic ahead of CME Ether futures

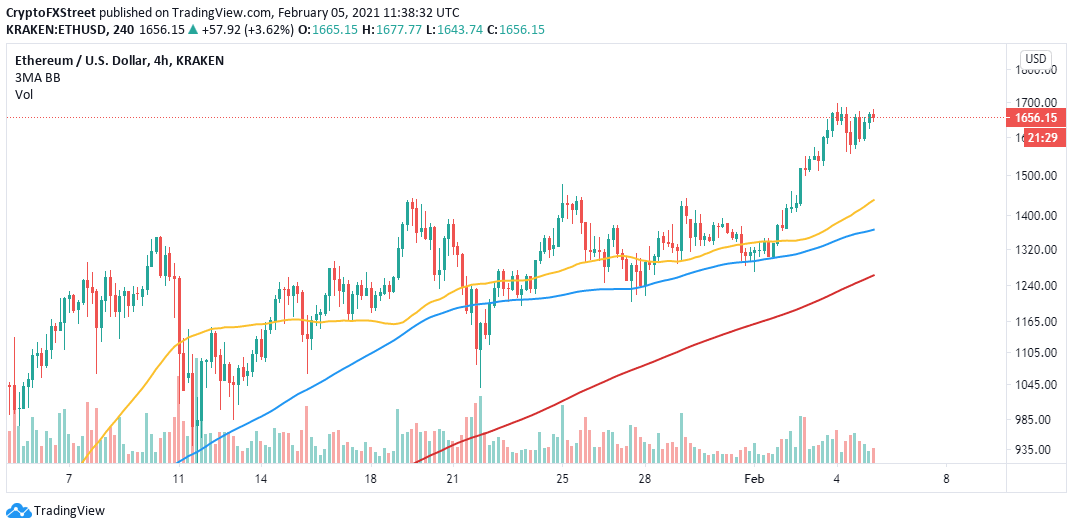

Ethereum extended the bullish leg to a new all-time high at $1,700 this week. The majestic move was anticipated by many in the market who still believe that Ethereum is nowhere near the top. A retreat came into the picture forcing ETH to revisit levels under $1,600. However, a recovery soon came into the picture, placing Ether back on the upward trajectory.

ETH/USD 4-hour chart

Investor sentiment is extremely positive for Ethereum and could rise higher ahead of the Chicago Mercantile Exchange (CME) Ethereum futures launch scheduled for Monday, February 8. Futures contracts allow investors to participate in buying and selling cryptocurrencies without owning the underlying digital asset. It also means that trading takes place on a regulated platform.

Ethereum whales on a buying spree

A significant drop in the number of large volume holders of Ethereum was evident toward the end of January. However, Santiment's holder distribution shows that whales started streaming in from the beginning of February, explaining the rally to new all-time highs.

The number of addresses holding between 100,000 and 10 million ETH shot up from 154 on February 3 to 158 on February 5. This increase may seem minor at first, but the ETH volume is massive enough to add to the buying pressure significantly.

Ethereum holder distribution

Peter Brandt, a prominent trader and investor, recently said he was willing to convert half of his Bitcoin holdings to Ethereum. He believes that Ethereum has a long way to go. Experts predict that Ethereum may hit $2,000 before the launch of CME Ether futures.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B14.32.56%2C%252005%2520Feb%2C%25202021%5D-637481218426183940.png&w=1536&q=95)